Uninterruptible Power Source 2025-2033 Analysis: Trends,

Apr 3, 2025 · The Uninterruptible Power Source (UPS) market is experiencing robust growth, driven by increasing demand for reliable power across diverse sectors. The market, estimated

Southeast Asia Uninterruptible Power Supply (UPS) Market

Feb 1, 2025 · Southeast Asia Uninterruptible Power Supply (UPS) Market by Capacity (Less than 10 kVA, 10-100 kVA, Above 100kVA), by Type (Standby UPS System, Online UPS System,

Southeast Asia Uninterruptible Power Supply (UPS)

Jan 5, 2025 · Southeast Asia Uninterruptible Power Supply (UPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) - The Southeast Asia

Asia Pacific Uninterruptible Power Supply (UPS) Market | Size

The Asia Pacific Uninterruptible Power Supply (UPS) Market report thoroughly covers the market by KVA rating, phases, applications and countries. The report provides an unbiased and

Uninterruptible Power Supply (UPS) for Home Market

Mar 26, 2025 · The home UPS market is experiencing robust growth, driven by increasing demand for reliable power backup in residential settings. The rising adoption of smart home

Asia Pacific Uninterrupted Power Supply Market

Based on type, the Asia Pacific uninterrupted power supply market is segmented into standby, line interactive, and online. The online segment held the largest market share in 2023. In terms

Uninterruptible Backup Power Supply Drivers of Growth:

Mar 28, 2025 · The Uninterruptible Backup Power Supply (UPS) market is experiencing robust growth, driven by increasing demand for reliable power across various sectors. The market,

Vietnam Uninterruptible Power Supply (UPS) for IDC

Aug 1, 2025 · Vietnam Uninterruptible Power Supply (UPS) for IDC (Internet Data Center) Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033,

Strategic Insights into Uninterruptible Backup Power Supply

Feb 15, 2025 · The global Uninterruptible Backup Power Supply (UPS) market is projected to grow from USD 11.5 billion in 2025 to USD 19.3 billion by 2033, at a CAGR of 6.5% from 2025

Southeast Asia Uninterruptible Power Supply (UPS) Market

Feb 1, 2025 · The size of the Southeast Asia Uninterruptible Power Supply (UPS) Market was valued at USD XX Million in 2023 and is projected to reach USD XXX Million by 2032, with an

Asia Pacific Uninterruptible Power Supply (UPS) Market | Size

The Asia Pacific Uninterruptible Power Supply (UPS) Market Share/Ranking, By Countries The Asia Pacific Uninterruptible Power Supply (UPS) Market Competitive Landscape Company

BPE Partners with TOTALPower to Expand Power Solutions in ASEAN

Apr 4, 2025 · Best Power Equipments (BPE) has announced a strategic partnership with TOTALPower, a Philippines-based energy company, to strengthen power infrastructure across

Uninterruptible Power Supply (UPS) Systems Unlocking

Jan 22, 2025 · The Uninterruptible Power Supply (UPS) systems market is estimated to be worth USD XXX million in 2025 and is projected to reach USD XXX million by 2033, exhibiting a

Uninterruptible Power System (UPS) 2025-2033 Trends:

Jul 8, 2025 · The Uninterruptible Power System (UPS) market, valued at $14,030 million in 2025, is projected to experience robust growth, driven by increasing demand for reliable power

Uninterruptible Power Supply (UPS) for Home in Emerging

May 11, 2025 · The global Uninterruptible Power Supply (UPS) for home market, valued at several million units in 2025, exhibits a moderately concentrated landscape. Key players such as

Vietnam Industrial Uninterruptible Power Supply (UPS)

Jul 31, 2025 · Vietnam Industrial Uninterruptible Power Supply (UPS) System Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at

东南亚不断电系统 (UPS) -市场占有率分析、产业趋势/统计

Jan 5, 2025 · The Southeast Asian uninterruptible power supply (UPS) market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include

Uninterruptible Power Supply(UPS) for IDC(Internet Data

Apr 1, 2025 · The global market for Uninterruptible Power Supplies (UPS) in Internet Data Centers (IDCs) is experiencing robust growth, driven by the escalating demand for reliable power in an

Vietnam Flywheel Uninterruptible Power Supply (UPS)

Aug 2, 2025 · Vietnam Flywheel Uninterruptible Power Supply (UPS) Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at a CAGR

6 FAQs about [ASEAN Uninterruptible Power Supply Ranking]

What is the outlook for Southeast Asian uninterruptible power supply (UPS) market?

