Top 15 Solar Inverter Manufacturers In the World

Fast forward to 2022, Sungrow Power emerged as the global leader in the PV inverter market, surpassing all competitors with nearly 8 gigawatts (GW) of shipments. Main Products: String

China s top ten photovoltaic inverter rankings

What is the global PV inverter market share in 2022? In terms of market concentration,the top 5 vendors (Huawei,Sungrow,Ginlong,Growatt,and GoodWe) shipped over 200 gigawatts (GW)

How many inverter brands are there in photovoltaic

How pvbl ranked the top 20 global photovoltaic inverter brands in 2023? On the first day of the conference, PVBL''s annual ranking of the Top 20 Global Photovoltaic Inverter Brands was

Top 20 Solar Inverter Manufacturers: A Global Overview of

Nov 26, 2024 · By 2022, Sungrow Power is no longer a novice, it has become the global leader in the PV inverter market, with shipments approaching 8 gigawatts (GW), an achievement that is

Top 15 Solar Inverter Manufacturers In the World

In 2011, Sungrow Power achieved a significant milestone by entering the top ten list for global PV inverter shipments. Fast forward to 2022, Sungrow Power emerged as the global leader in the

TOP 20 GLOBAL PHOTOVOLTAIC INVERTER BRANDS FOR 2023

What is the global PV inverter market share in 2022? In terms of market concentration, the top 5 vendors (Huawei, Sungrow, Ginlong, Growatt, and GoodWe) shipped over 200 gigawatts

Top 30 Solar Inverter Manufacturers Leading the

5 days ago · We have curated a list of the top 30 solar inverter manufacturers recognized for their innovation, efficiency, and reliability. Whether you''re

Top Solar Inverter Manufacturers in China: A 2024 Guide

Jan 8, 2025 · Top 10 Solar Inverter Manufacturers In China of 2024 With the growing global demand for renewable energy, solar photovoltaic (PV) power generation technology is

What does photovoltaic inverter gw stand for

A solar power inverter''s primary purpose is to transform the DC (direct current) electricity generated by solar panels into usable AC (alternating current) electricity for your home.

6 FAQs about [What brand of photovoltaic inverter gw]

Who are the top 10 solar inverter manufacturers in 2025?

Top 10 Solar Inverter Manufacturers in 2025 1. Huawei 2. Sungrow 3. SMA Solar Technology 4. SolarEdge Technologies 5. Fronius 6. Enphase Energy 7. Growatt 8. GoodWe 9. Sineng Electric 10. TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation) Part 4. Global Supply Chain Centers for Solar Inverters Part 6.

How pvbl ranked the top 20 global photovoltaic inverter brands in 2023?

On the first day of the conference, PVBL’s annual ranking of the Top 20 Global Photovoltaic Inverter Brands was announced. Preferential policies promoted the inverter market growth in 2023. Most of the major inverter companies won a large amount of orders and expanded their capacity with high shipment volume.

Who is goodwe solar inverter?

Company History: Established in 2010 in Suzhou, China, GoodWe is a fast-growing manufacturer of solar inverters and energy solutions. Product Range: GoodWe provides string inverters, hybrid inverters, and energy storage inverters for diverse applications.

Who makes the best solar inverter?

Building on almost a century of power electronics expertise, Italy’s Fimer has quickly become a leading global provider of solar inverters. Their comprehensive portfolio includes string, central, and large-scale inverters integrating storage and smart grid capabilities.

Who makes a solar inverter?

5. SMA Solar Technology AG (Germany) SMA Solar Technology AG, established in 1981 and based in Niestetal, Germany, holds the prestigious position as the world's leading provider of professional inverter production.

Who makes ultra solar inverters?

As a power electronics conglomerate from Spain, Power Electronics brings over 30 years of industrial process innovation to crafting premium solar inverters. Their ULTRA line offers extensive customization for large-scale solar and storage integration, simplifying end-to-end system design.

Update Information

- Oslo communication base station inverter photovoltaic power generation brand ranking

- The photovoltaic inverter is brand new and unused

- What brand of 24v inverter is economical and affordable

- Which photovoltaic inverter brand is better

- What is a photovoltaic inverter factory

- What is the prd effect of photovoltaic inverter

- Cape Verde photovoltaic inverter brand

- What brand of Tashkent 48v inverter is good

- What is the impedance of the photovoltaic inverter

- What is the lifespan of a 20kw photovoltaic inverter

- Greek brand photovoltaic inverter

- The best brand of high frequency inverter

- Solar Photovoltaic Panel Brand

Solar Storage Container Market Growth

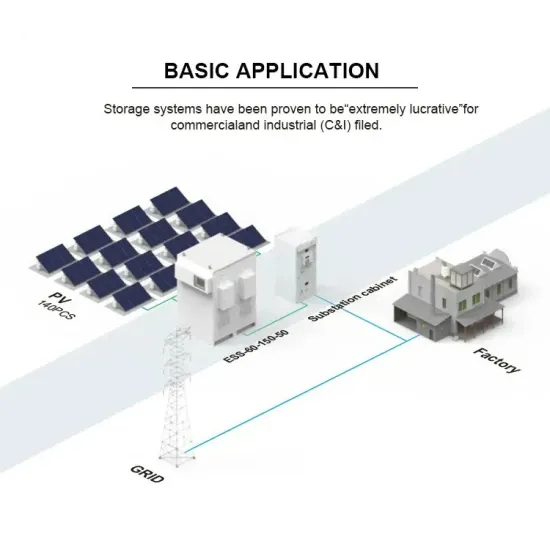

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.