Japan''s first fund dedicated to grid storage batteries begins

As a general partner, ITOCHU will utilize its abundant investment candidate projects and GSC''s fund management track record and know-how to build the optimal energy storage system for

Start of Full Operation of Japan''s First Fund Exclusively for

Sep 30, 2024 · Provides information about [Start of Full Operation of Japan''s First Fund Exclusively for Utility Scale Energy Storage in Collaboration with Tokyo Metropolitan

Six Japanese Companies Sign MoU to Explore Investment in

Mar 26, 2025 · This investment will accelerate the establishment of supply chains and the adoption of carbon-neutral solutions. Tokyo Century, traditionally focused on solar energy

Overseas agent for tokyo energy storage project

In addition to making major regulatory changes, such as allowing standalone energy storage assets to participate in energy trading, the Japanese government has introduced a subsidy

Tokyo government-industry BESS fund secures over 8B yen

Aug 13, 2025 · The Tokyo government-industry fund was first announced in 2023. Tokyo Energy Storage Plant Investment Limited Partnership raised over 8 billion yen, Itochu Corporation,

Japan''s first fund dedicated to grid storage batteries begins

ITOCHU has begun full-scale operation of the "Tokyo Electric Power Storage Investment Limited Partnership" with over 8 billion yen in investment from private institutional investors. The Fund

Initial Acquisition for Japan''s First Energy Storage Fund

Jan 9, 2025 · Following the announcement on 30 September 2024 detailing the successful fundraising round close of Japan''s first dedicated energy storage fund, the "Tokyo Energy

Tokyo energy storage project construction

Legal Issues on the Construction of Energy Storage Projects for To facilitate the progress of energy storage projects, national and local governments have introduced a range of incentive

Start of Full Operation of Japan''s First Fund Exclusively for

Sep 30, 2024 · The Fund is planning to launch an energy storage plant in its first project in FY2025 and to successively develop and operate energy storage plants. To meet the needs of

Tokyo Gas to buy US battery firm Longbow: Correction

Japanese gas and energy supplier Tokyo Gas plans to acquire US battery energy storage system (BESS) company Longbow in Texas, targeting to begin commercial operations of the system

Eku Energy breaks ground on 120 MWh battery storage project

Sep 26, 2024 · London-headquartered Eku Energy has initiated the construction of the Hirohara Battery Energy Storage System (BESS) in Oh-Aza Hirohara, Miyazaki City, Miyazaki

Japan: Tesla to supply 548MWh BESS, Sumitomo a 12MWh

Feb 5, 2025 · A render of the BESS project. Image: ORIX Corporation / PR Times. Tesla and Sumitomo Electric have both been selected to supply energy storage projects in Japan. Tesla

Japan tokyo energy storage project

Japan: First dedicated BESS investment fund launches The nascent grid-scale energy storage market in Japan now has its first-ever dedicated investment fund, and it will be jointly managed

"Battery Storage Subsidies in Japan" | Atsumi & Sakai

Feb 17, 2023 · Details Battery Storage Subsidies in Japan Introduction In the Sixth Strategic Energy Plan, published by the Japanese Government in October 2021, targets are set to (a)

Japan: First energy storage investment fund to be managed

Investments will be focused on projects in the Kanto region, which comprises the Tokyo Metropolitan area and six surrounding prefectures. Much of the new investment fund''s remit is

Gore Street Capital Successfully Completes

Sep 30, 2024 · The Fund is, therefore, well positioned to deliver strong returns for investors by leveraging ITOCHU Corporation''s project pipeline and experience

japan tokyo energy storage power station investment

Macquarie-backed Eku Energy closes first Japan battery storage project with Tokyo Gas offtake contract It is Eku Energy''''s first project in Japan to reach financial close and will be located in

Gore Street Capital Successfully Completes

LONDON, Sept. 30, 2024 /PRNewswire/ -- Gore Street Capital (''Gore Street'') is pleased to announce that it has successfully completed a fundraising round for Japan''s first fund

Gore Street Capital Successfully Completes Fundraising

LONDON, Sept. 30, 2024 /PRNewswire/ — Gore Street Capital ("Gore Street") is pleased to announce that it has successfully completed a fundraising round for Japan''s first fund

Japan: Eku begins first BESS project, Gore Street

Oct 1, 2024 · Gore Street, which invests in battery assets in the UK, Europe, and North America through its Gore Street Energy Storage Fund, was appointed

6 FAQs about [Tokyo Energy Storage Base Project Investment]

Does Japan have a dedicated Energy Storage fund?