The Southeast Asian uninterruptible power supply (UPS) market is expected to register a CAGR of about 3.3% during the forecast period. The market was moderately impacted by COVID-19 in 2020. The market has now reached pre-pandemic levels.

Who are the major players in the Southeast Asian uninterruptible power supply market?

The Southeast Asian uninterruptible power supply (UPS) market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Eaton Corporation PLC, Riello Elettronica SpA, Emerson Electric Co., Delta Electronics Inc., and Ltd. Need More Details on Market Players and Competitors?

What companies are in the Asia-Pacific uninterruptible power supply (UPS) market?

Riello Elettronica SpA, EATON Corporation PLC, Emerson Electric Co., Ltd and Schneider Electric SE are the major companies operating in the Asia-Pacific Uninterruptible Power Supply (UPS) Market. What years does this Asia-Pacific Uninterruptible Power Supply (UPS) Market cover?

What is the growth rate of Asia-Pacific uninterruptible power supply (UPS) market?

The Asia-Pacific Uninterruptible Power Supply (UPS) Market is growing at a CAGR of 4.94% over the next 5 years. Riello Elettronica SpA, EATON Corporation PLC, Emerson Electric Co., Ltd and Schneider Electric SE are the major companies operating in this market.

Who are the major players in the uninterruptible power supply market?

The Uninterruptible Power Supply (UPS) Market is fragmented. Some of the major players (not in particular order) include Riello Elettronica SpA, EATON Corporation PLC, Emerson Electric Co., Ltd, and Schneider Electric SE, among others. Need More Details on Market Players and Competiters?

How competitive is the UPS market in Southeast Asia?

Competitive Landscape The UPS market in Southeast Asia is highly competitive, with the presence of both global and regional players. Key companies operating in the market include Schneider Electric SE, Eaton Corporation, Vertiv Co., Ltd., and Delta Electronics, Inc.

Update Information

- ASEAN EK Uninterruptible Power Supply Equipment

- Majuro Uninterruptible Power Supply Ranking

- ASEAN Uninterruptible Power Supply Agent

- Uninterruptible Power Supply Production in Bandar Seri Begawan

- Uninterruptible power supply box manufacturers

- Uninterruptible power supply prices in Suriname

- Tbb Uninterruptible Power Supply

- BESS Uninterruptible Power Supply in Osaka Japan

- ATa ups uninterruptible power supply

- Outdoor Uninterruptible Power Supply Supplier

- Uninterruptible power supply capacity

- Nicosia single phase uninterruptible power supply manufacturer

- UK UPS uninterruptible power supply manufacturer

Solar Storage Container Market Growth

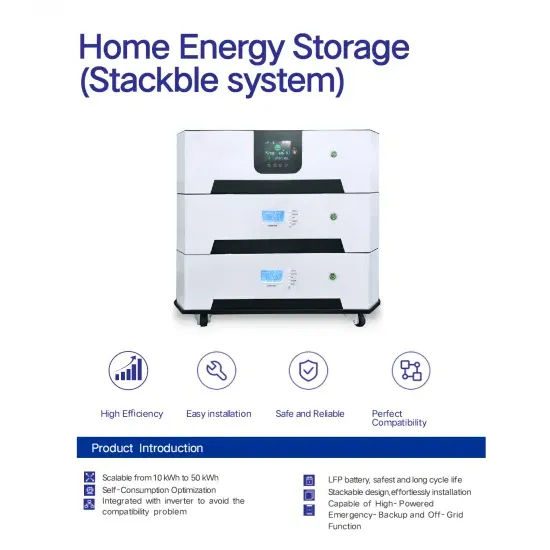

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

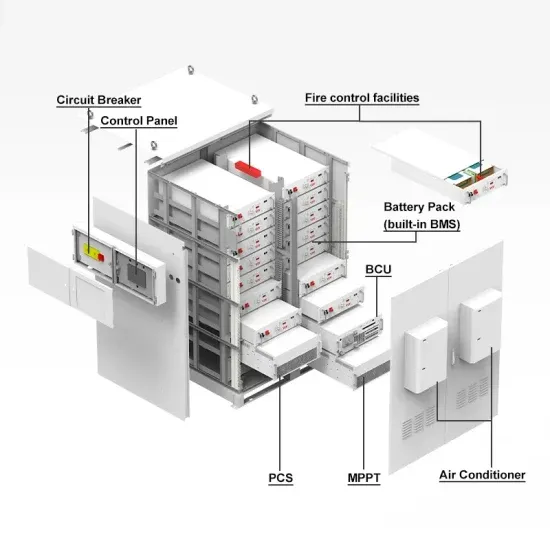

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.