Will 2.5 Slot GPU fit into 2 Slots?

A 2.5 slot card will only take up 2 expansion slots, but you''ll need vertical clearance below the card. So if those two slots are already against the bottom of the case or you''re putting

What are the advantages of dual-glass Dualsun modules?

Aug 18, 2025 · Dual-glass type modules (also called double glass or glass-glass) are made up of two glass surfaces, on the front and on the rear with a thickness of 2.0 mm each. Some

Double-glass PV modules with silicone encapsulation

May 21, 2024 · ABSTRACT Double-glass PV modules are emerging as a technology which can deliver excellent performance and excellent durability at a competitive cost. In this paper a

What are the advantages of dual-glass Dualsun modules?

Aug 18, 2025 · The thickness of the front glass generally used for this type of structure is 3.2 mm. Dual-glass type modules (also called double glass or glass-glass) are made up of two glass

What are Double Glass Solar Panels?

Jun 17, 2025 · SolarSpace PV modules are designed in accordance with the international IEC 61215 and IEC 61730 standards, and the application grade rating is class A: modules can be

CI + slot on TV: why do you need it

Oct 30, 2023 · Slot CI vs CI + The CI slot, or Common Interface slot, was the original standard. It allows you to install a Common Interface Module (CIM) or a Conditional Access Module (CAM)

Thermal and electrical performance analysis of monofacial double-glass

Nov 1, 2023 · Monofacial double-glass module consists of two pieces of PV glass, solar cell and encapsulated materials. Only the front side of solar cell absorbs sunlight and realizes power

INSTRUCTIONS FOR PREPARATION OF PAPERS

Jul 12, 2025 · ABSTRACT: Double-glass modules provide a heavy-duty solution for harsh environments with high temperature, high humidity or high UV conditions that usually impact

What are the differences between single-glass

Oct 22, 2020 · Furthermore, comparing to plastic backsheets (the back material of single-glass solar module) which are reactive, glass is non-reactive. This

The Difference Between Bifacial Module and

Sep 4, 2023 · Bifacial solar modules and double glass bifacial solar modules are both types of solar panels designed to capture sunlight from both sides (front

Single-glass versus double-glass: a deep dive into module

Oct 2, 2024 · For instance, the transition from 3.2mm to 2.8mm for single-glass modules and 2mm for double-glass modules, and even to 1.6mm, necessitates a careful consideration of the

Growth Strategies in Double Glass Module Photovoltaic Glass

Jan 17, 2025 · The global double glass module photovoltaic glass market is projected to reach a value of USD 29.5 billion by 2033, exhibiting a CAGR of 11.5% during the forecast period from

6 FAQs about [How thick is the card slot of the double-glass module ]

What is the thickness of a glass module?

The thickness of the front glass generally used for this type of structure is 3.2 mm. Dual-glass type modules (also called double glass or glass-glass) are made up of two glass surfaces, on the front and on the rear with a thickness of 2.0 mm each.

How much does a glass module weigh?

The weight of glass-glass modules are still an issue, with current designs using 2 mm thick glass on each side for framed modules, the weight is about 22 kg, while 2.5 mm on each side will increase the module’s weight to 23 kg. Compared to traditional glass-foil modules, which are about 18 kg, this is a 20% increase in weight.

What is a dual-glass module?

Dual-glass type modules (also called double glass or glass-glass) are made up of two glass surfaces, on the front and on the rear with a thickness of 2.0 mm each. Some manufacturers, in order to reduce the weight of the modules, have opted for a thickness of 1.6 mm. DualSun has chosen to stay with a thickness of 2.0 mm for reasons explained below.

What is a double glass module?

The double glass module design offers not only much higher reliability and longer durability but also significant Balance of System cost savings by eliminating the aluminum frame of conventional modules and frame-grounding requirements. The application of double-glass modules covers multiple markets including utility, residential and commercial.

Why are double glass modules symmetrical?

Mechanical constraints on cells: the fact that the structure of the double glass modules is symmetrical implies that the cells are located on a so-called neutral line, the upper part of the module being in compression during a downward mechanical load and the lower glass surface being in tension.

What is the difference between tempered glass and glass-foil modules?

Compared to traditional glass-foil modules, which are about 18 kg, this is a 20% increase in weight. Although there is no standard on glass thickness, in general it is a more complex and expensive process to produce very thin, tempered glass. However, 2.5 mm glass thickness does allow for frameless designs, which can reduce costs dramatically.

Update Information

- How much electricity does a photovoltaic double-glass module generate

- Double-glass photovoltaic thin-film module price

- How to store power in base station communication module

- Parameters of 170W double-glass monocrystalline module

- Double-sided double-glass module installation

- Sao Tome double-glass photovoltaic module prices

- How much is the price of double-glass photovoltaic curtain wall in Brussels

- How many types of photovoltaic module cells are there

- How is it easy to work in a battery and photovoltaic module factory

- How much does the third generation photovoltaic module cost

- How much does the Hargeisa smart photovoltaic module equipment cost

- How much is the price of double-glass photovoltaic curtain wall in Zimbabwe

- How powerful is the 12v inverter

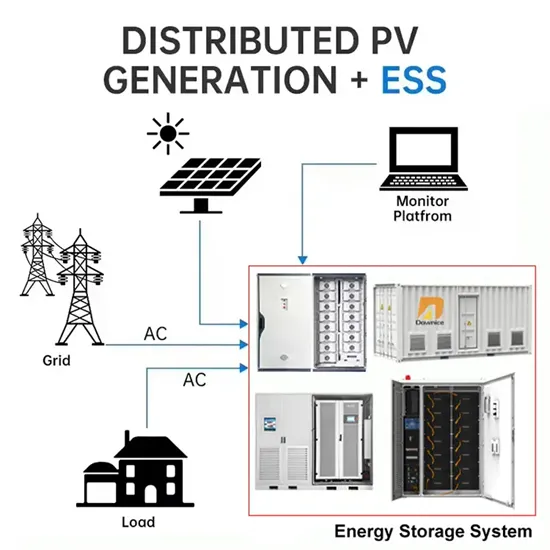

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.