Ethiopia Solar Microinverter Market (2025-2031) | Trends,

Historical Data and Forecast of Ethiopia Solar Microinverter Market Revenues & Volume By Utility Scale for the Period 2021-2031 Ethiopia Solar Microinverter Import Export Trade Statistics

Performance Assessment of PV mini-grids for effective

Aug 17, 2024 · Performance Assessment of PV mini-grids for effective replacement of diesel based mini-grids at selected sites in Ethiopia A thesis Submitted to Addis Ababa Institute of

TOP SOLAR PANEL SUPPLIERS IN ETHIOPIA | Solar Power

Turn on solar panel inverters How do you turn on your solar panels?Step 1: Find your breaker box and turn on the solar breaker. Electrical panels or breaker boxes are typically found in utility

SinoSoar Won the Bid of EEU Package II (C) Solar

Jan 8, 2024 · Recently, SINOSOAR successfully won the bid of EEU Package II (C) Solar Mini–Grids (Generation) Projects in 8 mini grids in Ethiopia funded

Solar-powered ANN-based MPPT with zeta converter for

Feb 25, 2025 · This paper explores the design and implementation of a solar-powered water pumping system that utilizes a Brushless DC (BLDC) motor, with an Artificial Neural Network

Ethiopia Portable Inverter Generators Market (2025-2031

Historical Data and Forecast of Ethiopia Portable Inverter Generators Market Revenues & Volume By Solar for the Period 2021-2031 Historical Data and Forecast of Ethiopia Portable Inverter

Ethiopia Inverter Systems Market (2025-2031) | Trends,

Market Forecast By Power Rating (Below 10 kW, 10-50 kW), By End user (Residential, Photovoltaic (PV) Plants), By Type (Solar inverter, Vehicle inverter), By Output Voltage (100

Ethiopia Solar Electric System and Inverter Market (2025

Ethiopia Solar Electric System and Inverter Industry Life Cycle Historical Data and Forecast of Ethiopia Solar Electric System and Inverter Market Revenues & Volume By Technology Type

MAPPING THE OFF-GRID SOLAR MARKET IN ETHIOPIA

Nov 5, 2020 · According to FAO potential area of 6,800 ha could be irrigated using solar PV water lifting in Ethiopia (9% of irrigated land and 18% of rainfed land) Market revenues are

Ethiopia Renewable Energy Market Size | Mordor

Feb 20, 2025 · In 2021, Ethiopia''s total installed solar capacity was 20 megawatts (MW), which is comparatively higher than the 10 megawatts (MW) installed in

Ethiopia Grid Forming Inverters Market (2025-2031)

Market Forecast By Inverter Type (Central Inverter, String Inverter, Micro Inverter), By Grid Connection (On-Grid, Off-Grid, Hybrid), By Power Capacity (Below 100 kW, 100-500 kW,

Ethiopia Grid Connected PV Systems Market (2025-2031)

Market Forecast By System Type (String Inverter System, Central Inverter System, Micro-Inverter System), By Component (Solar Panels, Inverters, Battery Storage), By Power Output (Below

Toyo Solar''s Strategic Expansion: Ethiopia Emerges as Key Solar

Since Section 201 tariffs hit bifacial solar modules in 2022, American installers have been scrambling. Ethiopia''s exemption status under the same legislation makes it sort of a backdoor

Factory Direct Sales PV Charging Inverter 12V 1.2KW 24V

Key attributes Output Type Single Phase Inverter Efficiency 94% Place of Origin Anhui, China Brand Name Amosolar Input Voltage 48V Output Voltage 240V Output Frequency 50/60Hz

New York Solar Guidebook For Local Governments-Solar

Dec 10, 2024 · Solar electric systems convert the energy in sunlight into electrical current, which can power electric loads, be fed back to the electric grid, or be stored in batteries. All solar

Design and Performance Analysis of 125 MW Floating

Jun 11, 2025 · Abstract. Floating solar PV power plants are currently emerging form of photovoltaic technologies that uses the surface of water bodies such as irriga-tion, canals,

Ethiopia Solar Electric System and Inverter Market (2025

Historical Data and Forecast of Ethiopia Solar Electric System and Inverter Market Revenues & Volume By Rooftop for the Period 2021- 2031 Ethiopia Solar Electric System and Inverter

Financing Secured for Establishment of 20 Solar

Jun 28, 2023 · Financing has been secured for the establishment of 20 solar mini-grid projects in Ethiopia. The funds were secured by the Ethiopian government

3 FAQs about [1 2 kw solar inverter factory in Ethiopia]

Is there a private investment in solar power plants in Ethiopia?

However, there was no private investment in solar power plants in Ethiopia. Mainly the Ethiopian Electric Power Corporation (EEPCo) has been a state-owned and vertically integrated monopoly that controls the market from generation to selling of electricity throughout the country .

How much does a solar PV system cost in Ethiopia?

Another recent study in Nigeria analyzed the technical and economic performance of an 80 kW solar PV grid connected system (contributing 40.4%) in combination with a 100 kW power from the grid and showed that the LCOE was about $0.103/kWh . Looking at such cases, the proposed system cost in Ethiopia falls within the range of LCOE in the region.

What is the history of solar PV systems in Ethiopia?

In the next section, brief overview of previous studies and historical background of PV systems in Ethiopia is included. The first standalone solar PV system in Ethiopia was introduced in the mid of 1980s to a remote village located in the central part of the country .

Update Information

- Cheap 3 6 kw solar inverter factory exporter

- 3 5 kw solar inverter factory in Mumbai

- 2 5 kw solar inverter factory in Slovakia

- Best 2 5 kw solar inverter factory Wholesaler

- 4 2 kw solar inverter factory in Latvia

- 3 6 kw solar inverter factory in Austria

- 7 5 kw solar inverter factory in Bahamas

- 1 5 kw solar inverter factory in Dubai

- 3 5 kw solar inverter factory in Sao-Paulo

- 7 5 kw solar inverter factory in Cape-Town

- China 2 5 kw solar inverter factory producer

- High quality 3 5 kw solar inverter factory Price

- Hot sale 4 2 kw solar inverter factory company

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

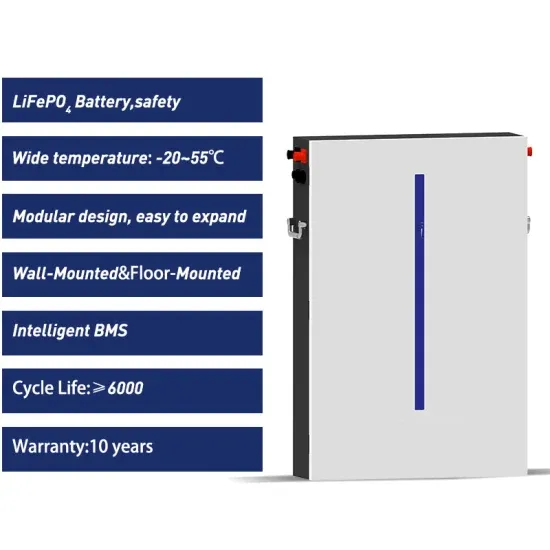

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.