(PDF) Glass Application in Solar Energy Technology

May 3, 2025 · This chapter examines the fundamental role of glass materials in photovoltaic (PV) technologies, emphasizing their structural, optical, and spectral conversion properties that

CPS to construct Canadian solar glass plant

Jul 7, 2025 · Canadian Premium Sand (CPS) plans to build two solar glass facilities, one in Canada and one in the US. Together, the projects represent a combined 10GW of annual

China Glass Manufacturers, OEM/ODM Glass Deep Processing

Jiangsu Chunge Glass Co., Ltd is a professional OEM/ODM glass manufacturers and glass deep processing factory, We specialize in custom glass, involving photovoltaic solar cell glass, new

A review of anti-reflection and self-cleaning coatings on photovoltaic

Mar 15, 2020 · Thus, to overcome these problems, photovoltaic solar cells and cover glass are coated with anti-reflective and self-cleaning coatings. As observed in this study, SiO 2, MgF 2,

An overall introduction to photovoltaic glass –

Jan 24, 2024 · Photovoltaic glass refers to the glass used on solar photovoltaic modules, which has the important value of protecting cells and transmitting

Critical minerals value chains – Solar photovoltaic (PV) modules

Jan 9, 2025 · Solar PV modules, commonly known as solar panels, are essential for a clean and digital economy. The development of solar PV modules relies on the increased supply of

Canadian-based solar glass manufacturer to open factory in

Nov 4, 2024 · The Company is now preparing plans to re-purpose a former glass manufacturing facility in the US to produce 4GW per year of solar glass and is advancing discussions with a

Canadian Solar TOPCon Module Technical White Paper

Mar 15, 2023 · CSI High Eficiency TOPCon Module White Paper CSI Solar Co., Ltd 1 troduction Canadian Solar is one of the world''s largest suppliers of solar photovoltaic modules, system

Canada Photovoltaic Laminated Glass Interlayer Film Market

Jul 4, 2025 · Canada Photovoltaic Laminated Glass Interlayer Film Market size was valued at USD 1.2 Billion in 2024 and is forecasted to grow at a CAGR of 9.

6 FAQs about [Canadian photovoltaic glass processing]

Is CPS the only patterned solar glass supplier in North America?

CPS is positioned to be the only patterned solar glass supplier in North America. Driven by an ambitious vision to add new domestic manufacturing capacity, CPS has initiated plans to build and operate an industry-leading sustainable solar glass manufacturing facility in Manitoba.

Why is Canadian premium sand launching a solar panel glass project?

Besides influencing First Solar and its growing glass supply chain, policies such as the US Inflation Reduction Act (IRA) are also spurring crystalline silicon manufacturing investment. This has triggered Canadian Premium Sand (CPS), a new entrant from Canada, to announce a solar panel glass project.

Can CPS glass be used in solar panels?

CPS glass can be used in solar panels – a key component of North American net-zero plans to reduce emissions. With 100% of North America’s patterned solar glass currently being imported, the lack of a made-in-North-America solution creates numerous challenges to our future customers.

How long has NSG been producing TCO-coated glass for thin-film PV?

NSG has been producing TCO-coated glass for thin-film PV for more than 25 years. “Every year the solar market is bigger and bigger; more capital, more resources,” said Stephen Weidner, who heads NSG’s North American architectural glass and solar products groups. “We see this on a global basis.” Glass for solar is becoming more significant.

Does Vitro Architectural Glass supply First Solar?

Vitro Architectural Glass is supplying First Solar with additional US capacity. In October 2023, it announced an expansion of its contract with First Solar and a plan to invest in a plant in Pennsylvania, as well as in adapting existing PV glass facilities.

Will solar pattern glass reach 100 GW by 2030?

Anshul Vishal, head of corporate development at CPS, estimates that demand for solar pattern glass in North America will reach nearly 100 GW by 2030. This growth is driven by the reshoring of the solar panel manufacturing supply chain in the US.

Update Information

- Huawei photovoltaic glass processing factory

- Georgia Photovoltaic Glass Processing Plant

- Architectural Photovoltaic Laminated Glass

- Photovoltaic panels to glass

- Is the Ashgabat Photovoltaic Glass Factory good

- Kuwait New Energy Photovoltaic Power Generation Glass Crystalline Silicon

- Photovoltaic glass installation in Dominican sun room

- Libreville single-glass photovoltaic module glass

- Kuwait Photovoltaic Glass Project

- Photovoltaic glass oblique stripes

- Photovoltaic glass natural soda

- Demand for photovoltaic glass explodes

- Helsinki photovoltaic panel glass

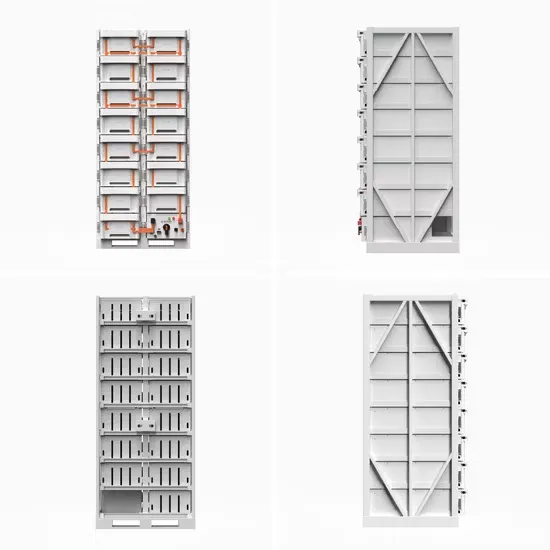

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.