Uninterruptible Power Supply System

Aug 3, 2022 · Businesses today invest large sums of money in their IT infrastructure, as well as the power required to keep it functioning. Uninterruptible power supplies (UPS) are an

Uninterruptible Power Supply UPS System Businesses in Syria

Syria Power Systems Co. is one of the leading power protection solution suppliers in Syria. It was established in 2001 (Under name of PCE UPS SYRIA)? ? Syria Power Systems Co. is part of

RFQ-HCR-SYR-2025-1053 For the Supply and Delivery and

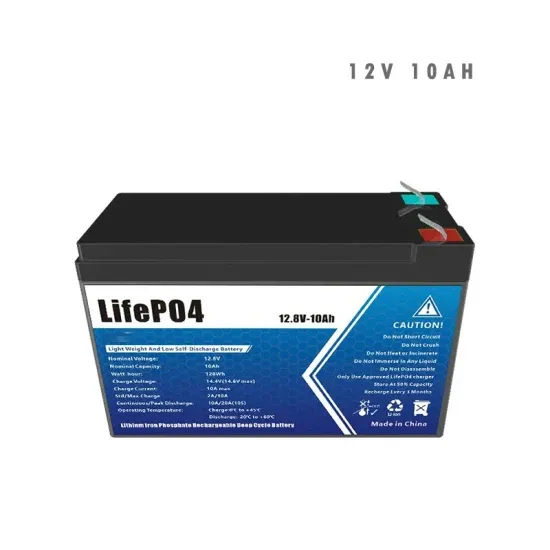

Feb 4, 2025 · Tender Title: For the Supply and Delivery and installation batteries for Uninterruptible Power Supply (UPS) to UNHCR Sub Office Qamishli in Syria. Reference

Makelsan | UPS | Uninterruptible Power Supplies

Akü, İnvertör, kesintisiz güç kaynağı, Uninterruptible Power Supplies, UPS, MAKELSAN Türkiye''nin önde gelen Kesintisiz Güç Kaynağı üreticisi, 600-1600 kVA Kesintisiz Güç

Tenders Are Invited For Uninterruptible Power Supply Units (Ups) in Syria

Tenders are Invited for Uninterruptible Power Supply Units (Ups) Baniyas Refinery Company Internal Tender Announcement No. 58/D/2024 for the First Time, Baniyas Refinery Company

Syria Power Supply Market (2024-2030) | Trends, Outlook

Historical Data and Forecast of Syria Power Supply Market Revenues & Volume By Power Supply With Medium Output (500��1,000 W) for the Period 2020-2030

Difference Between Standby Power Supply and Uninterruptible Power

Conclusion Understanding the difference between Standby Power Supply and Uninterruptible Power Supply is crucial for selecting the right power backup solution for your needs. An SPS is

Syria Govt Tender for Providing Batteries for the Ups Uninterruptible

Syria government tender for Providing Batteries for the Ups Uninterruptible Power Supply Unit for the Incubators Section, TOT Ref No: 88852716, Tender Ref No: 80884, Deadline: 24th Sep

DC To AC Power Inverter Businesses in Syria

Syria Power System Syria Power Systems Co. seeks to be the preferred partner of companies seeking powerprotection solutions for their information and communication projects that meets

Syria Rotary Uninterruptible Power Supply (UPS) Market

6Wresearch actively monitors the Syria Rotary Uninterruptible Power Supply (UPS) Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers,

Uninterruptible Power Supply UPS System Businesses in Syria

Syria Power System Syria Power Systems Co. seeks to be the preferred partner of companies seeking powerprotection solutions for their information and communication projects that meets

15 KVA 360 VDC Three Phase On-Line UPS Price in Syria

In Syria, as businesses and industries strive for uninterrupted power supply and enhanced reliability, the demand for advanced power backup solutions like the 15 KVA 360 VDC three

Syria UPS Uninterruptible Power Supply Production Plant

Summary: Syria''''s growing demand for reliable power solutions has fueled the rise of UPS production plants. This article explores the role of local manufacturing in addressing energy

Syria VRLA Battery Market (2025-2031) | Trends, Outlook

Historical Data and Forecast of Syria VRLA Battery Market Revenues & Volume By Uninterruptible Power Supply (UPS) for the Period 2021-2031 Historical Data and Forecast of

6 FAQs about [Syria non-standard uninterruptible power supply sales]

How does Syria get its electricity?

Most of Syria's electricity is generated by thermal power plants using oil and natural gas. The Tishrin hydroelectric plant near Aleppo supplies about 4 per cent of the country's power in normal circumstances. Due to frequent power cuts, most Syrians rely on generators, raising demand for diesel – a fuel in short supply.

Does Turkey supply electricity to Syria?

Turkey supplies electricity to several areas in northern Syria, particularly those close to the border. This includes cities like Aleppo, which was once Syria's largest and is a major industrial hub. However, the power supply from those lines has not been consistent in recent years, Mr Jain told The National.

Could Ankara provide electricity to Syria?

