Backup UPS (Uninterruptible Power Supply)

The global Backup UPS (Uninterruptible Power Supply) market size is expected to reach US$ million by 2029, growing at a CAGR of % from 2023 to 2029. The market is mainly driven by

Mecer UPS 220V / 230V uninterrupted power supplies. Sales

UPS - uninterrupted power supplies to power computers and laptops An uninterruptible power supply, also uninterruptible power source, UPS or battery/flywheel backup, is an electrical

Asia Pacific Uninterrupted Power Supply Market

Asia Pacific Uninterrupted Power Supply Market was valued at US$ 4,228.51 Million in 2023 and is projected to reach US$ 7,003.09 Million by 2031 with a CAGR of 6.5% from 2023 to 2031

Backup Power Market Report | Global Forecast From 2025 To

Uninterruptible Power Supplies (UPS) are increasingly gaining traction as they offer immediate power backup in the event of a power failure. They are highly valued in environments where

UPS Battery Backup: Uninterruptible Power Supply

Aug 27, 2011 · Shop battery backup systems from top brands at Best Buy. UPS backups, backup power supply and battery backup surge protectors all help maintain your electronics.

BBU电源点评:AI服务器对功率需求提升,充分利好BBU电池

Jan 1, 2025 · BBU可以简单理解为之前数据中心用UPS (uninterruptible power supply)的进阶版,但与使用铅酸电池的UPS相比,使用锂离子电池的BBU有着以下的优势:1)预期使用寿命

Uninterruptible Backup Power Supply

Dec 7, 2024 · This report aims to provide a comprehensive presentation of the global market for Uninterruptible Backup Power Supply, focusing on the total sales volume, sales revenue,

Global Uninterruptible Backup Power Supply Sales Market

An uninterruptible backup power supply is a machine that provides emergency power backup to anything that"s plugged into it in the event of a mains power failure, including computer

6 FAQs about [Bangui backup uninterruptible power supply sales]

What is the growth rate of Southeast Asia uninterruptible power supply (UPS) market?

The Southeast Asia Uninterruptible Power Supply (UPS) Market is growing at a CAGR of greater than 3.3% over the next 5 years. Riello Elettronica SpA, EATON Corporation PLC, Emerson Electric Co., Delta Electronics Inc. and Ltd are the major companies operating in this market.

What is uninterruptible power supply (UPS)?

Meaning Uninterruptible Power Supply (UPS) is a device that provides backup power when the main power source fails or experiences fluctuations. It ensures a continuous flow of electricity to connected equipment by using stored energy in batteries or flywheels.

Who are the major players in the Southeast Asian uninterruptible power supply market?

The Southeast Asian uninterruptible power supply (UPS) market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Eaton Corporation PLC, Riello Elettronica SpA, Emerson Electric Co., Delta Electronics Inc., and Ltd. Need More Details on Market Players and Competitors?

How will Vietnam's ups market change in 2024?

Building works for Phase II are expected to begin in 2024. Such growth and investments in Vietnam indicate the rise in the manufacturing sector, which in turn, is expected to increase the demand for UPS systems during the forecast period. The Southeast Asian uninterruptible power supply (UPS) market is moderately fragmented in nature.

What is the demand for a standby UPS system?

Overall, the demand for standby UPS system is primarily expected to come from consumer electronics as offline UPS system provides the least expensive power backup and protection to the devices, and it is likely to increase during the forecast period due to the increasing demand for desktop PC and gaming consoles.

What is a high power ups system?

By Power Rating: UPS systems can be classified into low power (below 5 kVA), medium power (5-20 kVA), and high power (above 20 kVA). By Application: The market can be segmented into data centers, telecommunications, healthcare, manufacturing, commercial, and others.

Update Information

- Lobamba processing ups uninterruptible power supply sales manufacturer

- Palau backup uninterruptible power supply

- Ups uninterruptible power supply 6kw factory direct sales

- Syria non-standard uninterruptible power supply sales

- Uninterruptible power supply sales in Norway

- Uninterruptible Power Supply Sales in Nicaragua

- Distribution Uninterruptible Power Supply Sales

- Windhoek backup ups uninterruptible power supply

- Bangkok backup ups uninterruptible power supply

- Georgia Outdoor Uninterruptible Power Supply Sales

- Home UPS uninterruptible power supply sales manufacturer

- St George Backup Uninterruptible Power Supply

- Oslo backup ups uninterruptible power supply

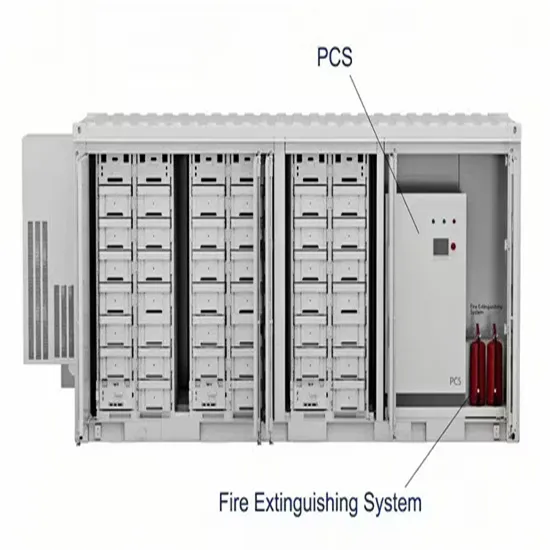

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.