A comprehensive review of wind power integration and energy storage

May 15, 2024 · Integrating wind power with energy storage technologies is crucial for frequency regulation in modern power systems, ensuring the reliable and cost-effective operation of

Energy storage systems: a review

Sep 1, 2022 · The world is rapidly adopting renewable energy alternatives at a remarkable rate to address the ever-increasing environmental crisis of CO2emissions. Renewable energy system

Guinea | Africa Energy Portal

4 days ago · Guinea, which is known as "the Water tower of Africa", could be the main player in the electricity market in West Africa. The country is planning, with the support of TFPs, to build

GUINEA RENEWABLE ENERGY STORAGE SYSTEM SOLUTIONS

Energy Storage Technology is one of the major components of renewable energy integration and decarbonization of world energy systems. It significantly benefits addressing ancillary power

Guinea current energy storage technologies

Energy storage technologies can be broadly categorized into five main types: mechanical energy storage, electrical energy storage, electrochemical energy it is important to provide focused

Guinea Backup Energy Storage Battery: Powering Resilience

With 65% of Guinea''s population lacking reliable electricity access [2], energy storage systems have become the unsung heroes in bridging power gaps. But here''s the kicker: Not all

GUINEA RENEWABLE ENERGY STORAGE SYSTEM SOLUTIONS

What type of energy is used in Guinea? Renewable energy here is the sum of hydropower, wind, solar, geothermal, modern biomass and wave and tidal energy. Traditional biomass – the

A review of energy storage technologies for wind power

May 1, 2012 · Due to the stochastic nature of wind, electric power generated by wind turbines is highly erratic and may affect both the power quality and the planning of power systems.

the future of power storage in guinea

Battery energy storage developments that are electrifying the sector In an era driven by an urgent need for sustainable energy solutions, battery energy storage systems (BESS) have become

6 FAQs about [What is the Guinea Wind Energy Storage System]

What is Guinea's energy strategy?

Includes a market overview and trade data. The Guinean government has announced a long-term energy strategy focusing on renewable sources of electricity including solar and hydroelectric as a way to promote environmentally friendly development, to reduce budget reliance on imported fuel, and to take advantage of Guinea’s abundant water resources.

Can China make guinea an energy exporter in West Africa?

The Chinese mining firm TBEA is providing financing for the Amaria power plant (300 MW, USD 1.2 billion investment). If corresponding distribution infrastructure is built, and pricing enables it, these projects could make Guinea an energy exporter in West Africa.

What is the biggest energy investment in Guinea?

The largest energy sector investment in Guinea is the 450MW Souapiti dam project (valued at USD 2.1 billion), begun in late 2015 with Chinese investment. A Chinese firm likewise completed the 240MW Kaleta Dam (valued at USD 526 million) in May 2015.

Is Guinea a potential exporter of power?

Guinea’s hydropower potential is estimated at over 6,000MW, making it a potential exporter of power to neighboring countries. The largest energy sector investment in Guinea is the 450MW Souapiti dam project (valued at USD 2.1 billion), begun in late 2015 with Chinese investment.

Is Guinea the water tower of Africa?

The electricity sub-sector has continued to build its capacity and reform its regulatory and institutional framework. Guinea, which is known as “the Water tower of Africa”, could be the main player in the electricity market in West Africa.

How has Kaleta changed Guinea's electricity supply?

Kaleta more than doubled Guinea’s electricity supply, and for the first-time furnished Conakry with more reliable, albeit seasonal, electricity (May-November). Souapiti began producing electricity in 2021. A third hydroelectric dam on the same river, dubbed Amaria, began construction in January 2019 and is expected to be operational in 2024.

Update Information

- What is the Bulgarian wind energy storage system

- What is the Montenegro wind energy storage system

- What are the energy storage wind turbine equipment

- What can wind solar and energy storage projects do

- What does PV energy storage swap mean in Papua New Guinea

- What are the small energy storage power stations in Auckland New Zealand

- What is the price of micro wind power storage cabinet

- What are the special photovoltaic energy storage systems

- What is photovoltaic energy storage cabinet assembly

- The role of Nairobi wind energy storage system

- What are the site requirements for energy storage containers

- What is container energy storage in Ghana

- Skopje Wind Energy Storage 2025

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

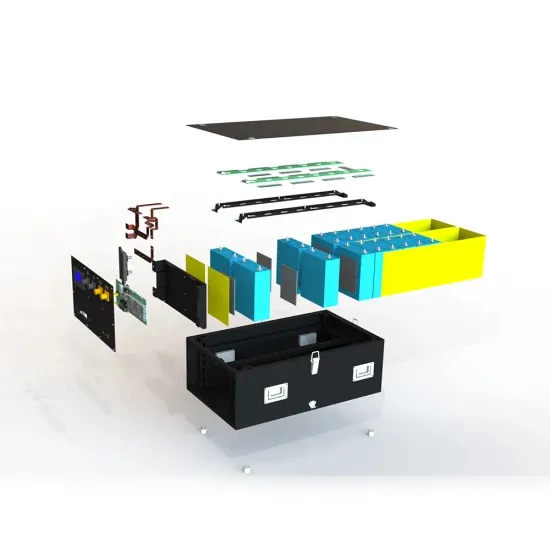

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.