BC''s Mangrove Lithium expands as global battery demand

Feb 13, 2025 · The plant will produce enough battery-grade lithium to supply up to 25,000 electric vehicles a year—about 10 per cent of Canada''s EV market. "The goal of this plant is to prove

Government of Canada investing almost $8.4M in critical

Sep 6, 2024 · Government of Canada investing almost $8.4M in critical minerals processing in Kingston, Ont. September 6, 2024 By Plant Magazine Sustainability Manufacturing The

Here''s the Status of Major EV Battery Plants and

Apr 21, 2025 · The plants, primarily located in Quebec and Ontario, include a diverse array of operations, from electric vehicle assembly facilities to those

Government of Canada invests in E3 Lithium to advance Canada

Nov 28, 2022 · This investment will support E3 Lithium''s $87 million project for the construction of a demonstration plant specializing in lithium production. This facility will be the first step toward

Frontier Lithium moves to secure land for lithium

Feb 27, 2025 · Frontier Lithium is getting closer to building a lithium conversion facility as part of its PAK lithium project with the purchase of industrial lands

Canada Is Building A New Lithium-Ion Battery

Jun 8, 2022 · Canada''s Budget 2022 calls for C$3.8B to launch Critical Minerals Strategy. Ontario ''all in'' to develop full EV, battery supply chains: minister.

Avalon PEA values Ontario lithium plant project

Sep 3, 2024 · The project is poised to provide high-quality, battery-grade lithium hydroxide to supply Canada''s projected demand from the rapidly growing EV

Hyundai Canada partners with Lithion for EV battery recycling

Oct 10, 2024 · Since the completion in June 2024 of its first commercial plant for extracting critical minerals from lithium-ion batteries, Lithion has signed several multi-year agreements for

Frontier Lithium in talks for public funding for

Mar 5, 2025 · Frontier Lithium is currently developing the Pakeagama (PAK) lithium project north of Red Lake, Ontario, in a joint venture with Mitsubishi. A

Canadian Recycler Advances North American Battery Supply

Jun 10, 2025 · The facility will process black mass — a powder derived from shredded batteries — using modular technology developed with Singapore-based partner Green Li-ion.

Here''s a list of recent electric vehicle and battery

Apr 25, 2024 · In March 2022, automaker Stellantis and South Korean battery maker LG Energy Solution announced they''re building a large-scale electric

Sudbury to host Canada''s first battery metals

May 29, 2024 · A news release said the new facility will fill a critical gap in Canada''s electric vehicle (EV) battery supply chain by establishing Canada''s

Frontier Lithium on a mission to build a Thunder

Feb 26, 2025 · The former site of the Thunder Bay generating station is Frontier Lithium''s preferred spot to build a lithium conversion plant. The Sudbury

6 FAQs about [Canadian power lithium battery processing plant]

Can frontier lithium build a processing plant in Thunder Bay?

A concept design of Frontier Lithium's proposed processing plant in Thunder Bay, Ontario. Courtesy of Frontier Lithium. Frontier Lithium got a vote of confidence from both the federal and Ontario governments on Tuesday, with the announcement of potential funding support for the construction of a lithium conversion facility in Thunder Bay, Ontario.

When will Ontario's lithium-ion battery separator plant be completed?

This article was originally published in the Spring 2025 issue of Plant. Ontario's $1.7 billion lithium-ion battery separator manufacturing facility in Port Colborne is expected to be completed in 2027.

Will a lithium plant benefit EV manufacturers in Northern Ontario?

“Operation of the plant and connection to the supply chain in northern Ontario will not only provide financial and social benefits to an economically vulnerable part of the country, but it will ensure a supply of lithium chemicals to EV battery manufacturers and EV manufacturers,” says Ugurgel.

Where will frontier lithium build a lithium conversion plant?

The former site of the Thunder Bay generating station is Frontier Lithium’s preferred spot to build a lithium conversion plant. The Sudbury company announced Feb. 25 that it expects to seal the deal on Friday to acquire the 183-acre brownfield land on Mission Island along the city’s harbourfront. A company representative confirmed the site.

What is frontier lithium's Pak Lithium Project?

Frontier Lithium’s multi-hundred-million-dollar PAK Lithium Project is the first fully integrated lithium development initiative in Canada. It supports the Government of Canada’s goal of developing Canadian end-to-end supply chains for critical minerals in the face of an increasingly uncertain world.

Where is the first lithium hydroxide facility in Ontario?

Photo: Frontier Lithium Ontario is on track to get its first lithium hydroxide facility courtesy of Frontier Lithium, Electric Autonomy can exclusively reveal, in the Township of Nairn and Hyman just 40 minutes west of Sudbury.

Update Information

- Power plant lithium battery energy storage power station price

- Nassau lithium battery processing plant

- Lima Power Lithium Battery Pack Processing

- Lithium battery station cabinet customized base station power generation

- Slovenia lithium battery uninterruptible power supply

- Ghana lithium battery outdoor power supply price

- Berlin lithium battery pack processing

- Solar power generation system of Kit processing plant

- Power battery lithium battery energy storage

- Brunei power lithium battery bms solution

- Skopje Power Lithium Battery Pack

- Brand lithium battery outdoor power supply

- All-in-one lithium battery assembly outdoor power supply

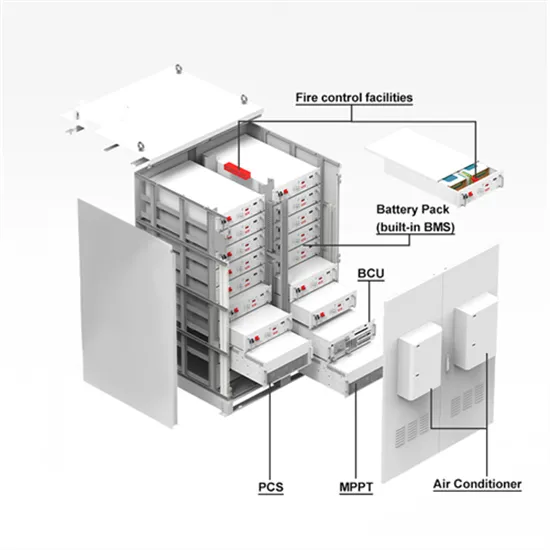

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.