Southeast Asia Uninterruptible Power Supply (UPS)

Jan 5, 2025 · The Southeast Asian uninterruptible power supply (UPS) market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include

News and Events | Uninterruptible power supply (UPS)

From July 16-18, 2025, ECOTEK CANADA has made a strong impression at a major international exhibition: The 18th International Exhibition on Electrical Technology & Equipment – Vietnam

Uninterruptible Power Supply System

Oct 24, 2014 · Businesses today invest large sums of money in their IT infrastructure, as well as the power required to keep it functioning. Uninterruptible power supplies (UPS) are an

Expanding ASEAN grid supply chains could mitigate critical

Jan 9, 2025 · Localizing grid equipment supply chains represents a significant business opportunity for high-growth economies in the Association of Southeast Asian Nations

Asia-Pacific Uninterruptible Power Supply (UPS) Market Size

Uninterruptible power supply (UPS) systems play a critical role in ensuring the continuous uptime of large data centers while providing comprehensive protection for sensitive electronics

UNINTERRUPTIBLE POWER SUPPLY (UPS) SYSTEMS SPS

Aug 30, 2021 · It is an Uninterruptible Power Supply (UPS) system with line-interactive technology that offers the best protec-tion solution for the units and the information that make up both

Uninterruptible Power Supply Equipment BESS in Nikšić

Summary: Discover how Battery Energy Storage Systems (BESS) are transforming Nikšić''s energy landscape. This article explores the role of uninterruptible power supply equipment in

Southeast Asia Uninterruptible Power Supply (UPS)

Jan 5, 2025 · Southeast Asia Uninterruptible Power Supply (UPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) - The Southeast Asia

Uninterruptible Power Supply Infographic | No Battery

Jul 30, 2025 · Uninterruptible Power Supply Infographic showing the benefits of the Ultracapacitor Design which requires no batteries versus the standard design that requires batteries

ENERGY STORAGE FOR RENEWABLE ENERGY INTEGRATION IN ASEAN

What are capacitors used for in electricity? Capacitors are used in power quality applications where their rapid charging and discharging capabilities are crucial. For instance, in

Asia-Pacific Uninterruptible Power Supply (UPS) Market Size

Aug 9, 2024 · The Asia-Pacific Uninterruptible Power Supply (UPS) Market Size is influenced by the rising adoption of digital technologies and the ongoing development of critical

UNINTERRUPTIBLE POWER SUPPLY (UPS) SYSTEMS SPS

Jan 27, 2023 · It is an Uninterruptible Power Supply (UPS) system with line-interactive technology that offers the best protec-tion solution for the units and the information that make up both

Asia Pacific Uninterrupted Power Supply Market

The Asia Pacific uninterrupted power supply market was valued at US$ 4,228.51 million in 2023 and is expected to reach US$ 7,003.09 million by 2031; it is estimated to register a CAGR of

6 FAQs about [ASEAN EK Uninterruptible Power Supply Equipment]

What is Southeast Asia uninterruptible power supply (UPS)?

The Southeast Asia Uninterruptible Power Supply (UPS) market is witnessing significant growth, driven by the increasing demand for reliable power supply and the expansion of data centers. While initial investment and limited awareness pose challenges, opportunities lie in renewable energy integration and emerging economies.

Who are the major players in the Southeast Asian uninterruptible power supply market?

The Southeast Asian uninterruptible power supply (UPS) market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Eaton Corporation PLC, Riello Elettronica SpA, Emerson Electric Co., Delta Electronics Inc., and Ltd. Need More Details on Market Players and Competitors?

What is the outlook for Southeast Asia uninterruptible power supply market?

The Southeast Asia Uninterruptible Power Supply Market is expected to register a CAGR of greater than 3.3% during the forecast period. The market was moderately impacted by COVID-19 in 2020. The market has now reached pre-pandemic levels.

What is uninterruptible power supply (UPS)?

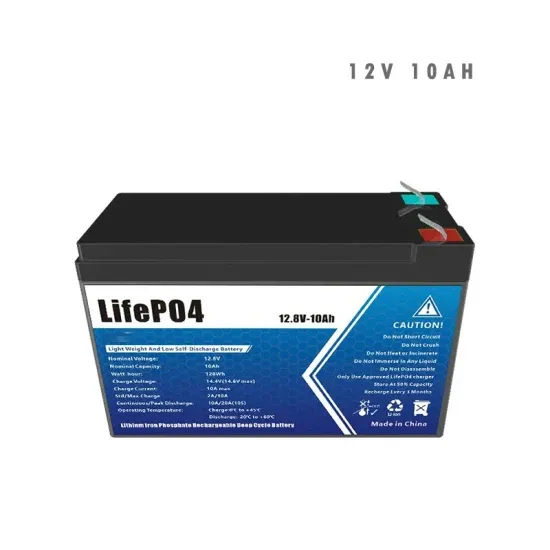

Meaning Uninterruptible Power Supply (UPS) is a device that provides backup power when the main power source fails or experiences fluctuations. It ensures a continuous flow of electricity to connected equipment by using stored energy in batteries or flywheels.

Does PT PLN provide electricity for ASEAN Summit 2023?

(Photo by: PR of Cabinet Secretariat/Agung) State-owned electricity company PT PLN has ensured a consistent electricity supply for the 43 rd ASEAN Summit held in Jakarta from September 5-7, 2023. “The ASEAN Summit will be held next week. This is our responsibility to maintain the security and stability of the summit’s electricity.

How competitive is the UPS market in Southeast Asia?

Competitive Landscape The UPS market in Southeast Asia is highly competitive, with the presence of both global and regional players. Key companies operating in the market include Schneider Electric SE, Eaton Corporation, Vertiv Co., Ltd., and Delta Electronics, Inc.

Update Information

- EK Uninterruptible Power Supply Equipment in New York USA

- Seoul Small Uninterruptible Power Supply Equipment

- Qatar power distribution uninterruptible power supply equipment

- UPS uninterruptible power supply equipment custom-made merchants

- Palau Uninterruptible Power Supply Equipment BESS

- Baku Uninterruptible Power Supply Equipment Company

- China-Africa Industrial Uninterruptible Power Supply Equipment

- Berlin Uninterruptible Power Supply Equipment BESS

- Uninterruptible power supply equipment for New Delhi Telecom

- Uninterruptible power supply for indoor sewage treatment equipment

- European Uninterruptible Power Supply Equipment Manufacturer

- Large-scale uninterruptible power supply equipment in Lyon France

- Which is the best uninterruptible power supply equipment for Basseterre communication base station

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.