Battery Energy Storage Systems: Main Considerations for

5 days ago · Battery Energy Storage Systems, or BESS, help stabilize electrical grids by providing steady power flow despite fluctuations from inconsistent generation of renewable energy

Lithium Ion Battery Energy Storage Market

According to Stratistics MRC, the Global Lithium-ion Battery Energy Storage Market is accounted for $5.26 billion in 2023 and is expected to reach $15.80 billion by 2030 growing at a CAGR of

CBTC China International Energy Storage and Lithium Battery

Mar 7, 2025 · This exhibition is a professional technology exhibition that focuses on the new lithium battery technology. Several lithium battery technology seminar will also be held in order

Analysis of market dynamics and price trends of energy storage lithium

Dec 5, 2024 · Energy storage lithium battery market demand The demand for Solar energy storage lithium battery is mainly driven by two factors: on the one hand, the demand for grid

It''s All Relative: RV Trading in Battery Metals Markets

Feb 11, 2025 · The rapid electrification of transportation and the growth of renewable energy storage have made battery metals such as lithium and cobalt critical commodities for the

The Ultimate Guide to Lithium-Ion Battery Banks

Mar 26, 2025 · As battery technology continues to evolve, lithium-ion batteries will remain at the forefront of home energy storage, offering greater efficiency,

Shanghai Stock Exchange and the Energy Storage Revolution

Feb 12, 2024 · This isn''t science fiction – it''s the energy storage revolution driving China''s markets. The Shanghai Stock Exchange (SSE) has become ground zero for this

Tesvolt Energy debuts for BESS energy trading – Batteries

February 14, 2025: German lithium battery storage systems specialist Tesvolt has launched a spin-off business, Tesvolt Energy, targeting the energy trading market using BESS systems of

Lithium Storage Solutions for a Greener Energy Future

Feb 6, 2025 · The shift to renewable energy drives demand for efficient energy storage solutions, with lithium technology leading the way in sustainability.

National Blueprint for Lithium Batteries 2021-2030

Jul 1, 2024 · Lithium-based batteries power our daily lives from consumer electronics to national defense. They enable electrification of the transportation sector and provide stationary grid

Batteries as an infrastructure asset class: A new

Jul 12, 2021 · Battery storage is flexible, remarkable — and investable — but you need to know what you''re doing and know where the market opportunities and

Strategies toward the development of high-energy-density lithium batteries

May 30, 2024 · Strategies such as improving the active material of the cathode, improving the specific capacity of the cathode/anode material, developing lithium metal anode/anode-free

Climate tech explained: grid-scale battery storage

Jul 17, 2024 · In addition, the costs are currently still too high to make lithium-ion batteries economic for longer-term storage of energy, to cover periods when

Will the Energy Transition Make Storage Batteries a

Jul 31, 2024 · Battery storage is a rapidly growing sector that is being fueled by a surge in solar and wind power and billions of dollars of debt-equity investment by Wall Street banks. Texas

Technology Strategy Assessment

Jul 19, 2023 · Technology Strategy Assessment Findings from Storage Innovations 2030 Lithium-ion Batteries July 2023 About Storage Innovations 2030 This report on accelerating the future

Lithium battery energy storage foreign trade

Jun 21, 2022 · Are lithium-ion batteries a strategic resource? This article explores the geopolitical relations and interdependencies emerging in the lithium extraction and manufacturing of

Top 10 Energy Storage Trends in 2023

Jan 11, 2023 · At the beginning of each year, we pause to reflect on what has happened in our industry and gather our thoughts on what to expect in the coming 12 months. These 10 trends

How to Become the Best Lithium Trader: Expert Strategies

Sep 18, 2024 · Lithium trading has become increasingly lucrative in recent years due to the growing demand for electric vehicles and renewable energy storage. Aspiring lithium traders

