Ranking of Bratislava Energy Storage Companies: Who''s Powering Slovakia

Here''s where Bratislava''s energy storage innovators step in. The top 3 companies are sort of rewriting the rules: 1. Slovak Energy Works: The Homegrown Hero. SEW''s modular battery

Slovakia Battery Energy Storage System Market (2025-2031)

6Wresearch actively monitors the Slovakia Battery Energy Storage System Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue

slovakia energy storage container manufacturer

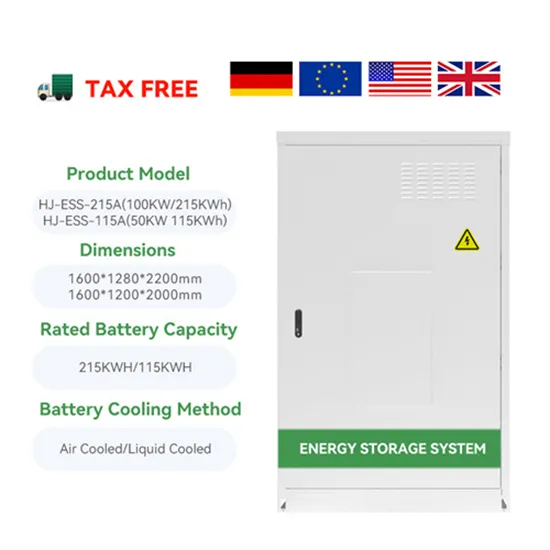

Shandong Wina Green Power Technology Co., Ltd: We offer wall mounted home energy storage, stacked energy storage, rack-mounted energy storage and energy storage container from our

Containerized Energy Storage System Complete battery

Mar 21, 2024 · What is containerized ESS? ''s containerized energy storage system is a complete, self-contained battery solution for large-scale marine energy storage. The batteries

Top 13 Energy Storage Companies in Slovakia (2025) | ensun

Identify and compare relevant B2B manufacturers, suppliers and retailers. Max. TESLA Liptovský Hrádok specializes in battery energy storage systems (BESS) and integrates renewable

Slovakia Energy Storage Group: Powering the Future of Renewable Energy

Here''s the kicker – Slovakia Energy Storage Group isn''t just another battery company. They''re like the Swiss Army knife of energy solutions, tackling everything from grid stabilization to

Energy storage container production in latvia

The battery system includes six battery containers, three inverter/transformer container and one distribution point container, providing a total electric capacity of up to 20 MWh. To get a better

Energy Storage Systems

Jul 28, 2025 · Energy-efficient operations with a full portfolio of energy storage systems featuring ECO, the Energy Controller Optimizer, and the Z Charger, our own fast charger for electric

what are the energy storage container factories in slovakia

Right now, we have a 1MWh battery (BESS) on-site at Mawson Lakes — available now for purchase or lease. This A 40ft BESS container solution more than just an energy storage.

Slovakia Energy Storage Base Project

Energy storage facility of a cumulative installed capacity of 384 MW, storage capacity allowing a net annual electricity generation of 250 GWh. The storage will consist of several

Leading the charge – How Greenbat and Pixii

Nov 12, 2024 · As Slovakia strides towards modernizing its energy infrastructure, Greenbat and Pixii have joined forces to pioneer the first battery storage

Top 14 Energy Companies in Slovakia (2025) | ensun

The company is the largest energy supplier in Slovakia, serving over 1.3 million customers, and is actively involved in the development of renewable energy sources and energy efficiency services.

Update Information

- What brands of energy storage battery container manufacturers are there

- What are the Freetown container energy storage battery manufacturers

- Battery container energy storage manufacturers

- What are the units of lithium battery container energy storage system

- What are the battery energy storage container systems

- Supply of energy storage battery container manufacturers

- What are the manufacturers of battery energy storage system equipment for emergency communication base stations

- New energy storage battery container manufacturer

- What are the design requirements for energy storage battery cabinets

- Energy Storage Battery Container Policy

- What is the use of lithium battery energy storage rack

- What kind of enterprise is energy storage cabinet battery

- Ngerulmud sodium sulfur battery energy storage container price

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

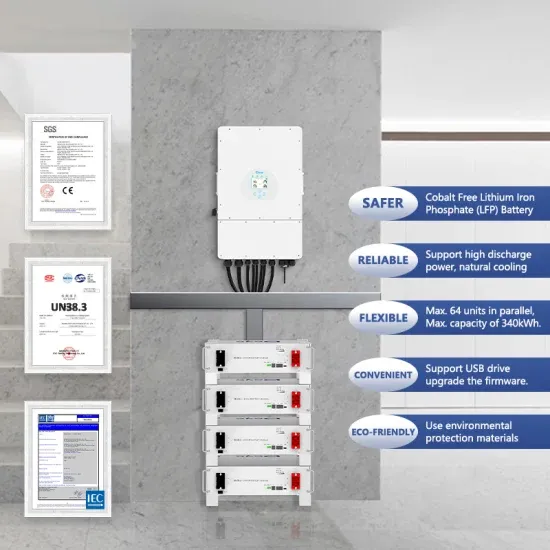

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.