Inverters Explained 2.0: Strengthening Europe''s Inverter

Oct 19, 2024 · Europe has a strong foundation in its inverter manufacturing industry. In 2023, there was equivalent of 82.1 GW of solar inverter manufacturing capacity in the EU (compared

France Inverter Market (2025-2031) | Trends, Outlook

France Inverter Market Overview The France Inverter Market is experiencing robust growth, driven by the increasing deployment of solar photovoltaic (PV) systems, energy storage

Solar Panel Inverters Distributor in UAE | Price in

4 days ago · A solar inverter is a critical component of a solar panel system, as it converts the DC (direct current) electricity produced by the solar panels into

France In Focus for Solis in 2022

Mar 9, 2022 · A wide range of inverters from 0.7 kW to 255 kW "Solar in France has strong development potential and a promising future, thanks in particular to all the measures taken by

France Power Inverter Market Size, Share, Analysis, Trends

Jul 31, 2024 · The growing trend of rooftop solar installations, coupled with increasing electricity costs, has boosted the demand for sub-5 KW inverters in France. The 100 KW to 500 KW

Fronus Solar Energy

Aug 18, 2025 · Discover sustainable and cost-effective solar energy solutions with Fronus Solar Energy. We offer high-efficiency solar panels, inverters, and batteries designed to maximize

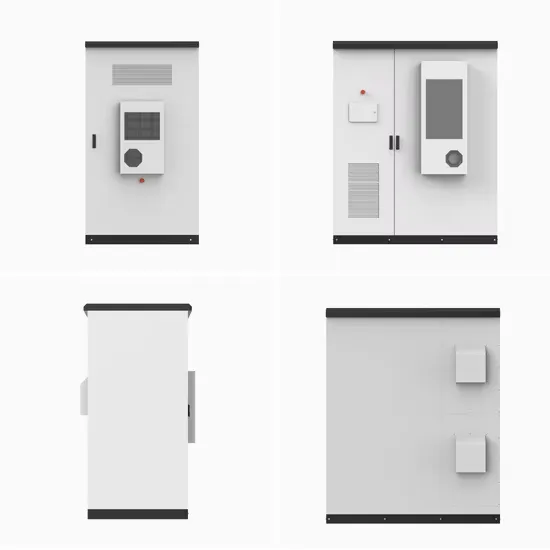

Solar Hybrid Inverter Manufacturers, Grid Interactive Inverter

NingBo Deye Inverter Technology Co.,Ltd is famous hybrid inverter manufacturers and grid interactive inverter suppliers, we offer hybrid inverter with solar battery charging.

4 FAQs about [2 5 kw solar inverter factory in France]

Does Europe have a solar inverter industry?

Ensuring interoperability. Europe has a strong foundation in its inverter manufacturing industry. In 2023, there was equivalent of 82.1 GW of solar inverter manufacturing capacity in the EU (compared to around 60 GW of solar installed in the same period).

How many solar inverter jobs are there in Europe in 2023?

In 2023, there was equivalent of 82.1 GW of solar inverter manufacturing capacity in the EU (compared to around 60 GW of solar installed in the same period). The industry employed around 35,000 jobs in the EU in 2023, making it the most significant contributor of solar manufacturing employment in Europe.

Are European inverter manufacturers facing competition?

However, European inverter manufacturers are facing pressure and growing competition. While some EU inverter companies keep growing and announcing reinvestment plans, their relative market share in Europe is shrinking. It is estimated that EU inverter manufacturers are only able to capture 20% of the market currently.

Are European inverter manufacturers able to capture 20% of the market?

It is estimated that EU inverter manufacturers are only able to capture 20% of the market currently. Right now, European inverters have a critical opportunity to further tap into the technological advancements needed for the electrification and digitalisation of the energy system.

Update Information

- Cheap 3 6 kw solar inverter factory exporter

- 2 5 kw solar inverter factory in Bahrain

- 7 5 kw solar inverter factory in Cape-Town

- Cheap 7 5 kw solar inverter factory company

- 3 6 kw solar inverter factory in Austria

- 2 5 kw solar inverter factory in Slovakia

- 4 2 kw solar inverter factory in Latvia

- China 2 5 kw solar inverter factory producer

- 7 5 kw solar inverter factory in Uae

- High quality 3 5 kw solar inverter factory Price

- 3 5 kw solar inverter factory in Mumbai

- 1 2 kw solar inverter factory in Ethiopia

- 2 5 kw solar inverter factory in Cape-Town

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.