Sungrow Unveils MEA Innovations

4 days ago · NEWS POWER Utilities Sungrow launches modular inverter, PowerTitan platform in Middle East Sungrow has unveiled its latest inverter and energy storage technologies at the

Sellers in Middle East | PV Companies List | ENF Company

List of Middle Eastern solar sellers. Directory of companies in Middle East that are distributors and wholesalers of solar components, including which brands they carry.

Top Solar Inverters for Efficient Energy Conversion | Alraebi Middle East

We provide full services across Yemen (Aden, Sana''a, Hadramout, Taiz, Ibb, Shabwa) and ship professionally to: We''re ready to partner with energy companies, contractors, and renewable

Top Solar Inverters for Efficient Energy Conversion | Alraebi Middle East

Discover top-rated solar inverters by Al-Raebi for optimized energy conversion. Reliable performance, advanced MPPT, and smart integration for homes and businesses.

MUST Showcases at the 2024 Saudi Solar & Energy Storage

On October 15, 2024, the Saudi Solar & Energy Storage Expo, the largest renewable energy event in the region, opened with great fanfare at the Riyadh International Convention and

Middle East and Africa Power Conversion System Inverter

Jul 3, 2025 · Middle East and Africa Power Conversion System Inverter Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at a CAGR

inverter Companies and Suppliers in Asia and Middle East

Reliable Electric Co., Ltd is a leading company specialized in developing, manufacturing, and marketing advanced power inverters and systems for mobile power markets and PV industries

Top Companies in Middle East Power Electronics Market

List of Top Companies in Middle East Power Electronics Market. 1. El Sewedy Electric is a leading provider of integrated energy solutions in the Middle East. It specializes in engineering,

Inverters: Hitachi in Middle East and North Africa

Mar 28, 2024 · Hitachi Inverters are equipped with advanced features that deliver superior performance, reliability and flexibility. They are designed to meet various requirements from a

Top 10 Wholesale Suppliers for solar inverter in

Jun 9, 2024 · Conclusion In the Middle-East, consumers demonstrate a significant rise in their consumption of renewable energy attributed to solar power. So,

Middle East Solar Inverter Industry Report 2025 | Market Size

Major companies such as Huawei Technologies Co. Ltd., SMA Solar Technology AG, and Ltd. dominate the market, accounting for a significant share of the global market. In February

Middle East and Africa Low-power Inverter Market Size

Jul 5, 2025 · Middle East and Africa Low-power Inverter Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at a CAGR of XX% from

Top Solar Inverter Companies and Suppliers in Iraq: Your

Apr 2, 2025 · Local Iraqi Solar Suppliers Part 4. Regional Suppliers (Middle East) Part 3.Solar Inverter Supply Chain & Manufacturing Hubs What Other Inverter or Power Products You

Must Shines at SolarEX Istanbul 2025, Unlocking

Apr 12, 2025 · Throughout the event, the Must booth attracted high traffic from visitors across Türkiye, the Middle East, Africa, and Europe. The Must team

Update Information

- Middle East Inverter Power

- Middle East Uninterruptible Power Supply Customization Company

- Middle East energy storage lithium battery manufacturer

- Inverter AC power supply manufacturer

- Middle East Outdoor Communication Battery Cabinet Manufacturer

- Mauritania power inverter manufacturer

- Dili Emergency Power Inverter Manufacturer

- Dominica Power Inverter Manufacturer

- East Africa Water Pump Inverter Customized Manufacturer

- Inverter Manufacturer Power Supply

- Hot sale 10000w power inverter factory manufacturer

- Middle East lithium battery portable energy storage manufacturer

- Middle East portable ups power supply

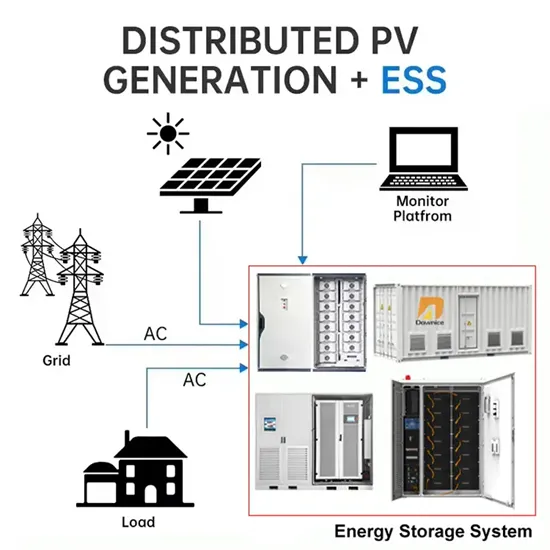

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.