Solar photovoltaic recycling strategies

Mar 1, 2024 · This paper overviews the commitment level of different countries to solar PV recycling. It summarizes the various solar PV recycling strategies for different types of solar

PHOTOVOLTAIC INDUSTRY IN GERMANY

Thin-film solar PV panels are mainly used in utility-scale and commercial applications owing to their low installation costs. These panels are known as cost-effective substitutes for silicon

Solar Installed System Cost Analysis | Solar

Apr 3, 2025 · Solar Installed System Cost Analysis NREL analyzes the total costs associated with installing photovoltaic (PV) systems for residential rooftop,

33 Top Solar Companies in Germany · August 2025 | F6S

Aug 1, 2025 · Detailed info and reviews on 33 top Solar companies and startups in Germany in 2025. Get the latest updates on their products, jobs, funding, investors, founders and more.

Top 24 Photovoltaic Equipment Producers Worldwide

2 days ago · The photovoltaic equipment manufacturing industry is a growing field with a pivotal role in our switch to renewable energy. The industry consists of companies that engineer,

Top 10 Solar Panels Makers from Germany

3 days ago · Despite the setbacks, Germany still boasts of some leading solar panel manufacturers, the top 10 as per accepted rankings being: The Bonn-based SolarWorld,

Top German Solar Panel Manufacturers 2025 | We Group

German manufacturers allocated €2.3 billion to R&D in 2024, focusing on three breakthroughs: You know, it''s not just about the tech specs. Local suppliers like Wacker Chemie provide ultra

Top 24 Solar Energy Companies in Germany

1 day ago · Aesolar, officially known as AE Alternative Energy GMBH, is a solar panel manufacturer based in Gersthofen, Bavaria, Germany. Established in 2003, the company

German Solar Panel Manufacturers: Top Industry Leaders

Aug 23, 2024 · When it comes to high-quality and reliable solar panels, German manufacturers lead the industry. Ever wondered why sustainable energy enthusiasts consistently choose

Top 10 Solar Panels Makers from Germany

3 days ago · Solar thermal panel manufacturers since 1973, Solimpeks is one of the world''s leading brands in high-quality solar thermal collectors, PV-T hybrid panels, thermosiphon

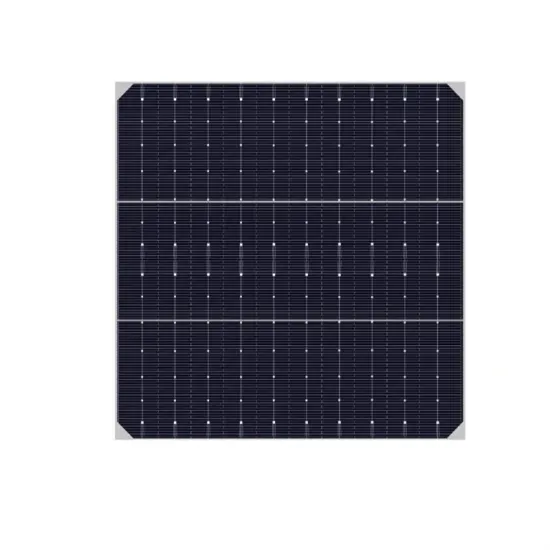

Cost-Effective Solar Cell Panel Manufacturer Mono Photovoltaic

We develop,manufacture and sell photovoltaic modules. Our manufacturing covers the entire PV value chain,from ingot casting through wafering and solar cell production,to module assembly.

Top Solar Panel Manufacturers in Germany You should know

Aug 15, 2025 · Sonnex, a German solar company, specializes in premium quality and high-efficiency solar modules. They offer three cutting-edge technologies: PERC, N-type, and smart

Germany photovoltaic cell manufacturers

This article will explore the largest factory centers for solar panels made in Germany, spotlight the top 10 solar panel manufacturers in Germany, and delve into the certifications that govern the

6 FAQs about [Germany s most cost-effective photovoltaic panel manufacturer]

Who makes solar panels in Germany?

Based in Bonn, SolarWorld is one of the oldest and most respected solar panel manufacturers in Germany. Established in 1988, SolarWorld has made significant contributions to the solar industry. It is recognized for its quality products and rigorous manufacturing standards.

Why is Berlin a top 8 solar inverter manufacturer?

As a dynamic hub of technological innovation and forward-thinking entrepreneurship, Berlin is a driving force behind Germany’s solar panel manufacturing industry and is the Top 8 German Solar Inverter Manufacturers. The city’s focus on renewable energy solutions has resulted in numerous companies developing and producing top-tier solar panels.

Why are solar panels certified in Germany?

As such, certification is a significant aspect of the solar panel market in Germany. The German market, as one of the pioneers and leaders in the solar industry, has established stringent certification standards to ensure the performance, durability, and safety of the solar panels being used in the country.

Why are Germany's solar panels so expensive?

Yet, in Germany in recent years, local solar panel manufacturers have had to grapple with rock-bottom prices from Chinese rivals, a flooded market and dwindling incentives across the EU. Some companies, unable to withstand harsh competition from imported solar panels, collapsed in the wake of the 2008 global meltdown.

What makes the German solar industry unique?

From companies like Invertermanufacturer.com and Q-Cells, with a long history in the market, to relative newcomers like Heckert Solar and CentroSolar, the German solar industry is characterized by innovation, quality, and a commitment to renewable energy.

Why is Germany a leader in solar energy?

Germany has been a leading force in the global solar energy industry for several decades, and it’s clear why. The country is home to some of the world’s top manufacturers of solar panels. The companies highlighted above are part of a robust and diverse industry that has made Germany a leader in solar energy.

Update Information

- Top photovoltaic panel manufacturer in Hamburg Germany

- Third generation desert photovoltaic panel manufacturer

- South Korean home photovoltaic panel manufacturer

- London regular photovoltaic panel manufacturer

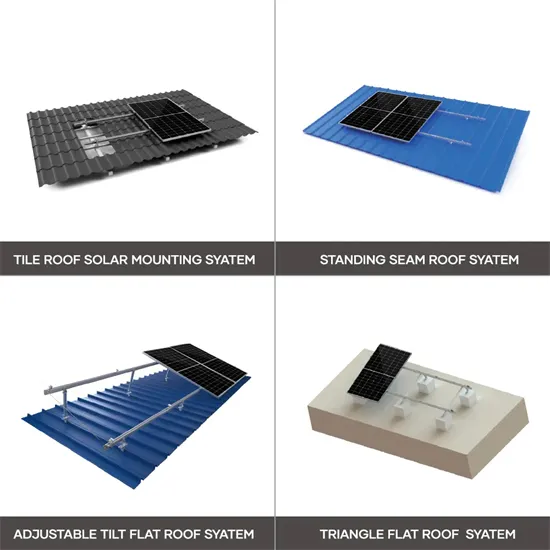

- Photovoltaic panel fixing parts manufacturer in Lyon France

- Caracas photovoltaic panel new panel manufacturer

- Harare monocrystalline photovoltaic panel manufacturer

- Photovoltaic panel battery manufacturer

- Honduras small photovoltaic panel manufacturer

- Tokyo Solar Photovoltaic Panel Manufacturer

- Libya photovoltaic panel monocrystalline panel manufacturer

- Brunei rooftop photovoltaic panel manufacturer

- India Mumbai Monocrystalline Photovoltaic Panel Manufacturer

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.