Solar Power Systems & Solar Energy Equipment

6 days ago · A1 SolarStore is an online shop of solar panels, inverters, batteries, controllers, etc. | Equipment from Panasonic, REC, Jinko Solar, Q CELLS, JA

Energy & Solar Liquidators: Sell Used Solar Equipment | Local

4 days ago · Local Liquidators is a team of energy & solar liquidators, auctioneers, marketing experts and other industry professionals all working together to design custom energy

Top Solar Energy Equipment Suppliers in Germany

SMA is a prominent manufacturer of solar energy equipment, providing a wide range of solar inverters designed for different system types and sizes, from residential to large-scale

A new tool to track transitions: the IEA clean energy equipment price

Sep 13, 2023 · To monitor these influences on clean energy equipment prices – a critical determinant of investment in clean energy technology and infrastructure – the IEA developed

Solar PV Panel Prices in 2024 | Cost of Installing

Nov 9, 2024 · These prices reflect the range for each brand, offering a variety of options for different energy needs and budgets. Typical Solar Battery and

Powering Forward: Integrating Electric Equipment With On-Site

Jun 23, 2025 · Key benefits include the following: Fuel savings — Solar and wind generation and rechargeable power banks reduce or eliminate diesel purchases. Reduced downtime — On

4 FAQs about [Solar on-site energy equipment price]

What is NREL's PV cost benchmarking work?

NREL analyzes the total costs associated with installing photovoltaic (PV) systems for residential rooftop, commercial rooftop, and utility-scale ground-mount systems. This work has grown to include cost models for solar-plus-storage systems. NREL's PV cost benchmarking work uses a bottom-up approach.

How does Seto calculate PV system cost?

Unlike most PV cost studies that report values solely in dollars per watt, SETO’s PV system cost benchmark reports values using intrinsic units for each component. For example, the cost of a mounting structure is given in dollars per square meter of modules supported by that structure.

How efficient are bifacial solar modules?

Each module has an area (with frame) of 2.57 m 2 and a rated power of 530 watts, corresponding to an efficiency of 20.6%. The bifacial modules were produced in Southeast Asia in a plant producing 1.5 GW dc per year, using crystalline silicon solar cells also produced in Southeast Asia. In 2024Q1, these modules were not subject to import tariffs.

Is Sun store a good platform for distributors?

"Sun.Store is an exceptional online platform for distributors. Its intuitive design makes both product showcasing and finding desired items effortless. Direct communication and secure transactions make this platform a valuable resource for any distributor seeking online success. Highly recommended!"

Update Information

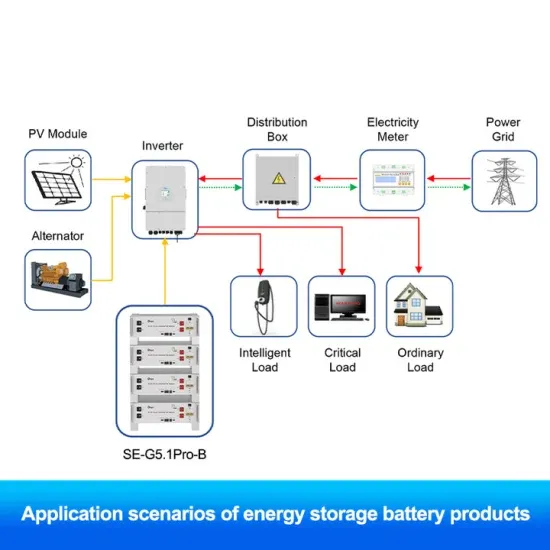

- Solar Energy Equipment On-site Energy

- 1000w energy storage equipment price

- Solar wireless mobile no network on-site energy

- Solar Small Micro On-site Energy Storage Inverter

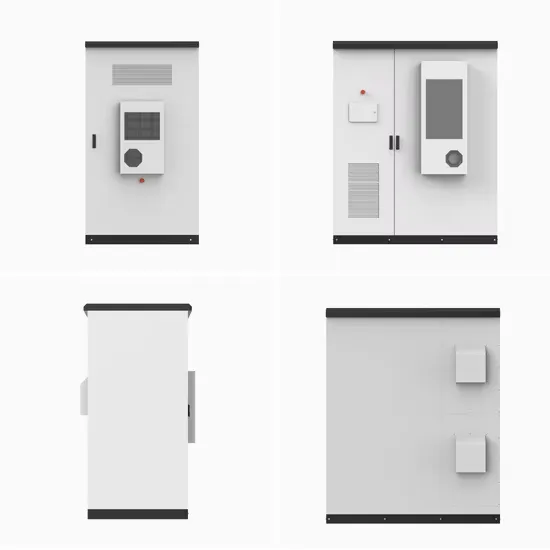

- China Photovoltaic Energy Storage Cabinet Solar Power Supply System Price

- Price of greenhouse solar energy storage cabinet

- Energy storage cabinet battery appearance inspection equipment price

- Agricultural Photovoltaic Solar On-site Energy

- Jamaica DC energy storage equipment price

- Solar Wireless On-site Energy System

- BESS energy storage equipment price

- Vatican solar energy storage cabinet control panel price

- Warsaw solar energy storage module price

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.