Residential solar photovoltaic adoption: An in-depth review

Jul 15, 2025 · With the accelerated electrification of residential energy consumption, residential solar PV is a crucial pathway. Besides, households'' solar PV provides an avenue for families

$25 million to power-up apartment solar and bring down

Mar 1, 2025 · The Albanese Labor Government is working with the Minns NSW Government to deliver a new $25 million program to help apartment residents save up to $600 on their energy

China''s Solar Subsidy Policy: Government Funding Yields to

Apr 17, 2020 · The Chinese Government has issued numerous regulations that significantly affect the number of photovoltaic (PV) installations in the country and the subsidies for their use.

Government Incentives for Solar Power: An Overview of Subsidies

Aug 4, 2025 · Explore the various government incentives for solar power, including tax credits, grants, and rebates, designed to promote the adoption of solar energy. Learn about federal

The impact of government subsidy on photovoltaic

Dec 15, 2023 · With the gradual reduction of subsidies for China''s solar PV industry, enterprises are seeking updated technologies to reduce manufacturing costs, and the on-grid price of PV

Government subsidies for the Chinese photovoltaic industry

Dec 1, 2016 · Abstract Since 2009, the subsidy for large-scale photovoltaic (PV) power plants had been launched, which effectively promoted the development of PV industry. At the same time,

Solar incentives and rebates in Switzerland

Aug 8, 2023 · Learn about solar incentives and rebates available in Switzerland. This guide explains national and cantonal programs that provide financial support for installing solar PV

Photovoltaic supply chain and government subsidy decision

Aug 10, 2023 · However, lucrative government subsidies often lead to PV enterprises not paying attention to technological innovation and blind production. Therefore, to improve the efficiency

China''s Solar Subsidy Policy: Government Funding Yields to

Apr 17, 2020 · The Chinese Government has issued numerous regulations that significantly affect the number of photovoltaic (PV) installations in the country and the subsidies

Performance analysis of government subsidies for photovoltaic industry

Mar 1, 2021 · Energy is the basis for development of material civilization. Since fossil energy can cause environmental problems, clean energy has become the trend of energy development.

Free Arizona Solar Incentives: Register for Solar

Jan 1, 2024 · Arizona offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles. In combination with

Government ''pre-financing'' for solar panels aims to speed up

Announced in the coalition programme, pre-financing for the installation of solar panels or energy storage systems became a reality with the tabling of draft regulations at the end of November.

A systematic analysis of stakeholder interaction and the

Nov 1, 2023 · Political, economic, and social factors that impede the diffusion of residential solar photovoltaics (RSPV) are at the frontline of academic research in renewable energy

An optimal incentive policy for residential prosumers in

Jul 25, 2021 · The contribution of government subsidy in the PV market has gradually changed from inducing residents to start investing in solar PV equipment to inducing investment in

Driving sustainable energy transition: Understanding

Jun 1, 2025 · To reduce carbon emissions, the power sector must transition to a low-carbon pathway, supported by policies, technology advancements, and new business models. Solar

6 FAQs about [Solar photovoltaic panels subsidies for residents]

What is a government subsidy for residential photovoltaics?

Policy variables. A government subsidy (Subsidy) for residential photovoltaics mainly refers to power generation subsidies, that is, a monetary reward for every kilowatt-hour of electricity generated by solar panels. The subsidy standards for each household are obtained from the National Development and Reform Commission (NDRC).

Why is government subsidy important in the PV market?

The contribution of government subsidy in the PV market has gradually changed from inducing residents to start investing in solar PV equipment to inducing investment in larger-capacity PV equipment. An appropriate government subsidy can reduce the restrictions of SRI, LCOE, FIT, and other factors on the residential installation.

Does government subsidy affect PV installation?

Although resident also installs PV facilities when the government subsidy is higher than 0.06 CNY/kWh, this has brought unnecessary financial pressure to government. This confirms the necessity of establishing an appropriate government incentive policy according to the SRI in different regions.

Is PV subsidy a unit subsidy?

Regardless of the electricity sales model adopted, the subsidy policy for residential distributed PV is unified as a unit subsidy (National Development and Reform Commission of China, 2019).

Does PV generation subsidy phase-out affect total electricity consumption?

The results of our study indicate that there is a larger rebound effect on total electricity consumption during the announcement of the PV generation subsidy phase-out. However, this effect gradually weakens over time as the policy is implemented.

Does China have a PV generation subsidy phase-out policy?

To test our argument, we use the case of the PV generation subsidy phase-out policy in China. China is the world's largest PV market, and the household PV industry has heavily relied on subsidy-based business models (Xiong and Yang, 2016).

Update Information

- Bending of solar photovoltaic panels

- Paramaribo 600W solar photovoltaic panels

- Photovoltaic solar panels in rural Alexandria Egypt

- Car pulling solar photovoltaic panels

- Photovoltaic modules solar panels

- Indonesian Photovoltaic Solar Panels

- Solar panels to transform photovoltaic power stations

- Lithium iron phosphate for solar photovoltaic panels

- Solar panels and photovoltaic panels for electricity storage

- The shading effect of photovoltaic solar panels

- There are photovoltaic panels for solar lights

- Will installing solar photovoltaic panels on low floors reflect light

- Photovoltaic panels solar panel assembly

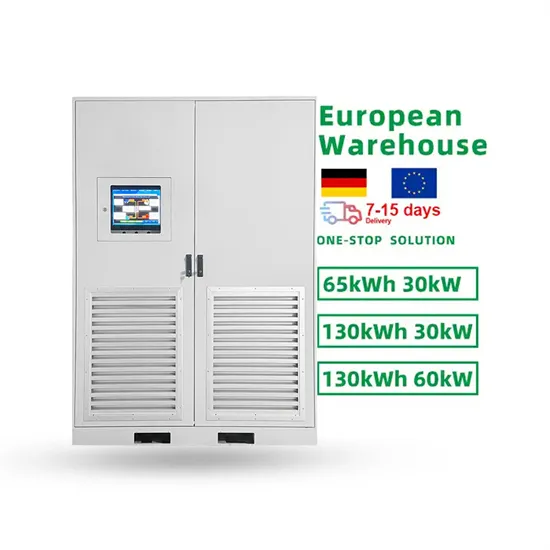

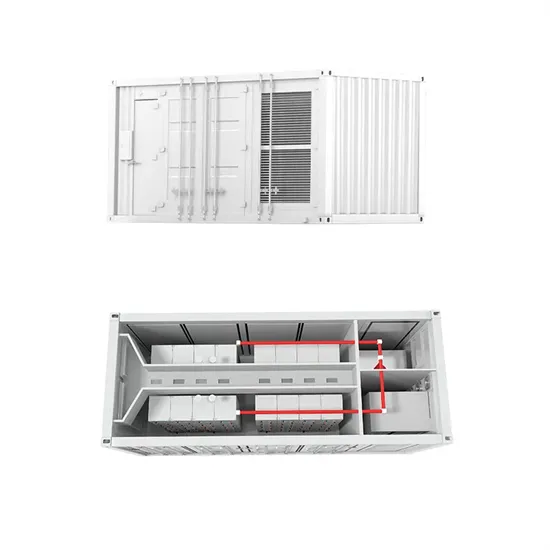

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.