Top Solar Panel Manufacturing Companies in United Arab

The company specializes in supplying solar energy products and collaborates with top international manufacturers to provide innovative solutions and competitive pricing. Its

Press Release: Press Information Bureau

Dec 7, 2023 · (iv) Imposition of Basic Customs Duty on import of solar PV cells & modules: The Government has imposed Basic Customs Duty (BCD) on import of solar PV cells and

Photovoltaic Module Businesses in the United Arab Emirates

DuSol, Dubai''s pioneering PV modules manufacturing company, is primarily involved in production of PV modules of sizes starting from 300mm x 400 mm (40Wp) modules all the way to 320Wp

UAE Photovoltaics Market Share, Growth & Industry Analysis

UAE Photovoltaics Market size was valued at USD 1.45 billion in 2022 which is expected to grow to USD 16.79 billion in 2030 with a CAGR of 5.02% for the forecast period between 2023 and

Solar Panels in UAE | Solar Panels & Equipment Suppliers in UAE

List of 20+ solar panel manufacturers & suppliers in UAE. Get quality photovoltaic cells, flexible solar PV panels for homes, plants & solar farms for best price from top solar panels dealers in

From Trade to Supply Chain Investments: China''s Three

Apr 23, 2025 · As shown in Figure 8, between 2017 and 2024, solar PV exports to the UAE consistently accounted for two percent of China''s total exports, while solar PV exports to Saudi

Solar Panel in Dubai : Buy online solar panels at low price

Best solar panel in Dubai Powernsun is a global company serving as a hub for some of the reputed brands of solar panels across the world. We provide a full range of solar panels for

Sellers in UAE | PV Companies List | ENF Company Directory

Emirati wholesalers and distributors of solar panels, components and complete PV kits. 37 sellers based in UAE are listed below. List of Emirati solar sellers. Directory of companies in UAE that

Top Solar Panel Manufacturing Companies in United Arab

Find the right companies for free by entering your custom query! The company is dedicated to supporting global clean energy efforts by supplying solar panels and providing comprehensive

United Arab Emirates (UAE) Photovoltaic Market (2025-2031)

United Arab Emirates (UAE) Photovoltaic Market Synopsis The United Arab Emirates has made significant strides in harnessing solar energy, and the Photovoltaic (PV) market has played a

Small-Scale Solar Photovoltaic Energy Netting Regulations

May 19, 2020 · 1.4 Scope 1.4.1 These Regulations apply to Distribution Companies, Owners, Producers Licensed Contractors, and any other Persons involved in the connection of small

2024 Monthly Solar Photovoltaic Module Shipments

Dec 11, 2024 · Data source: U.S. Energy Information Administration, Form EIA-63B, Monthly Photovoltaic Module Shipments Report Note: Includes both domestic shipments and exports.

Sellers in Middle East | PV Companies List | ENF Company

List of Middle Eastern solar sellers. Directory of companies in Middle East that are distributors and wholesalers of solar components, including which brands they carry.

5 FAQs about [Dubai Photovoltaic Module Export Company]

Why should you buy solar panels in Dubai?

The company is dedicated to supporting global clean energy efforts by supplying solar panels and providing comprehensive solutions for solar street and park lighting systems in Dubai, UAE. They emphasize quality and sustainability in their solar products, contributing to the transition to green energy.

Why is the solar panel manufacturing industry important in the UAE?

The Solar Panel Manufacturing industry in the United Arab Emirates presents significant opportunities amid a growing emphasis on renewable energy solutions. Key considerations include understanding the regulatory framework, which is influenced by the UAE's commitment to sustainability and the UAE Vision 2021, promoting clean energy.

Where are solar PV modules manufactured?

With our continuous commitment to research and development, we adopt highest technology to meet global requirements of most demanding energy users. Our solar PV modules are manufactured at advanced 250,000 square feet manufacturing facility, with the expansion plan to reach 950,000 square feet, located in Dubai Investment Park, UAE.

Who is Tek solar?

TEK Solar LLC, established in Dubai in 2016, specializes in the construction and maintenance of solar plants in the MENA region. The company has successfully built several phases of the Al Maktoum Solar Park, contributing to its expertise in solar panel manufacturing and installation.

What are the different types of solar PV systems offered?

Solar PV systems offered include off grid as well as grid interactive systems. Also offered are solar PV products like camping lights, battery chargers, emergency lights etc and now solar powered actuators and power packs for RTUs. Major projects completed/under execution include 91KW for Dubal and 1 MW for EEMC in Dubai.

Update Information

- Germany Hamburg photovoltaic module inverter company

- Photovoltaic module export tax rate

- Bolivia photovoltaic module export companies

- Southern Europe Double Glass Photovoltaic Module Company

- Egypt s photovoltaic module export manufacturers

- Photovoltaic module export standard container

- Tbilisi s first photovoltaic module export

- Photovoltaic module export 2971186Z space

- Riga photovoltaic inverter export company

- Dubai photovoltaic off-grid energy storage company

- Photovoltaic module prices in Kathmandu

- Djibouti s main export of photovoltaic modules

- EU export PV module prices

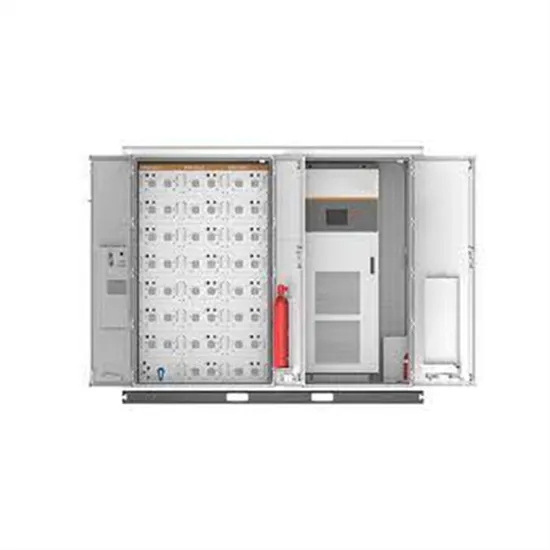

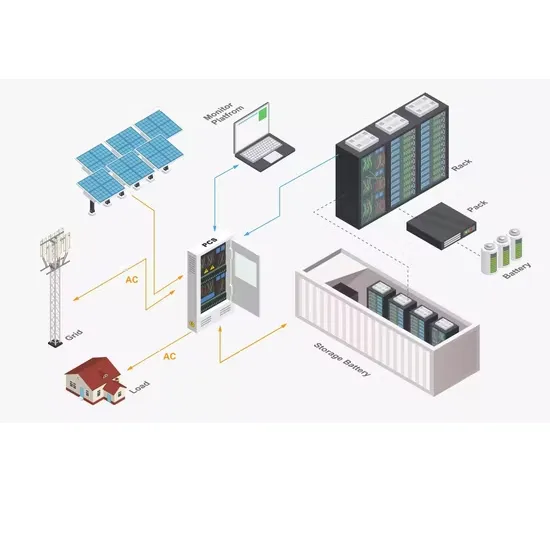

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.