Argentina to begin lithium battery production in Sept

Jul 2, 2023 · Argentina''s first plant for lithium batteries will begin operations in September, using metal extracted locally by U.S. company Livent Corp, mining officials said on Saturday.

Buenos Aires lithium battery energy storage agent

Buenos Aires -- YPF Tec, the technology arm of Argentina''''s majority state-owned energy company YPF (), has announced that its lithium battery factory will begin operations in April,

How Will Lithium Shape Argentina''s Economic Recovery?

Oct 24, 2024 · Jose Hofer, lithium battery specialist at consultancy SC-Insights and former analyst at Chile''s Ministry of Mining: "What we are witnessing today in Argentina''s lithium sector is the

Argentina to begin lithium battery production in Sept

Jul 2, 2023 · Argentina''s first plant for lithium batteries will begin operations in September, using metal extracted locally by U.S. company Livent Corp, mining officials said on Saturday. Livent

Operations | Lithium Argentina AG

Aug 19, 2025 · Our scale-up and roll-out of DLE (Direct Lithium Extraction) in both our projects means faster extraction, higher recovery rates, lower water requirements, and higher-purity

Argentina lithium battery custom processing factory

Where will lithium batteries be made in Buenos Aires? State company Y-TEC, the tech arm of YPF, will open the first lithium battery cell factory in September, in La Plata, the capital of

From lithium to batteries: Opportunities and challenges for

Argentina''s attempts to exploit its huge reserves of lithium – a strategic mineral crucial to the global green transition – has prompted public discussion on how best to link these resources

Lithium Mining in Argentina-广东盛邦科技有限公司

Apr 29, 2025 · As a core member of the "Lithium Triangle" (Argentina, Chile and Bolivia), Argentina has about 56% of the world''s lithium resource reserves, of which Argentina accounts

Argentina is about to unleash a wave of lithium

Jun 30, 2024 · Argentina is about to unleash a wave of lithium in a global glut Four new projects will finally begin to churn out lithium in the weeks and

Buenos Aires Lithium Battery Key Project

Buenos Aires -- Last week, Argentina''''s President Alberto Fernández visited the first Argentine lithium cells and batteries manufacturing plant belonging to Y-TEC, a company that

Argentina to Compete in the Global Lithium Battery

Aug 18, 2025 · In August 2022, the President of Y-TEC (YPF-Tecnología), Roberto Salvarezza, stated that next December the production of cells for lithium batteries will start in Argentina, a

Lithium batteries, made in Argentina: Can they

Dec 6, 2023 · The majority-state-owned company Y-TEC is set to open its first industrial-scale lithium battery plant in the city of La Plata, in Buenos Aires

Argentina''s Lithium Resource Holds Potential to Power the

Jan 14, 2025 · Argentina''s lithium resources in the Lithium Triangle are attracting investors due to high-grade brine, low production costs and government support.

Buenos Aires Lithium Battery Cathode Materials Company

Deep dive into battery materials research As a global leading supplier of battery materials for lithium-ion batteries, we aim to contribute to sustainable battery materials value chain and

Argentina publishes details of 500 MW battery tender

May 22, 2025 · The AlmaGBA Storage tender, for the metropolitan area of Buenos Aires (AMBA), will pay a fixed $10/MW of electricity supplied and energy storage capacity bids must have a

From lithium to batteries: Opportunities and challenges for

Recent scientific and technological advances in Argentina around lithium extraction and processing, as well as the manufacturing of components and batteries, spotlight the potential

Where can I learn lithium battery technology in Buenos Aires

An Outlook on Lithium Ion Battery Technology | ACS Central Lithium ion batteries as a power source are dominating in portable electronics, penetrating the electric vehicle market, and on

Rio Tinto expands Argentina lithium plans, eyes

Dec 13, 2024 · Rio Tinto is on the shortlist to partner Chilean state miner Codelco on a new lithium project, and has expanded production plans for the battery

6 FAQs about [Buenos Aires Power Tools Lithium Battery]

Where will lithium batteries be made in Buenos Aires?

State company Y-TEC, the tech arm of YPF, will open the first lithium battery cell factory in September, in La Plata, the capital of Buenos Aires province. Another plant, five times bigger, will kick off in Santiago del Estero in 2024.

How many people can a lithium battery power Buenos Aires?

The plant will generate 15 megawatts per year, which means it will produce lithium batteries capable of powering 2500 households. The batteries are envisaged for use in rural areas. For example, there is already a Buenos Aires province-backed project to supply the Paulino-Berisso island, home to 70 families who are currently off the power grid.

Does y-TEC sell lithium in Argentina?

In the case of lithium, Y-TEC signed a contract with American company Livent, which extracts the mineral in Catamarca and, for the first time, sold part of its production in Argentina. According to Salvarezza, for industrialization to grow in scale, part of the production ought to be sold on the local market.

How many companies are involved in a lithium project in Argentina?

These are some of the findings from a report prepared by the consulting firm Aleph Energy, led by Daniel Dreizzen, which analyzes the global lithium market while delving into Argentina in greater detail. These are the 41 companies of various characteristics that participate in the country’s 64 projects.

How much lithium will Argentina produce in 2040?

If Argentina manages to bring all of projects to production , the country would produce up to 1.5 million metric tons of lithium carbonate equivalent per year, exporting around US$30 billion. This scenario could be achieved by 2040, according to Dreizzen’s estimates.

Is Arcadium lithium still produced in Argentina?

Arcadium Lithium, the firm that resulted from the merger between Livent and Allkem, two of the three companies that were already producing lithium in Argentina, accounts for 13% of global production. Output has quadrupled in the last ten years, but is still attributable to only a few countries and projects. Another Argentine Unicorn on the Horizon?

Update Information

- Branded lithium battery for power tools in Vaduz

- Beiya Power Tools Lithium Battery

- Canadian power lithium battery processing plant

- Lithium iron phosphate battery assembly 12 volt outdoor power supply

- Power tool lithium battery working current

- Outdoor power supply connection lithium battery

- Saint Lucia Power Lithium Battery Pack Customization

- Power battery lithium battery energy storage

- 24V lithium battery portable power supply

- Outdoor lithium battery power inverter

- Energy storage lithium battery power precision

- Thimbu Universal Power Tool Lithium Battery

- Myanmar lithium battery outdoor power supply

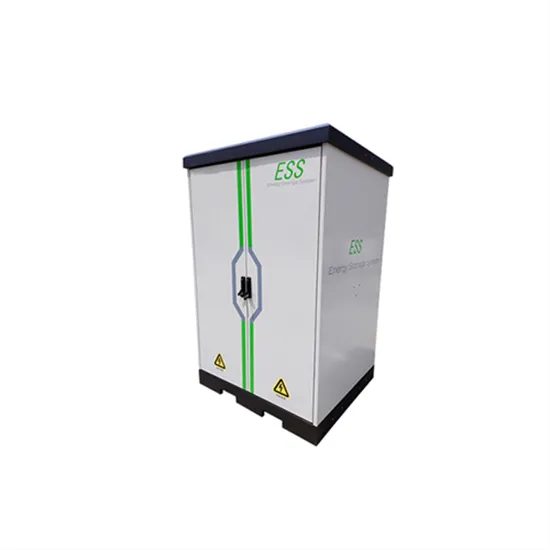

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.