MET Group inaugurates Hungary''s largest battery energy storage

Jun 20, 2025 · MET Group has commenced operation of Hungary''s largest standalone battery energy storage system (BESS), with a total nominal power output of 40 MW and a storage

MET Group inaugurates Hungary''s largest battery energy storage

Jun 20, 2025 · MET Group installed a battery energy storage system of 40 MW and a two-hour duration at its gas power plant Dunamenti near Budapest. The company said it is the largest

Hungarian Lithium Battery Energy Storage Companies:

Dec 14, 2022 · Hungary''s strategic position in Europe makes it a hidden MVP in energy storage – think of it as the "Battery Valley" where Eastern and Western energy grids hold hands. With

MET Group Inaugurates Hungary''s Largest Battery Energy Storage

Jun 19, 2025 · MET Group inaugurated a battery electricity storage plant with total nominal power output of 40 MW and storage capacity of 80 MWh (2-hour cycle) today, the company tells the

MET Group Launched into Commercial Operation the Largest Battery Energy

Jun 19, 2025 · Hungary''s largest operating standalone battery energy storage system (BESS) has been inaugurated today. It is the latest example in a series of MET investments in BESS

Hungary – the future paradise for EV battery manufacturers?

Jun 28, 2024 · EV battery cell and module manufacturers currently present at Hungary come from the Far East – namely South Korea, Japan, and, first of all, China. The supplier segment is

MET Group Launched into Commercial Operation the Largest Battery Energy

Jun 19, 2025 · /BUDAPEST, HUNGARY, June 19, 2025, 10:00 CET, MET Group/ Hungary''s largest operating standalone battery energy storage system (BESS) has been inaugurated

ALTEO-Budapest Battery Energy Storage System, Hungary

Sep 1, 2021 · The ALTEO-Budapest Battery Energy Storage System is a 6,000kW energy storage project located in Budapest, Hungary. The project was commissioned in 2018.

Sunwoda Hungary base overseas power battery factory started

Feb 13, 2025 · In March 2022, Sunwoda has announced that it will invest in the construction of "30GWh power battery project" and "20GWh power battery and energy storage battery

Top 13 Battery Suppliers in Hungary (2025) | ensun

Opportunities abound in research and development, particularly in innovative battery technologies such as solid-state batteries and energy storage solutions. The competitive landscape features

Top 13 Battery Suppliers in Hungary (2025) | ensun

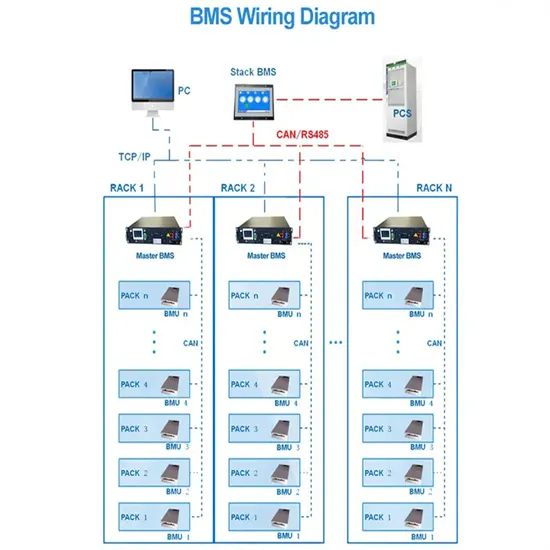

Etheron Systems specializes in designing and building Battery Management Systems (Etheron BMS™) that enhance the performance and longevity of energy storage systems. Their

6 FAQs about [Budapest energy storage battery supplier]

Why is battery storage important in Hungary?

State-of-the-art battery storage has great development potential in both areas all over the world. Hungary’s industrial, R&D traditions and capabilities are already outstanding in this field. The development of this sector can make the Hungarian battery industry a strategically important one in the Hungarian economy.

Who makes EV batteries in Hungary?

The only exception is BYD, which operates (among others) a bus assembly plant in Hungary and uses its own batteries. In below, we provide a slight overview about the EV battery producer companies which already operate manufacturing plants in Hungary or announced to do so in the near future.

Where is the battery industry located in Hungary?

Many of the significant suppliers of the battery industry in Hungary are located directly near the main car manufacturing plants. Since 2016, a total of HUF 1,903.8 billion (EUR 5.29 billion) and approximately 13,757 jobs have been created as a result of working capital investments in the battery industry.

Which companies make lithium-ion batteries in Hungary?

Today, Samsung SDI and SKI Innovation operate several giant factories in Hungary, whose total production will potentially grow to 47.3 GWh by 2025 and up to 87.3 GWh by 2030. GS Yuasa also produces automotive lithium-ion starter batteries, while Inzi Control also manufactures battery modules.

Why is Hungary a good place to buy a battery?

Hungary is ideally located on the European battery map, thanks to its central geographical location, investments in cell and battery production facilities, the presence of large car manufacturers and its extensive supplier industry.

Should Hungary invest in EV battery plants?

Within the European Union, Hungary puts a particularly high stake on EV battery plants, in the hope that it will find itself among the leading countries of an emerging industry within a few years. Commitment to green mobility is not the only motivation for attracting large battery manufacturers to the small Central European country.

Update Information

- Outdoor energy storage battery supplier

- Energy storage lithium battery supplier

- Budapest liquid-cooled energy storage battery cabinet communication power supply

- Phnom Penh energy storage battery supplier

- Budapest energy storage lithium battery sales

- Global energy storage battery supplier

- Battery energy storage system supplier in Kosovo

- Philippines Cabin Battery Energy Storage

- Seychelles solar energy storage cabinet supplier

- European battery energy storage suppliers

- Bahamas Energy Storage Battery Construction Project

- Paraguay configures energy storage battery companies

- Czech Brno lithium iron phosphate energy storage battery

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.