The nascent grid-scale energy storage market in Japan now has its first-ever dedicated investment fund, to be jointly managed by Gore Street.

What is the GI Energy Storage fund?

The Fund is managed by GI Energy Storage Management, which was jointly established with Gore Street Capital (GSC), and is Japan's first dedicated fund that handles everything from investment and development to operation in new energy storage plants (including those with renewable energy facilities) in the Kanto area and elsewhere.

What is Japan's first fund dedicated to grid storage batteries?

Japan's first fund dedicated to grid storage batteries begins full-scale operation Raised over 8 billion yen from 11 public and private investors Norbert Gehrke Oct 02, 2024 Share this post Japan Startup Observer Japan's first fund dedicated to grid storage batteries begins full-scale operation Copy link Facebook Email Notes More Share

How will a new 'green financing model' work in Japan?

Investments will be focused on projects in the Kanto region, which comprises the Tokyo Metropolitan area and six surrounding prefectures. Much of the new investment fund’s remit is around establishing a new “green financing model” for investments in utility-scale battery energy storage system (BESS) assets in Japan, Gore Street said.

Does Japan need energy storage?

Japan, like Britain, is an island country with relatively little interconnection to neighbouring states. That means it needs to balance and manage volatility within its own grid networks, and energy storage is a key technology to enable that, especially as rising shares of renewable energy will increase that volatility.

When will Itochu launch its first energy storage station?

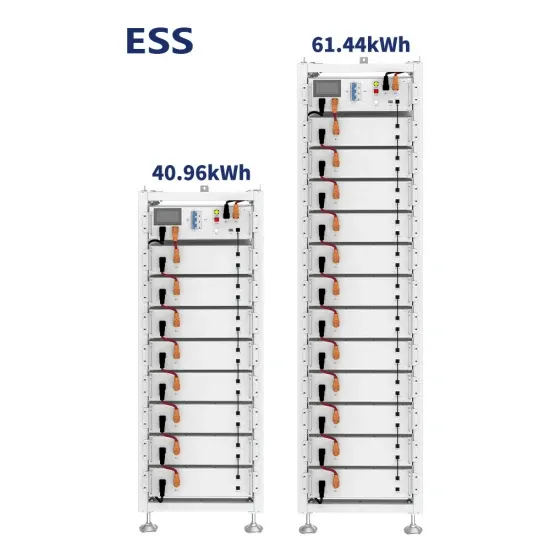

Going forward, the plan is to launch the first energy storage station around fiscal 2025, and then proceed with the development and operation of energy storage stations one after another. ITOCHU has developed a product lineup that meets market needs, from home storage batteries to large-scale energy storage systems for industrial and grid use.

Update Information

- Energy storage project investment structure

- Africa Photovoltaic Energy Storage Investment Project

- Georgia Energy Storage Sodium Ion Battery Base Project

- Valletta Communication Base Station Flywheel Energy Storage Project Bidding Website

- Bolivia Energy Storage Large Investment Project

- Sweden Gothenburg Industrial Investment Group Energy Storage Project

- Gaborone Communication Base Station Battery Energy Storage System Project

- Home energy storage project investment plan

- Telecom Energy Storage Base Station Investment Plan

- Heishan Communication Base Station Energy Storage Project

- Namibia Mobile Huawei Communication Base Station Battery Energy Storage System

- Energy storage battery container parameters base station

- Baghdad Base Station Energy Storage Battery System

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.