The future of solar power in Indonesia: What can

Oct 5, 2024 · In this article, we discuss the potential and challenges of solar power in Indonesia, including government strategies and growth projections

Indonesia Solar PV Panels Market (2025-2031) | Trends,

The future outlook for the Indonesia solar PV panels market appears promising, driven by various factors such as government initiatives to promote renewable energy, increasing awareness

Indonesia''s installed solar capacity surpasses 700

Oct 18, 2024 · The Institute for Essential Services Reform says Indonesia''s solar industry has faced a downturn over the past two years, but policy reforms

Powering Indonesia with floating solar panels — Group

Jun 16, 2025 · Indonesia fully on board with floating solar projects Indonesia has identified floating solar as a technology with great potential to help meet its goal of achieving 23 percent

Indonesia''s plan to export solar power to S''pore

Feb 20, 2025 · JAKARTA – A new manufacturing plant producing floating solar panel systems was officially launched in Batam on Feb 14 to tap opportunities

Indonesia Bets on Solar Manufacturing Amid US-China Trade

Jan 21, 2025 · Indonesia is attracting significant investment in its solar manufacturing industry due to US tariffs on Chinese and other Southeast Asian solar products.

Solar Energy In Indonesia: Potential and Outlook

Feb 21, 2024 · Indonesia has significant potential for solar energy. However, it has remained largely untapped. The country''s 2030 and 2060 decarbonisation goals heavily rely on the

How to power Indonesia''s solar PV growth opportunities

Oct 19, 2023 · Up to now, solar PV growth in Indonesia has been slow compared to various other countries in the region and, to overcome this, Indonesia''s government has set targets to

SEG Solar Commences Construction on Indonesia''s Largest

Sep 30, 2024 · Batang, Central Java, Indonesia – September 30, 2024- SEG Solar (SEG), a leading U.S. photovoltaic module manufacturer, commenced construction of its integrated

Indonesia''s Solar Policies

Jan 6, 2025 · The proof is in the numbers. Despite having substantial solar resources, Indonesia''s solar policy framework has failed to deliver cost-effective renewables to the grid. According to

Indonesian Solar Panels: Development, Benefits and

May 5, 2024 · Indonesia has enormous solar energy potential, namely around 4.8 kWh/m2 or the equivalent of 112,000 GWp. In a report published by the Ministry of Energy and Mineral

6 FAQs about [Indonesian Photovoltaic Solar Panels]

Is solar PV growing in Indonesia?

Up to now, solar PV growth in Indonesia has been slow compared to various other countries in the region and, to overcome this, Indonesia’s government has set targets to increase solar PV substantially by 2030. 4 The sector, though, will face challenges in producing solar products that can compete with those of other exporting nations.

Does Indonesia have a potential for solar energy?

Cirata Reservoir floating solar power plant. Source: Solar Industry Indonesia has significant potential for solar energy. However, it has remained largely untapped. The country's 2030 and 2060 decarbonisation goals heavily rely on the industry's rapid expansion. The capacity of solar energy in Indonesia is steadily climbing.

Can solar power improve Indonesia's energy security?

Indonesia Solar Energy Outlook 2025 highlights the crucial role of solar power in improving Indonesia’s energy security. The report analyzes how solar PV can help reduce dependence on fossil energy, improve the reliability of electricity supply, and address the challenges of climate change.

Why are solar power plants growing in Indonesia?

Technological advancements in solar energy are also propelling the growth of solar power plants in Indonesia. The introduction of advanced photovoltaic (PV) technologies, energy storage solutions, and smart grid systems has enhanced efficiency and reliability.

Can solar panels be used in Indonesia?

Even though the potential and benefits of solar panel technology are enormous, its implementation in Indonesia faces many challenges, including inadequate infrastructure, low public understanding of the technology, and so on. Development of Indonesian Solar Panels

Where are solar power plants located in Indonesia?

Solar Power Plants in Indonesia: Notable Locations 1. Cirata Floating Solar Power Plant The Cirata Floating Solar Power Plant, located in West Java, is one of the largest solar projects in Indonesia and Southeast Asia. With an installed capacity of 145 MW, it began operations in 2021 (Jakarta Post, 2023).

Update Information

- Solar photovoltaic panels for rural households in Brussels

- Installing solar photovoltaic panels in Funafoti

- Cuban home solar photovoltaic panels

- Huawei brand solar photovoltaic panels

- Household solar photovoltaic panels in Brno Czech Republic

- Beirut Photovoltaic Panels Greenhouse Solar Energy

- Solar panels photovoltaic panels 600w

- Photovoltaic solar panels installed in Cambodia

- Niamey s new solar photovoltaic panels

- Belize Photovoltaic Solar Panels

- Photovoltaic solar panels in rural Syria

- High power 220 volt solar photovoltaic panels

- Berne bus station equipped with solar photovoltaic panels

Solar Storage Container Market Growth

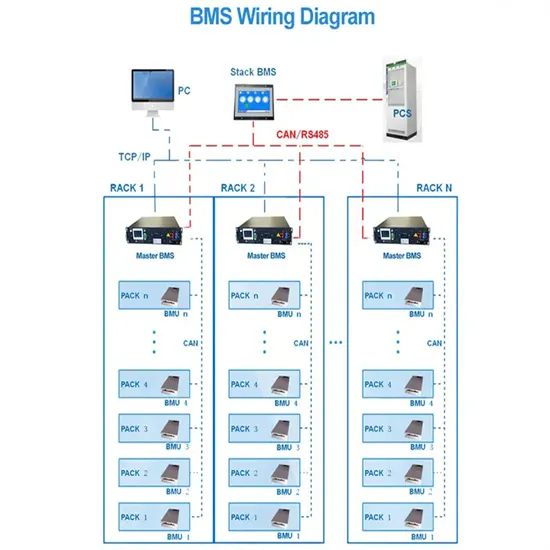

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.