Battery Energy Storage Financing Structures and

4 days ago · The revenue strategies project sponsors (also referred to as project owners) can pursue for their battery energy storage systems (BESS) projects. Financing structure options

BBDF 2025: Understanding BESS project bankability

Jul 16, 2025 · During the session, representatives from Commerzbank, Nord LB, ABN AMRO, Santander CIB, and DAL shared insights into their current approaches to structuring BESS

Battery Energy Storage Financing Structures and

4 days ago · Discusses the fixed and variable offtake structures project company (special purpose vehicles project owners or project sponsors establish to own the project assets and enter into

Northland Power Secures Financing to Advance the Jurassic

Apr 9, 2025 · Announcement Highlights Northland closes its second battery storage financing, reflecting the Company''s growing expertise in battery storage technology. The project is

Energy storage 2023: biggest projects, financings, offtake deals

Dec 27, 2023 · The expansion of Moss Landing Energy Storage Facility in California, already the world''s biggest BESS project, to more than 3GWh was one of the highlights of the first half of

Modern BESS offtake agreements: A guide for project

Mar 31, 2025 · Reading time: 10 min The financial viability of Battery Energy Storage Systems (BESS) and renewable energy projects hinges on well-structured offtake agreements. These

What Investors Want to Know: Project-Financed Battery

6 days ago · Battery energy storage systems (BESS) store electricity and flexibly dispatch it on the grid. They can stack revenue streams offering arbitrage, capacity and ancillary services

UK BESS: 2.5GW of CM wins, £1bn in project

Mar 20, 2025 · 2.5GW of battery storage projects won capacity market contracts in the UK, in a week which also saw around £1 billion of project financings.

Financing Battery Energy Storage for Sustainable Futures

Jul 25, 2025 · This article delves into the crucial role of battery energy storage systems (BESS) in boosting renewable energy generation and its subsequent distribution. It also examines the

BESS revenue models: tolling, floor & fully merchant

Feb 4, 2025 · Project developers and investors encounter a variety of financing structures in this pursuit, each with unique risk and revenue profiles. These revenue strategies determine the

Fully merchant battery storage project in

May 27, 2022 · The projects will be in the service territory of utility SDG&E, which commissioned this 30MW lithium-ion BESS at Escondido in 2017, the largest

Eku Energy secures over £45 million in funding for new Ocker Hill BESS

May 13, 2025 · Global energy storage specialist secures financial backing to build a 99MW / 198MWh for Ocker Hill Battery Energy Storage System in the West Midlands London, May 13,

The BESS Brief – Part 2: BESS Financing is Entering a New Phase

Jul 15, 2025 · Today, we are seeing non-recourse project finance for 600+ MW portfolios, mezzanine debt entering the capital stack, and public banks co-financing with private lenders.

What Investors Want to Know: Project-Financed Battery Energy Storage

Jun 20, 2023 · Battery energy storage systems (BESS) store electricity and flexibly dispatch it on the grid. They can stack revenue streams offering arbitrage, capacity and ancillary services

UK Roundup: Developers net large-scale BESS financing and

May 20, 2025 · British battery energy storage system (BESS) firm Field has secured new financing to continue building out its UK project pipeline. The £42 million non-recourse loan

Red Sands BESS Project Secures R5.4bn Financing, Set to

Jul 7, 2025 · The ambitious 153 MW/ 612 MWh Red Sands battery energy storage system (BESS) project, poised to become Africa''s largest standalone facility of its kind, has reached financial

Quinbrook closes debt financing for Australia''s Supernode BESS

Jan 22, 2025 · GE Vernova has been selected to provide the BESS for stages one and two of the Supernode project. Image: Quinbrook Infrastructure Partners. Global sustainable energy

How to finance battery energy storage | World Economic

May 10, 2024 · Independent BESS projects, only supporting renewable energy projects, can be bundled together, and issued as green bonds to potential large investors. Partial credit

Peregrine Energy secures US$168 million for 150MW BESS

Mar 19, 2025 · Developer Peregrine Energy Solutions has secured US$168 million for a 150MW battery energy storage system (BESS) currently under construction. Peregrine closed a

Bankability and the funding Pathway for BESS

Apr 15, 2025 · Securing debt for BESS and hybrid projects requires a "bankable" revenue forecast from lenders preferred consultants. Developers need their

Akaysha Energy Secures $650M | Largest Global

Jul 15, 2024 · The financing will provide construction funding for Akaysha''s Orana Battery Energy Storage System (BESS) project, which is one of the largest

6 FAQs about [BESS Energy Storage Project Financing]

What is akaysha's Bess project?

