Sungrow, Huawei Lead PVBL 2025 Global Solar Inverter

Jun 14, 2025 · As per the report, Sungrow posted record-breaking revenue of 77.86 billion yuan and a net profit of 11.04 billion yuan, up 7.76 percent and 16.92 percent year-on-year,

Photovoltaic inverter company profit ranking

top 10 global solar photovoltaic (PV) inverter vendors accounted for 86% of market share in 2022, increasing by 4% year-over-year since 2021, according to latest analysis by Wood Mackenzie,

A review on single-phase boost inverter technology for low

Feb 1, 2024 · Solar Photovoltaic (SPV) inverters have made significant advancements across multiple domains, including the booming area of research in single-stage boosting inverter

How to make profit from photovoltaic inverter

For a solar farm with $500,000 in annual revenue and $425,000 in annual costs,the profit margin would be 15%,in line with the typical industry range for solar farms which ranges from 10-20%.

Tier 1 Q1 2025 list | Blog Vico Export Solar Energy

Feb 27, 2025 · Tier 1 List of Solar Panel Manufacturers – Q1 2025 The Tier 1 list of solar panel manufacturers for the first quarter of 2025 has been published by Bloomberg New Energy

Solar inverter solutions for Utility applications

Jul 29, 2021 · Meet your bankability and profit targets with FIMER solar inverter solutions Maximize the return on your PV investment with solar inverter solutions designed for high total

Solar inverter solutions for Utility applications

Oct 9, 2021 · Meet your bankability and profit targets with FIMER solar inverter solutions Maximize the return on your PV investment with solar inverter solutions designed for high total

Overview of power inverter topologies and control structures

Feb 1, 2014 · In grid-connected photovoltaic systems, a key consideration in the design and operation of inverters is how to achieve high efficiency with power output for different power

Global Photovoltaic Inverter Market Research Report 2024

Jan 16, 2024 · Photovoltaic Inverter, also known as power regulator and power regulator, is an indispensable part of the photovoltaic system. The global Photovoltaic Inverter market was

Solar inverters and inverter solutions for power generation

Mar 13, 2020 · Optimized levelized cost of energy over the complete plant lifetime — has one of the widest portfolios of solar inverters ranging from single-and three-phase string inverters

Optimization of PV Array-to-Inverter Power Ratio in Grid

Jun 17, 2021 · Since PV arrays do not generate nominal power most of the time due to climate conditions, determining the optimal array-to-inverter power ratio (AIPR) is a significant factor in

Sungrow, Huawei Lead PVBL 2025 Global Solar Inverter

Jun 14, 2025 · At the 10th Century Photovoltaic Conference held in Shanghai on June 10, the Photovoltaic Brand Lab (PVBL) released its much-anticipated 2025 Global Top 100 Solar

The photovoltaic industry continues to prosper, and inverter

Benefiting from factors such as the continued prosperity of the photovoltaic industry, the net profits of many inverter companies last year more than doubled year-on-year. As of now, five inverter

Top 10 Solar Inverter Manufacturers Dominating the Market

Dec 13, 2024 · In 2023, the global photovoltaic (PV) inverter market clocked a value of $13.09 billion. With the anticipated growth at a compound annual growth rate (CAGR) of 18.3% from

Solar Energy Basics Coursera Quiz Answers

Oct 20, 2020 · 14 What is the correct sequencing of electrical components for an on-grid PV System design, going from an array on a roof to the main electrical panel in the house? Array

Transformative Trends in the Photovoltaic Inverter Market:

May 7, 2025 · For instance, Yuneng Technology''s net profit was 29 million yuan, down about 28% year-on-year. HeMai reported a loss of 10.36 million yuan, a staggering 115% decline, making

6 FAQs about [The photovoltaic inverter with the highest profit is]

What is the global photovoltaic inverter market?

Photovoltaic Inverter, also known as power regulator and power regulator, is an indispensable part of the photovoltaic system. The global Photovoltaic Inverter market was valued at US$ 5776.2 million in 2023 and is anticipated to reach US$ 5889.2 million by 2030, witnessing a CAGR of 0.2% during the forecast period 2024-2030.

Who is the largest PV inverter supplier in the world?

SUNGROW is the largest supplier of PV inverter systems in the world. Danfoss was recognized as the Strategic Partner Supplier in 2017, topping the award received in 2016, for being a Distinguished Supplier in this field.

Is the inverter the most expensive part of a PV system?

The inverter is typically the most expensive component within a PV system and is essential to properly select and install Surge Protection Devices (SPDs) on both the ac and dc lines. The closer the strike is to the inverter, the more damaged it will be.

What are the major players in global PV inverter market?

The major players in global PV Inverter market include SMA, Huawei, etc. The top 2 players occupy about 30% shares of the global market. Asia-Pacific is main market, and occupies over 60% of the global market. String Inverter is the main type, with a share about 60%. Public Utilities is the main application, which holds a share about 45%.

Which PV inverter vendors shipments grew the most in 2022?

The top five vendors – Huawei, Sungrow, Ginlong Solis, Growatt, and GoodWe – shipped more than 200 GWac and accounted for 71% of total global PV inverter shipments in 2022, growing 8% from 2021. Huawei’s shipments saw a significant increase of 83% in 2022 compared to 2021, while Sungrow’s shipments expanded 56% in the same period.

What is the global demand for PV inverters in 2022?

The global PV demand of 201 gigawatt alternating current (GWac) in 2022 contributed to 48% growth year-over-year for PV inverters. In terms of inverter shipments, strong growth in Europe, Asia Pacific, and the United States where government support bolstered to meet clean energy goals led to a total of 333 GWac of global shipments in 2022.

Update Information

- Highest parameters of photovoltaic inverter

- Photovoltaic inverter export profit

- How much profit does photovoltaic inverter have

- Huawei 8kw photovoltaic inverter

- Three-phase photovoltaic inverter maximum voltage

- Three-level photovoltaic inverter

- Assembly and assembly of photovoltaic inverter

- Sao Tome Photovoltaic Pump Inverter Project

- Photovoltaic inverter mw

- Photovoltaic micro inverter financing

- Somalia New Energy Photovoltaic Inverter

- Photovoltaic 24 kW inverter

- Micro inverter for photovoltaic power station

Solar Storage Container Market Growth

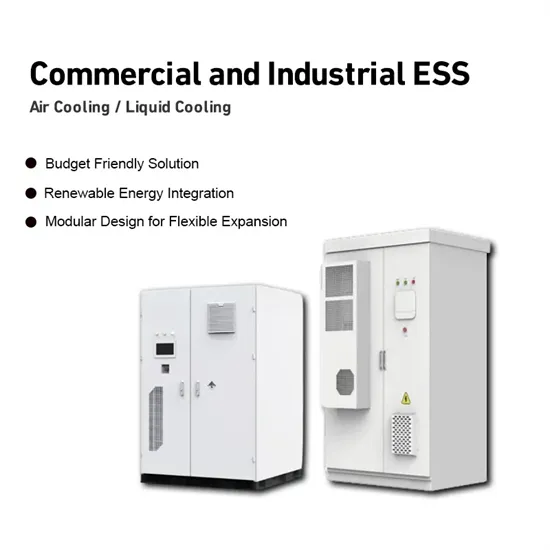

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.