Lithium Storage Solutions: Advancing the Future of Energy Storage

Jan 24, 2025 · Lithium-ion batteries (LIBs) have long been the cornerstone of energy storage technologies. Known for their high energy density, lightweight design, and impressive cycle

Lithium-ion Battery Technologies for Grid-scale Renewable Energy Storage

Jun 1, 2025 · Furthermore, this review also delves into current challenges, recent advancements, and evolving structures of lithium-ion batteries. This paper aims to review the recent

Lithium Storage Solutions: The Future of Energy

Jan 17, 2025 · As the global energy sector transitions towards renewable sources, the demand for efficient, scalable, and long-duration energy storage solutions

6 FAQs about [Lithium battery energy storage traders]

Are lithium batteries the future of energy storage?

Lithium (Li)-metal batteries are one of the most promising candidates for the next-generation energy storage devices due to their ultrahigh theoretical capacity. Realistic development of a Li metal battery is impeded by the uncontrollable dendrite proliferation upon the chemically active [parts]. Lithium batteries are a potential solution for the future of energy storage.

Can battery storage assets be traded across markets?

Trading around battery storage assets is challenging and no single model may fit across markets. It demands sophisticated tools that have the flexibility to model business processes and/or the integration capability to import proprietary attributes for customer-specific valuation purposes.

Are battery energy storage systems a good investment?

The latest Battery Energy Storage Systems (BESS) are now at a scale where they can be used as a flexible asset that stores clean energy which can be dispatched to the grid with potentially attractive revenues.

Why should battery storage owners invest in digital solutions?

This offers battery storage owners an opportunity to monetize and profit from their assets, provided they equip themselves with digital solutions that enable the required automation and visibility: Charging ahead – Battery storage in energy trading.

Why is battery storage important?

As renewable energy resources become a more dominant part of the energy mix, battery storage solutions become critical to help optimize renewable assets and balance a grid that is increasingly populated by intermittent energy sources such as wind and solar.

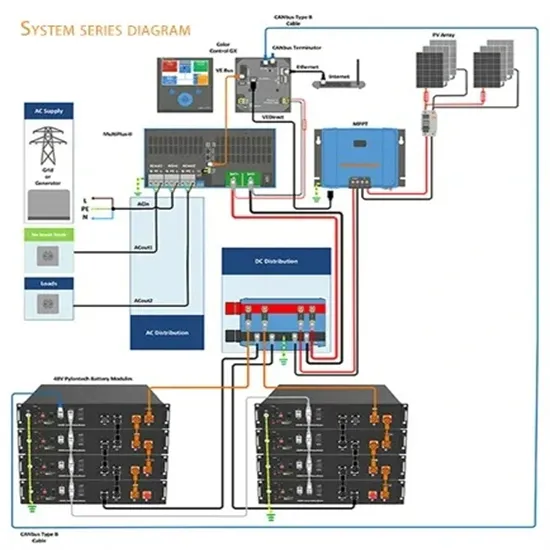

Who is Tu Energy Storage Technology (Shanghai)?

Safe operation and system performance optimization. TU Energy Storage Technology (Shanghai) Co., Ltd., founded in 2017, is a high-tech enterprise specializing in the research and development, production and sales of energy storage battery management systems (BMS) and photovoltaic inverters.

Update Information

- Czech Brno lithium iron phosphate energy storage battery

- What is the use of lithium battery energy storage rack

- Charging time of energy storage lithium battery cabinet

- Banjul energy storage lithium battery manufacturer wholesale

- Budapest energy storage lithium battery sales

- Energy Storage Project Lithium Battery

- Muscat energy storage low temperature lithium battery

- Libya solar energy storage lithium battery

- Thimbu lithium battery portable energy storage recommendation

- Mauritius household rooftop power station energy storage lithium battery

- Skopje energy storage battery lithium iron phosphate

- Dushanbe distributed energy storage lithium battery

- New Delhi Energy Storage Lithium Battery Pack Manufacturer

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.