The financing will provide construction funding for Akaysha’s Orana Battery Energy Storage System (BESS) project, which is one of the largest four-hour batteries globally and will add more than 1,660MWh of storage capacity to the National Electricity Market (NEM).

Why should a private financer invest in a Bess project?

This offers comfort to private financers to provide capital at a competitive rate. Independent BESS projects, only supporting renewable energy projects, can be bundled together, and issued as green bonds to potential large investors.

Is Bess a good investment?

Although risk-taking investors seeking a higher return on their investment in BESS can translate into higher energy tariffs, it is not ideal for large-scale adoption of BESS. Moreover, the capital available with this class of investors is limited compared to this solution's growth potential.

Is blended financing a viable financial model for Bess projects?

As per McKinsey & Company, the market size of the BESS ecosystem is expected to reach $150 billion by 2030. Thus, blended financing as a financial model should be considered, where public capital can be used as a first-loss capital for BESS projects. This offers private financers the comfort of providing capital at a competitive rate.

Can a Bess project be issued as a green bond?

Independent BESS projects can be bundled together and issued as green bonds to potential large investors. A partial credit guarantee can be provided by public capital providers to improve the credit ratings of green bonds, which is necessary to attract these low-risk-seeking investors.

How complex are Bess assets?

BESS assets are more technically complex than many of the assets that come across the average UK project finance lender’s desk. This nascent market is rapidly adapting to several somewhat unpredictable factors and its impact on both senior debt cover ratios and equity IRRs.

Update Information

- Niamey Electric Power Institute BESS Telecommunication Energy Storage Project

- Ouagadougou BESS Telecom Energy Storage Project

- BESS power generation and energy storage project

- Details of the BESS Telecom Energy Storage Project in Cote d Ivoire

- BESS air energy storage project bidding information

- BESS price for Myanmar energy storage project

- Two and a half hours energy storage project

- 120MW energy storage project

- Huawei deploys energy storage project in Helsinki

- Togo Energy Storage Project

- Which project uses energy storage

- Huawei Malawi Battery Energy Storage Project

- Myanmar Zhongshiye Energy Storage Project

Solar Storage Container Market Growth

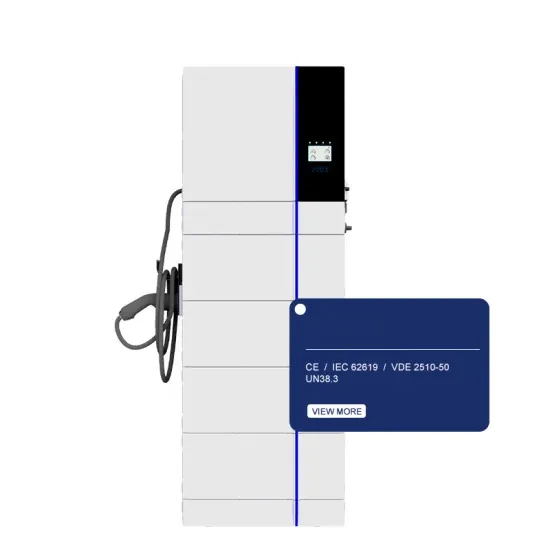

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

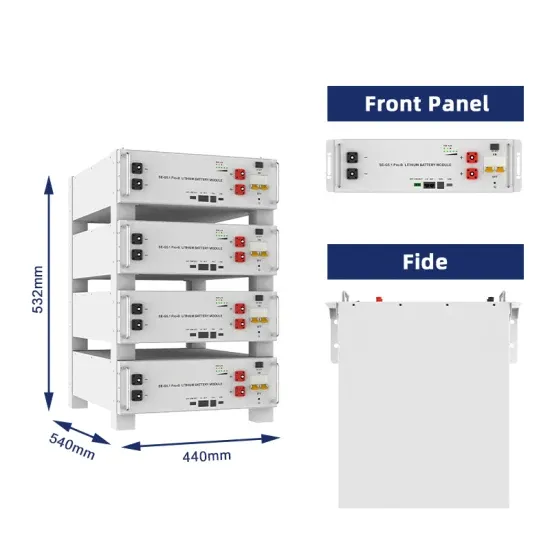

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.