Pakistan is experiencing a solar power boom. Here''s what

Nov 25, 2024 · Pakistan''s unstable electricity grid has driven a boom in adoption of renewable energy, led by solar. This sudden expansion in private renewables risks driving the national

Techno-Economic Feasibility Analysis of 100 MW Solar Photovoltaic Power

Apr 18, 2022 · In this era of adaptation of renewable energy resources at huge level, Pakistan still depends upon the fossil fuels to generate electricity which are harmful for the environment and

Solar Power Plants in Pakistan (Map)

How much electricity is generated from solar farms each year? According to the latest data from the International Energy Agency (IEA), the global electricity generation from solar photovoltaic

Shining a light on Pakistan''s solar boom

Apr 20, 2025 · Pakistan''s solar energy revolution is transforming the country''s energy landscape, driven by a combination of government incentives, decreasing costs, and growing awareness

Solar Energy in Pakistan: A Growing Market

Nov 5, 2024 · According to the National Electric Power Regulatory Authority''s (NEPRA) 2022 report, Pakistan''s total installed power generation capacity stands at 43,775 MW, with only 7%

Pakistan''s solar journey is feeling the heat from cost shifting

May 28, 2025 · In 2015, Pakistan quietly ushered in a new era of decentralised energy. The drily named Net Metering Regulations bill allowed households and businesses to install solar

World Bank Document

Aug 19, 2025 · Solar project developers interested in developing solar power in Pakistan have two options to secure land: through direct negotiations with landowners or with the support of

Pakistan''s net-metering solar capacity hits 4 GW

Mar 20, 2025 · Pakistan''s net-metering solar capacity surpassed 4 GW in 2024, marking significant growth in its solar market ahead of upcoming changes to

Pakistan''s 22 GW Solar Shock: How a Fragile

Apr 4, 2025 · Pakistan''s solar boom, EV rise, and climate action signal a historic shift from fragility to clean tech leadership across Asia''s most unexpected

Pakistan''s net-metering capacity hits 5.3 GW

Jun 2, 2025 · According to Renewables First''s report, Pakistan has now imported 36 GW of Chinese solar panels in total, equivalent to 78% of its entire power generation capacity.

Solar Panel in Pakistan : Buy online solar panels or PV

Looking for solar panel in Pakistan? Discover the best solar solutions for your energy needs in Pakistan. Our high-quality solar panels harness the power of the sun to provide clean and

Solar PV Analysis of Rawalpindi, Pakistan

Maximise annual solar PV output in Rawalpindi, Pakistan, by tilting solar panels 30degrees South. Situated in the Northern Sub Tropics, Rawalpindi, Pakistan is a viable location for solar PV

Pakistan ranks as sixth-largest solar market

Nov 27, 2024 · Pakistan has emerged as the sixth-largest solar energy market globally, with its rapid transition to renewable energy offering critical lessons

6 FAQs about [Solar panels photovoltaic power generation in Pakistan]

What are the different types of solar panels in Pakistan?

With the potential to generate 40 GW of solar power, as reported by the World Bank, the Pakistani government is rolling out favorable policies and incentives to spur solar energy adoption across the nation. Let’s delve into the three primary types of solar panels: monocrystalline, polycrystalline, and thin film. Types of Solar Panels

Is solar energy a viable solution for Pakistan?

As electricity costs soar and energy shortages persist, a growing number of Pakistanis are turning to solar energy as a viable solution. With the potential to generate 40 GW of solar power, as reported by the World Bank, the Pakistani government is rolling out favorable policies and incentives to spur solar energy adoption across the nation.

What is the solar PV market in Pakistan?

According to GlobalData, solar PV accounted for 3% of Pakistan’s total installed power generation capacity and 0.98% of total power generation in 2021. GlobalData uses proprietary data and analytics to provide a complete picture of this market in its Pakistan Solar PV Analysis: Market Outlook to 2035 report. Buy the report here.

Why are solar panels becoming more popular in Pakistan?

Declining solar panel prices, coupled with skyrocketing grid electricity tariffs that have increased by 155% over three years, are fuelling a rush in renewable energy adoption in Pakistan, with solar power leading the way. The country is now the world’s sixth-largest solar market.

How much solar energy does Pakistan have in 2022?

According to the National Electric Power Regulatory Authority’s (NEPRA) 2022 report, Pakistan’s total installed power generation capacity stands at 43,775 MW, with only 7% of energy coming from renewable sources like solar. Despite the promising outlook for solar energy in Pakistan, several challenges must be addressed.

How can solar energy transitions be managed in Pakistan?

The Pakistan case study illustrates how energy transitions must be carefully managed, incorporating renewables through grid modernization. Pakistan's rapid adoption of solar energy, driven primarily by market forces and with minimal political support, provides valuable lessons for other emerging markets.

Update Information

- Solar panels photovoltaic power generation can be charged

- Photovoltaic panels for Gobi solar power generation

- How many solar panels are there for 30kw photovoltaic power generation

- Solar photovoltaic panels plus wind power generation

- Rooftop photovoltaic panels for solar power generation

- Guinea-Bissau solar panels photovoltaic power generation

- Do photovoltaic power generation require solar panels

- Power generation from photovoltaic panels in Mombasa Kenya

- Solar energy storage panels and power generation panels

- Bangui exports solar photovoltaic power generation and energy storage systems

- Does the unevenness of photovoltaic panels affect power generation

- Does solar photovoltaic power generation require energy storage

- London off-grid solar photovoltaic power generation system

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

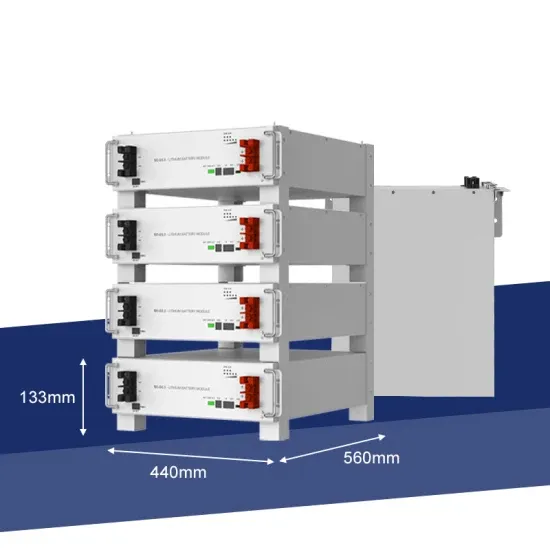

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.