In December, Turkish Energy Minister Alparslan Bayraktar said Ankara could provide electricity to Syria, and help develop its oil and gas resources. At the time, Mr Bayraktar said Syria's pre-war installed power of 8,500 megawatts had fallen to about 3,500 megawatts.

Can Turkey and Qatar solve Syria's power crisis?

Due to frequent power cuts, most Syrians rely on generators, raising demand for diesel – a fuel in short supply. Turkey and Qatar have committed to deploying floating power-supply vessels to provide electricity to Syria, but analysts are sceptical about their ability to resolve the crisis.

Will Syria get 8 hours of power a day?

A man sells petrol by the side of a road in Damascus. Syria’s new President, Ahmad Al Shara, aims to provide eight hours of power a day by late February. AFP Syria's electricity sector, long plagued by a cascade of crises – from war-torn infrastructure and fuel shortages, to economic woes and sanctions – faces a daunting path to recovery.

Why is Syria unable to export oil?

Once an oil exporter, Syria has been unable to export petroleum since 2011 due to stringent international sanctions. “Syrian infrastructure has sustained damage over the decades, and electricity production has suffered significantly,” Syed Rizvi, energy market analyst at Primary Vision, told The National.

Update Information

- Uninterruptible power supply sales in Norway

- Ups uninterruptible power supply 6kw factory direct sales

- Large UPS uninterruptible power supply sales manufacturer

- Uninterruptible Power Supply Sales in Nicaragua

- Taipei Uninterruptible Power Supply Direct Sales Store

- Uninterruptible power supply sales for Bloemfontein computer room

- San Diego Uninterruptible Power Supply Brand Direct Sales

- Lobamba processing ups uninterruptible power supply sales manufacturer

- Syria Uninterruptible Power Supply System

- Georgia Outdoor Uninterruptible Power Supply Sales

- Distribution Uninterruptible Power Supply Sales

- Chisinau uninterruptible power supply manufacturer

- Tbb Uninterruptible Power Supply

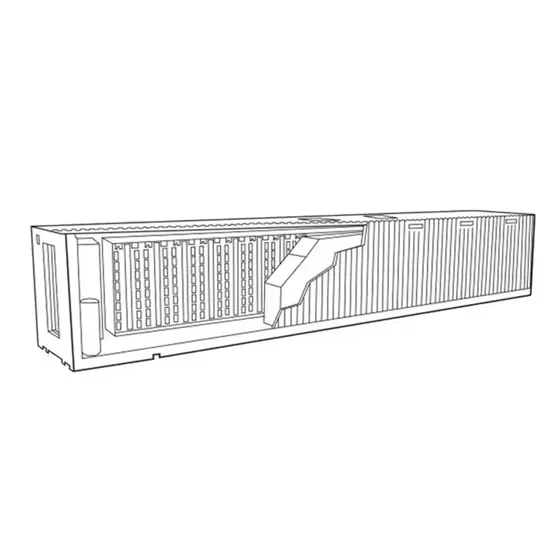

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

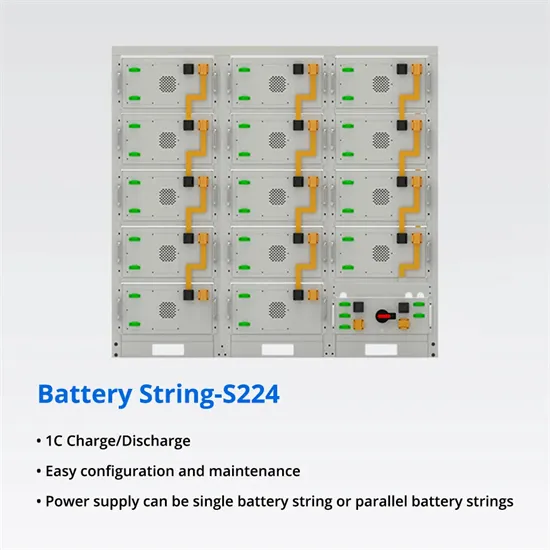

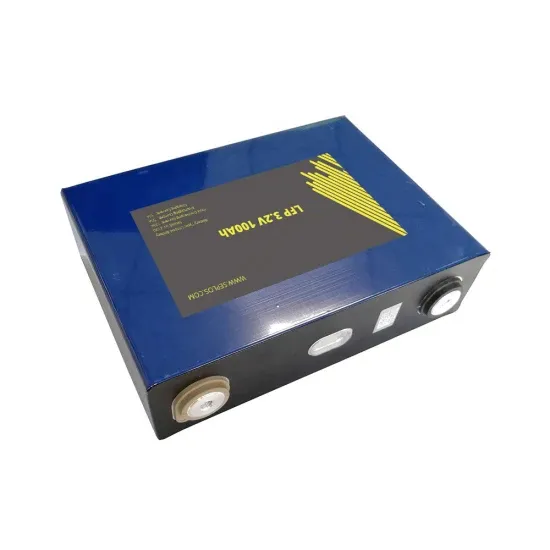

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.