Simulation and Classification of Mobile Communication Base Station

Dec 16, 2020 · In recent years, with the rapid deployment of fifth-generation base stations, mobile communication signals are becoming more and more complex. How to identify and classify

Ocean Winds and Martifer announce partnership for

Jul 24, 2024 · We are thrilled to join forces with Martifer Renewables & Energy for the first historic tender, that should soon be announced. Ocean Winds has been developing and operating

Completion and evaluation tender — Preliminary Technical

Completion and evaluation tender — Preliminary Technical Study and Design of Island Terminal and Breakwater Structure at Port Louis Harbour — for Mauritius by AfDB, Government in

Latest Wind Turbines Tenders and RFP

Aug 15, 2025 · View wind turbines tenders, RFPs and contracts. Bid on readily available wind turbines tenders with the best and most comprehensive tendering platform, since 2002.

Saint Louis (Mauritius) power station

Aug 5, 2025 · Saint Louis (Mauritius) power station is an operating power station of at least 110-megawatts (MW) in Port-Louis, Mauritius. Loading map Unit-level coordinates (WGS 84):

Eemshaven base port for world''s largest offshore

Mar 11, 2020 · The port has become a base, marshalling and service port of note for offshore windfarms especially in the German neighbouring part of the North

Carbon emission assessment of lithium iron phosphate

Jul 29, 2024 · The demand for lithium-ion batteries has been rapidly increasing with the development of new energy vehicles. The cascaded utilization of lithium iron phosphate (LFP)

Tender buying of vhf radio communication base-6959813

Apr 29, 2024 · This tender with title Buying of VHF Radio Communication Base Station - 73/Walkie Talkie Sets/NLC/2024 has been published on Bidding Source portal dated 29 Apr

Wind Farm RFP, bids and Government Contracts

4 days ago · Latest Wind Farm RFPs, bids and solicitations. Bid on readily available Wind Farm contracts with the best and most comprehensive government procurement platform, since

Port Louis Harbour

Jul 5, 2025 · Port Louis Harbour is strategically situated in the Indian Ocean on the shipping routes linking Africa, Europe, Asia, and Australia. As the principal gateway of the country, the

Construction of buildings Tenders

Construction of buildings Tenders See below for a list of Construction of buildings Tenders. These tenders can consist of Request for Information (RFI), Request for Quotation (RFQ), Request

Wind Power Tenders | Wind Power RFP and Bids 2024

With just one click, users can access all the necessary documents for Wind Power tenders, including RFPs, RFQs, BOQs, EOIs, GPNs, and prequalification documents (PQ docs). Stay

P9691 [GDCPC 2023] Base Station Construction

中国移动通信集团广东有限公司深圳分公司(以下简称深圳移动)于 1999 年正式注册。四年后,广东省大学生程序设计竞赛第一次举办。深圳移动与广东省大学生程序设计竞赛一起见证了

6 FAQs about [Tender for wind power construction of communication base station in Port Louis]

What contractual structures are essential for wind energy project development?

Explore the contractual structures essential for wind energy project development, including design and engineering services, procurement of wind turbine generators, and construction of infrastructure facilities.

How does a wind energy project developer finance a project?

A. Financing Issues. A wind energy project developer often requires some form of substantial debt financing or joint venture financing to pay for the design, engineering, procurement, construction, and initial operation of the project.

Are offshore wind projects more risky than land-based wind projects?

Access to installation or maintenance vessels capable of erection or major warranty work of large offshore units is limited and needs to be carefully coordinated. As a result, construction risk for offshore wind projects is higher than for land-based wind projects.

How do I submit a tender?

Tenders must be placed in the prescribed tender box, or submitted electronically where instructed, at or before the closing time on the closing date. Late tenders will not be accepted. Prospective suppliers are warned that fraudulent Requests for Proposals and Quotations are sent to suppliers using the Transnet name and logo from time to time.

What tax credits are available for wind projects?

Federal production tax credits (PTC) and investment tax credits are available to wind projects at certain rates and based upon the project’s construction and procurement schedule. Accelerated depreciation (MACRS) is also part of the federal scheme to support and provide incentives for wind development.

What is a Typical EPC agreement structure for a wind project?

IV. Typical EPC Agreement Structure for a Wind Project. In light of the multiple factors influencing the development of a wind energy project, no single contractual structure applies to all projects. However, the following example is typical of how many developers address certain common issues.

Update Information

- Port Moresby Communication Base Station Wind Power Construction Bidding Network

- Lome Communication Base Station Wind Power Infrastructure Construction Project

- Micronesia Communication Base Station Wind and Solar Complementary Power Generation Tender

- Asia Communication Base Station Wind Power Construction Company

- Communication base station wind power small

- Ireland Tower Communication Base Station Wind Power

- Liberia-produced communication base station wind power products

- Nuku alofa communication base station wind power and photovoltaic power generation parameter query

- Sophia Communication Base Station Wind Power Planning

- Rooftop construction communication base station wind and solar complementarity

- Communication base station wind power maintenance company

- Tunisia communication base station wind power equipment installation 6

- About 5G communication base station wind power

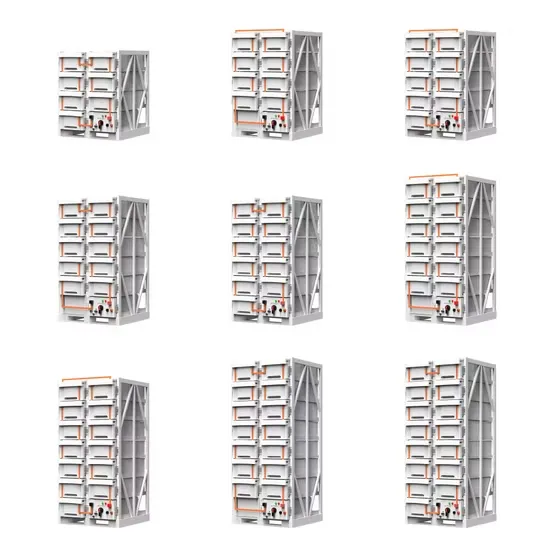

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.