Top 10 energy storage manufacturers in the world

Aug 19, 2025 · This article will mainly explore the top 10 energy storage manufacturers in the world including BYD, Tesla, Fluence, LG energy solution, CATL, SAFT, Invinity Energy

Top 10 Global EV/REEV Battery Pack Suppliers – LEAPENERGY

Jul 21, 2025 · The demand for high-performance, scalable, and safe energy storage solutions is rapidly growing across sectors. In this blog, we explore the top 10 global battery pack

REPT BATTERO has been honored as a Tier 1 global energy storage

May 10, 2025 · REPT BATTERO has been honored as a Tier 1 global energy storage manufacturer in Q2 by BloombergNEF once again! With its global footprint and seamless

Bess Manufacturers Top 10 in the World 2024

Aug 14, 2024 · LG Energy Solution Ltd., based in Seoul, South Korea, is the world''s leading battery manufacturer and ranks first in the 2024 global Battery Energy Storage System (BESS)

2024 Global energy storage system (ESS) shipment ranking

Feb 21, 2025 · The top five global battery energy storage system (BESS) integrators in the AC side for 2024 were Tesla, Sungrow, CRRC Zhuzhou Institute, Fluence, and HyperStrong.

Shipment ranking 3Q23: Global energy-storage cell

Nov 24, 2023 · The world shipped 143.8 GWh of energy-storage cells in the first three quarters of 2023, with utility-scale and C&I accounting for 122.2 GWh and residential and communication

Top 10 Energy Storage Companies Powering Renewables

Jun 3, 2025 · 10. China''s Sungrow Power Supply Co. Ltd. Sungrow is a top supplier of energy storage systems and inverter solutions. Sungrow''s significant contribution in promoting a

Who Are the Suppliers of BESS Systems? an Analysis of Global Energy

Jun 11, 2025 · A high-quality supplier directly impacts the system''s reliability, efficiency, and return on investment. While companies like Tesla and CATL dominate the global market, firms like

Top 10 Global Power & Storage Battery Manufacturers 2024

Apr 2, 2025 · Among the top 10 global battery manufacturers (power + energy storage) in 2024, six are Chinese companies: CATL, BYD, EVE Energy, CALB, Gotion High-Tech, and

Global energy storage cell, system shipment ranking 1H24

Aug 6, 2024 · According to InfoLink''s global lithium-ion battery supply chain database, energy storage cell shipment reached 114.5 GWh in the first half of 2024, of which 101.9 GWh going to

Update Information

- ASEAN Lead Acid Battery Energy Storage Container Supplier

- Outdoor energy storage battery supplier

- Phnom Penh energy storage battery supplier

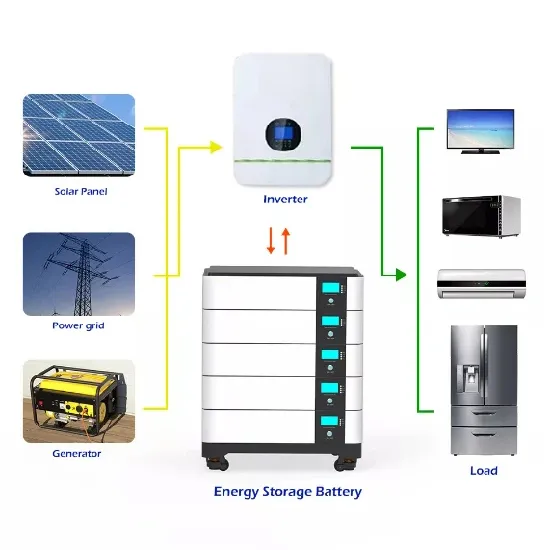

- Lithium battery energy storage system supplier

- Thailand household energy storage battery supplier

- Malawi flow battery energy storage container supplier

- North Korea portable energy storage battery enterprise

- Yerevan battery energy storage power station approved

- 30kw lithium battery energy storage system inverter

- All-solid-state battery and energy storage projects

- How much does a battery energy storage cabinet cost in Beijing

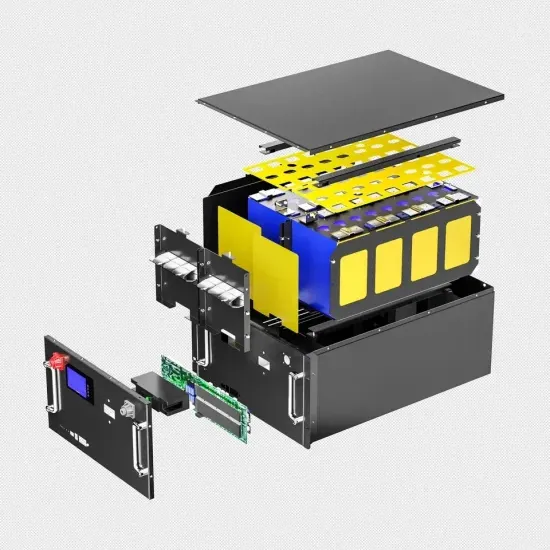

- Energy Storage Battery Cabinet Design Method

- Home battery energy storage equipment

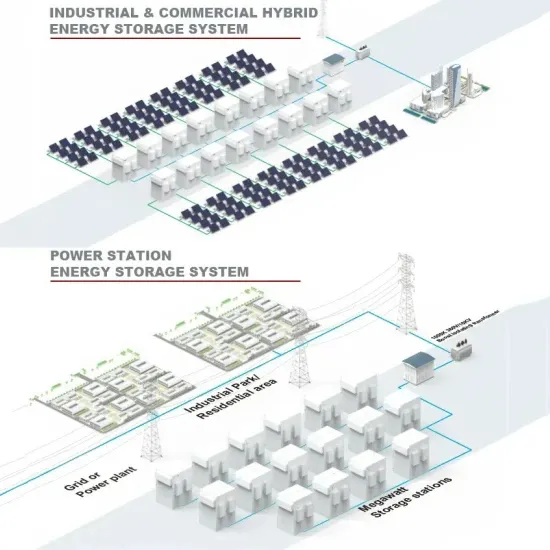

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.