Electricity Generation Costs 2020

Aug 25, 2020 · Levelised costs provide a straightforward way of consistently comparing the costs of different generating technologies with different characteristics, focusing on the costs

Wind energy in Europe: 2022 Statistics and the outlook for

Feb 28, 2023 · We expect the EU to build 20 GW of new wind farms a year on average over 2023-2027. The EU should be building over 30 GW a year of new wind on average to meet its

European wind power | Inside the wipe-out in Europe''s wind

Jun 27, 2024 · The UK''s success came after a breakthrough decade for wind power in Europe when the levelized cost of electricity – which accounts for capital and operating expenditure

Land-based wind energy cost trends in Germany, Denmark, Ireland

Nov 1, 2020 · International trend is for larger, taller wind turbines with lower specific powers. Capital costs fell by 10% to 1,422€/MW over the period. Reduction of 33% in levelised cost of

Cost of bringing wind power plants into operation drops by

Apr 12, 2024 · The average cost of launching 1 kilowatt (kW) of capacity has gone from $2,179 in 2010 to $1,274 in 2022 for onshore wind generators and from $5,217 in 2010 to $3,461 in 2022

How much does wind power really cost? | World

Apr 13, 2015 · Giberson''s estimate, however, includes the most relevant factors in attempting to measure the true cost of producing electricity from wind power.

How much wind power potential does europe have? Examining european wind

Sep 1, 2019 · The European Energy Agency report partially explained the bias toward wind power development in Western Europe by noting that wind power developments in Eastern European

Wind-energy potential in Europe 2020-2030

May 7, 2019 · This paper addresses the potential for wind energy in Europe in the future, with a time horizon up to 2030. Indicative quantitative estimates of the technical and economic

Wind energy in Europe

Mar 18, 2024 · 454 MW of wind power capacity was decommissioned in Europe in 2022. 1.5 GW was expected to be decommissioned but very high electricity prices throughout the year likely

Wind energy in Europe: 2024 Statistics and the outlook for

Mar 2, 2025 · Overview Europe installed 16.4 GW of new wind power capacity in 2024. The EU-27 installed 12.9 GW of this. 84% of the new wind capacity built in Europe last year was onshore.

6 FAQs about [How much does a wind power base station cost in Southern Europe ]

How much does a wind turbine cost?

The capital costs of wind energy projects are dominated by the cost of the wind turbine itself (ex works) . Table 1.1 shows the typical cost structure for a 2 MW turbine erected in Europe. An average turbine installed in Europe has a total investment cost of around €1.23 million/MW.

How many wind farms will the EU build a year?

We expect the EU to build 20 GW of new wind farms a year on average over 2023-2027. The EU should be building over 30 GW a year of new wind on average to meet its 2030 targets. In 2022 new wind installations in Europe amounted to 19.1 GW (16.7 GW onshore and 2.5 GW offshore).

How much wind power does Europe need?

We expect Europe to install 129 GW of new wind power capacity over the next five years. We expect the EU to install 98 GW of this, 19.6 GW a year on average. We expect 74% of the new installations in Europe over 2023-27 to be onshore. The EU needs to build on average 31 GW a year to 2030 to meet the REPowerEU renewable energy goals.

Which countries install the most wind turbines in Europe?

87% of the new wind installations in Europe were onshore, with Germany, Sweden, and Finland building the most. Almost half the ofshore installations were in the UK, and France installed its first large ofshore wind farm. FIGURE A. New onshore and ofshore wind installations in Europe in 2022

How many new wind turbines will be installed in Europe?

Total capacity additions across Europe over the next five years are expected to come to 129 GW, 95 GW (74%) from onshore wind and 34 GW of new capacity installed of-shore. Up to 500 MW of this will be floaing ofshore wind, including Hywind Tampen and the first projects in France and the UK. FIGURE 20. New installations in Europe – Central scenario

How many wind farms will Europe build in 2023-2027?

We expect Europe to install 129 GW of new wind farms over the period 2023-2027, and the EU-27 to install 98 GW of that. Three quarters of the new capacity additions over 2023-27 will be onshore. We expect the EU to build 20 GW of new wind farms a year on average over 2023-2027.

Update Information

- How long can the EMS wind power of the communication base station be stored before use

- How to calculate the cost of building a base station power supply

- How much does the power distribution room of a communication base station cost

- How many companies make up the communication base station wind power

- How much does wind power cost for outdoor communication base stations

- Is the cost of wind power for Manama communication base station high

- How much does it cost to change the power supply of Damascus 5g base station

- How to connect wind power to the communication base station

- How long will the wind power of the communication base station be disconnected if no one maintains it

- Lome Communication Base Station Wind Power Infrastructure Construction Project

- Tender for wind power construction of communication base station in Port Louis

- The wind power contract for the communication base station expires and the station is not moved

- Wind power communication equipment base station

Solar Storage Container Market Growth

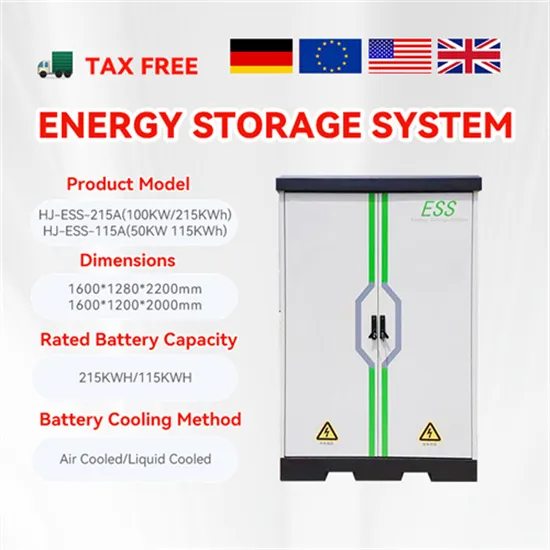

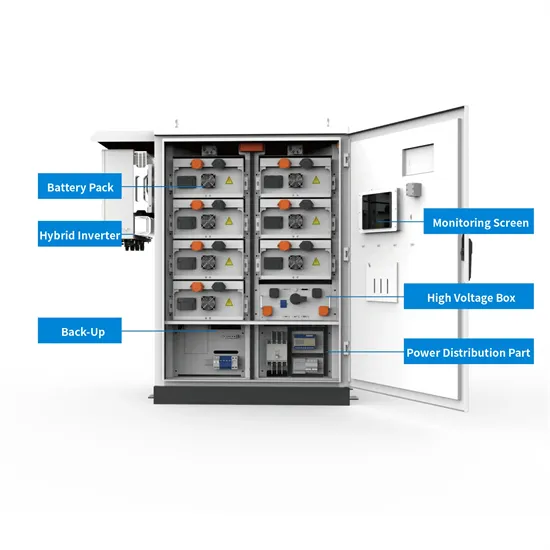

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.