Progress of PV cell technology: Feasibility of building materials, cost

Jul 1, 2023 · Recently, the demand for PV technology by various sectors, including the public domain, industry, and space technology, has significantly increased. The feasibilities of

Solar Panel Cost In 2025: It May Be Lower Than

Jul 31, 2025 · Your state-level average cost-per-watt will be a more relevant benchmark, but those numbers vary widely. Even with that number, you''ll still

Solar modules now selling for less than €0.06/W

Nov 14, 2024 · Search4Solar, a European platform for buying and selling solar panels, inverters, and batteries, received a record-low PV module price this

U.S. market solar panel prices increase from April

Oct 2, 2024 · From April''s low to the Q2 high in June 2024, the median U.S. module price rose from $0.25 cents per watt to $0.275 cents per watt, marking

Solar module prices in India ''likely to remain

Dec 29, 2023 · Vikram V, vice president and co-group head of corporate ratings at Indian investment information and credit rating agency ICRA Ltd, speaks to

Rising Solar Module Prices: Insights On Market Trends And

Oct 3, 2024 · The Q3 Solar Module Pricing Insights report shows an overall increase in solar module prices between April and August 2024. Several factors have influenced these price

6 FAQs about [Latest price per watt for photovoltaic modules]

How much are Chinese solar modules worth?

Prices for Chinese solar modules have reached record lows, according to the latest data from OPIS. The benchmark assessment for TOPCon modules from China has fallen to $0.100 per watt, a decline of $0.005 per watt compared to the previous week. Similarly, Mono PERC module prices have also dropped by $0.005 per watt, now standing at $0.090 per watt.

How much does a solar panel cost?

Average EXW prices from distributors for residential solar panels are reported between €0.125/W and €0.100/W, depending on the volumes. US DDP: The spot price for TOPCon utility-scale modules DDP US rose this week from 0.71% to $0.284/W.

How much does a PV module cost in China?

According to price analysis firm InfoLink: “Since March, the spot price of n-type modules in China has soared from RMB0.7/W to RMB0.73/W. Quotes from leading manufacturers are approaching the RMB0.75/W mark.” The results of the China Datang Group’s 2025-2026 PV module framework. Image: Datang.

How much will PV modules cost in 2025?

On 11 March 2025, the results of the China Datang Group’s 2025-2026 PV module framework purchase tender were announced, with the spot price of n-type modules increasing from RMB0.7/W (US$0.097/W) to RMB0.73/W (US$0.1/W), and some modules priced as high as RMB0.75/W (US$0.11/W).

How much will solar modules cost in 2025?

CEA has predicted that solar module prices may increase from around $0.8/W to $10/W currently to $0.11/W by the end of 2025 and likely up to $0.13/W by 2027.

How much do Topcon solar modules cost in China?

The current tradable indications for TOPCon modules are being reported at $0.10 per watt Free-on-Board (FOB) China. As the market struggles with low demand, these new record low prices highlight the ongoing challenges faced by Chinese solar module makers.

Update Information

- Latest price of n-type photovoltaic modules

- How much is the price of photovoltaic modules in Kigali

- Price of one watt photovoltaic module

- Photovoltaic panel price per watt now

- Daily maintenance of solar photovoltaic modules

- What is the price of installing photovoltaic panels in Myanmar

- Latvian building photovoltaic curtain wall price

- Marshall Islands new photovoltaic panels for sale price

- Middle East 300W photovoltaic glass price

- Light transmittance of curtain wall photovoltaic modules

- Single-sided and double-sided photovoltaic modules

- 5kw photovoltaic energy storage price

- 660Wp photovoltaic panel price

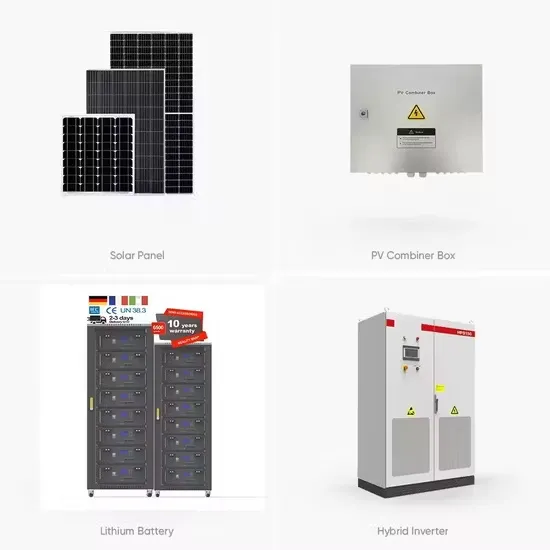

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.