How do energy storage equipment manufacturers make profits?

Jun 23, 2024 · Profitability for energy storage equipment manufacturers relies on multiple interlinked aspects including operational efficiencies, innovative product development,

Analysis of potential equipment manufacturing profits in

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset,

New Energy Storage Business Models and Revenue Levels

Jun 15, 2024 · Under the current energy storage market conditions in China, analyzing the application scenarios, business models, and economic benefits of energy storage is

Analysis of future energy storage equipment

Energy Storage Market Size, Share & Trends Analysis Report By Application, Regional Outlook, Competitive Strategies, And Segment Forecasts, 2019 To 2025. The global energy storage

Three Investment Models for Industrial and

Sep 30, 2023 · In this article, we''ll take a closer look at three different commercial and industrial energy storage investment models and how they play a key role

Profit Model|Home Energy Storage System|ESSCOLLEGE

In the industrial and commercial sector, solar energy + energy storage systems provide enterprises with a low-input, high-yield profit path through energy service contracts.

Profit analysis of energy storage scientific research

Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is globally on the rise (IEA,2020). One

How to make profit from exporting energy storage equipment

6 FAQs about [How to make profit from exporting energy storage equipment] How can energy storage be profitable? Where a profitable application of energy storage requires saving of

Profit analysis of energy storage industrial cooling

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is

Hierarchical game optimization of independent shared energy storage

Apr 15, 2025 · With the rapid development of renewable energy, independent energy storage systems have garnered increasing attention. However, challenges such as limited revenue

Energy storage battery profit analysis equipment

Conclusion Our financial model for the Battery Energy Storage System (BESS) plant was meticulously designed to meet the client''s objectives. It provided a thorough analysis of

Business Models and Profitability of Energy Storage

Oct 22, 2020 · SUMMARY Rapid growth of intermittent renewable power generation makes the identifica-tion of investment opportunities in energy storage and the establishment of their

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Summary Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their

Business Models and Profitability of Energy Storage

Dec 28, 2020 · We propose to characterize a ''''business model'''' for storage by three parameters: the application of a stor-age facility, the market role of a potential investor, and the revenue

Energy storage power profit analysis equipment

Conclusion Our financial model for the Battery Energy Storage System (BESS) plant was meticulously designed to meet the client''s objectives. It provided a thorough analysis of

Techno-economic assessment and mechanism discussion of

Apr 15, 2024 · Consequently, to enhance the efficiency and economic viability of energy storage power stations, particularly in the domain of electrochemical energy storage, a paradigm shift

A study on the energy storage scenarios design and the business model

Sep 1, 2023 · On this basis, an optimal energy storage configuration model that maximizes total profits was established, and financial evaluation methods were used to analyze the

Analysis and Comparison for The Profit Model of Energy Storage

Nov 7, 2020 · The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators continue to increase in the power sys

Energy Storage System Modeling

Apr 26, 2011 · Energy storage system model comprises of equations that describe the charging/ discharging processes of energy storage facility and cumulative variation of its energy content,

Energy storage equipment profit analysis method

Energy storage equipment profit analysis method By implementing the concept of shared energy storage assets, which is a novel concept, the optimal allocation utilization of resources can be

Energy storage industry profit analysis equipment

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is

6 Emerging Revenue Models for BESS: A 2025 Profitability

Mar 31, 2025 · Explore 6 practical revenue streams for C&I BESS, including peak shaving, demand response, and carbon credit strategies. Optimize your energy storage ROI now.

6 FAQs about [Energy storage equipment profit model]

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Is energy storage a profitable investment?

profitability of energy storage. eagerly requests technologies providing flexibility. Energy storage can provide such flexibility and is attract ing increasing attention in terms of growing deployment and policy support. Profitability profitability of individual opportunities are contradicting. models for investment in energy storage.

How many business models are there for energy storage technologies?

Figure 1 depicts 28 distinct business models for energy storage technologies that we identify based on the combination of the three parameters described above. Each business model, represented by a box in Fig- ure 1, applies storage to solve a particular problem and to generate a distinct revenue stream for a specific market role.

What is a business model for storage?

We propose to characterize a “business model” for storage by three parameters: the application of a storage facility, the market role of a potential investor, and the revenue stream obtained from its operation (Massa et al., 2017).

Does energy storage configuration maximize total profits?

On this basis, an optimal energy storage configuration model that maximizes total profits was established, and financial evaluation methods were used to analyze the corresponding business models.

Update Information

- Profit model of peak energy storage power station

- Brazzaville Industrial Energy Storage Peak Shaving and Valley Filling Profit Model

- Energy storage terminal equipment model

- Practical operation of the profit model of energy storage power station

- Fiji energy storage equipment exports

- Introduction to equipment in the battery energy storage system of communication base stations

- Electrical Equipment Energy Storage System

- Energy storage cabinet aging test equipment

- Senegal installs 5g base station equipment energy storage

- How much does energy storage equipment cost in Hamburg Germany

- New Energy Grid-connected Energy Storage Equipment

- BESS energy storage equipment price

- Battery energy storage system equipment for Funafuti communication base station

Solar Storage Container Market Growth

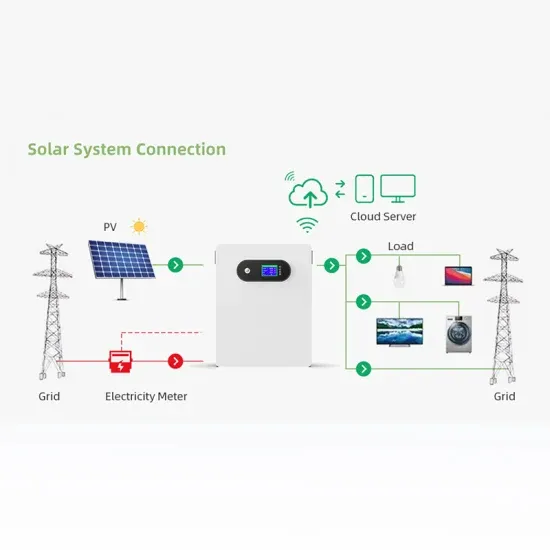

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.