Algeria''s Strategic Energy Vision: A Roadmap for

Jan 20, 2025 · Through its National Program for the Development of Renewable Energies, Algeria aims for a 30% renewable energy share – equating to 15,000 MW – by 2035. The country is

Algeria | Green Hydrogen Organisation

With vast renewable energy resources, including solar and wind, Algeria envisions using green hydrogen as a clean and sustainable energy source to diversify its energy mix, reduce carbon

Align Algeria''s Energy Diversification Strategies with Energy

Jun 12, 2024 · These scenarios analyze Algeria''s future power system pathways and focus on the country''s national energy policies related to integrating renewable energy and developing

National Energy Grid of Algeria

Jun 30, 2016 · In July 2002, Sonatrach and Sonelgaz formed a new, renewable energy joint venture company, called New Energy Algeria (NEAL). NEAL will look at development of solar,

Algiers grid invests in energy storage

Conclusion The paper clearly shows that Algeria has the potentialto become the major energetic hub of Europe in fossil and renewable energies. The country has enormous potential both for

Algeria hybrid solar and wind power generation

Why is Algeria a good country for solar energy? a substantial global reserve for solar energy. Thus, Algerian electricity users expect a reliable, affordable, and high-quality energy supply

Assessment of solar and wind energy complementarity in Algeria

Jun 15, 2021 · In this regard, this paper evaluates the spatial and temporal complementarity between solar and wind energy in Algeria for different timescales. To this end, a grid with 0.5°

Mega-scale solar-wind complementarity assessment for

Download Citation | On Oct 1, 2024, Aziz Haffaf and others published Mega-scale solar-wind complementarity assessment for large-scale hydrogen production and storage (H2PS) in

A turning point for Algerian solar – pv magazine

Nov 7, 2024 · Nevertheless, nearly 100% electrified Algeria generates 99% of its energy from domestic gas. Solar has long been restricted to research projects

MENA Solar and Renewable Energy Report

Sep 5, 2024 · Introduction Renewable energy usage has been growing significantly over the past 12 months. This trend will continue to increase as solar power prices reach grid parity. In 2019,

Renewable energy overview in Algeria

Aug 18, 2025 · The 10.2 MW wind power plant in Kabertène (Adrar), comprising 12 wind turbines with a rated power of 850 KW each (commissioned in 2014). Between 2015 and 2018, power

Renewable energy in Algeria

Jul 8, 2024 · By 2030, the country aims to reach a clean energy capacity of 22,000 megawatts. It expects to generate most of its renewable power through solar photovoltaic technology, with a

Assessment of solar and wind energy complementarity in Algeria

Jun 15, 2021 · The recent transition towards sustainable energy resources, aiming for the decarbonisation of the electrical power sector has gained global and regional importance.

Algeria Renewable Energy Market Analysis

Aug 16, 2025 · Conclusion The Algerian renewable energy market is witnessing a positive transformation, driven by government initiatives, favorable resource availability, and increasing

6 FAQs about [Algerian electricity and wind solar and energy storage]

Does Algeria have solar energy resources?

Algeria is one of the countries with one of the highest solar potentials in the world, estimated at 13.9 TWh per year. Algeria has solar energy resources. Algeria has joined the Desertec Industrial Initiative, which aims to use Sahara solar and wind power to supply 15 per cent of Europe’s electricity needs by 2050.

What is the energy mix in Algeria?

In 2010, Algeria's energy mix was almost exclusively based on fossil fuels, especially natural gas (93%). However, Algeria has enormous renewable energy potential, mainly solar, which the government is trying to harness by launching an ambitious Renewable Energy and Energy Efficiency Program.

Is Algeria a good place to invest in solar and wind energy?

Taking into account the aforementioned, Algeria has immense solar and wind energy potential and evaluating its resources is a very important step in selecting optimal RES sites before any investments. However, the energy sector in Algeria has to overcome other barriers, such as the increase of energy demand.

Are solar and wind resources available in Algeria?

The potential of solar and wind resources in Algeria have been extensively studied in literature. For instance, Yaiche et al. provided revised solar radiation maps for Algeria, where the province of Djanet was found as the location with the highest solar radiation resources.

How much electricity does Algeria generate a year?

Algeria currently generates a relatively small amount of its electricity (e.g., three percent or 686 MW annually), from renewable sources, including solar (448 MW), hydro (228 MW), and wind (10 MW).

How much wind does Algeria have?

For wind, Algeria has a 1,300-kilometer Mediterranean coastline with wind speeds of more than eight meters per second, in addition to winds coming off the surface of the Sahel in the South. Algeria aims to produce 27 percent of its electricity from renewable resources by 2035, mostly from solar power.

Update Information

- USA New York Wind and Solar Energy Storage Project

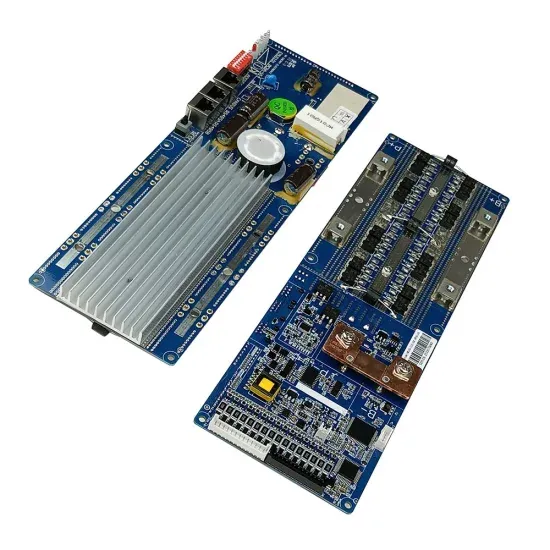

- The practical application of wind and solar energy storage

- Is the wind and solar energy storage power station cost-effective

- Wind solar and energy storage industry destocking

- Nuku alofa Wind and Solar Energy Storage Power Station

- Equipment cost of wind and solar energy storage power station

- Finland wind and solar energy storage project

- The world s largest wind and solar energy storage power generation

- Invest in wind and solar energy storage power stations

- Huawei Wind and Solar Energy Storage Power Station EK

- Ecuador wind and solar energy storage power generation

- Indian wind and solar energy storage power station

- Wind solar and energy storage projects were withdrawn

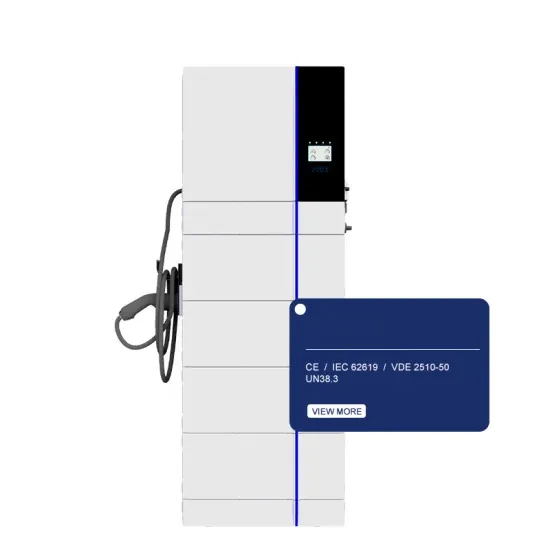

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.