New report reveals that European solar production

Mar 5, 2025 · SolarPower Europe has published a new report mapping Europe''s solar PV module production equipment capacity. Today, at least 38 companies are active in Europe

Solar Production Equipment In Focus For Solar Power Europe

Mar 7, 2025 · SolarPower Europe, the leading European solar body, has released a new report that calls upon Europe to seek deeper backward integration for solar manufacturing. The

European Solar PV Manufacturing: Terminal Decline or

Aug 9, 2024 · How did the European Union (EU) come to this situation? The current crisis is mostly the result of different factors: 1) a dependence on Chinese solar panel prices, 2) a lack

Solar Production Equipment

Mar 5, 2025 · In the solar sector, European companies originally played a key role in developing the production equipment needed for the mass production of solar wafers, cells, and modules.

#MakeSolarEU: WACKER''s role in reshoring solar manufacturing to Europe

Oct 18, 2024 · The European solar manufacturing landscape is at a critical crossroads. Excess demand, combined with overcapacity on the supply side, has resulted in a record drop in

#MakeSolarEU: Oxford PV''s role in reshoring solar manufacturing to Europe

Feb 2, 2024 · The European solar manufacturing landscape is at a critical crossroads. Excess demand, combined with overcapacity on the supply side, has resulted in a record drop in

European solar supply chain taking a hit in 2025 | Solar Builder

May 28, 2025 · The good: European solar supply additions Several new manufacturers have been added to the map, including Kivanc, with plans for 1.2 GW of module production and 5 GW of

Clean Energy Technology Observatory, Photovoltaics in the European

Nov 13, 2024 · As part of the Clean Energy Technology Observatory (CETO), this report on Photovoltaics (PV) is built on three sections: the technology state of the art, future

Sinovoltaics Releases 2025 Europe Solar Supply Chain Map

May 23, 2025 · Sinovoltaics unveils the 2025 Europe Solar Supply Chain Map, revealing new manufacturers and widespread factory closures. Discover how transparency and verified

#MakeSolarEU: HoloSolis''s role in reshoring solar manufacturing to Europe

Jul 25, 2025 · The European solar manufacturing landscape is at a critical crossroads. Excess demand, combined with overcapacity on the supply side, has resulted in a record drop in

Making solar a source of EU energy security

Aug 29, 2022 · A larger European PV manufacturing industry has the potential to provide lucrative employment and advance technological leadership. More importantly, in-house PV

Sinovoltaics updates solar module supply chain

May 23, 2025 · There are 125 factory sites listed in the Sinovoltaics Europe Solar Supply Chain Map for 1Q2025, which is available as a free download. It tracks

European solar supply chain taking a hit in 2025 | Solar Builder

May 28, 2025 · Their first 2025 edition of the Europe, Mediterranean, and Turkey Solar Supply Chain Map (SSCM) highlights the rapid changes taking place at European manufacturing

6 FAQs about [EU Solar Cell Supply Site]

Does Europe have a solar supply chain?

SolarPower Europe has released a report mapping Europe’s solar PV module production equipment capacity, identifying at least 38 companies involved in manufacturing key machinery for the solar supply chain, including cells, ingots, wafers, and polysilicon.

How many solar plants are there in Europe?

The latest report on the supply chain for European PV module production provides the status of 121 solar manufacturing sites, including closures and capacity on hold. It maps plants that produce PV modules, cells, wafers, ingots, polysilicon, and metallurgical-grade silicon.

What is the sinovoltaics supply chain map – European for Q2 2024?

The Sinovoltaics Supply Chain Map (SSCM) – European for Q2 2024 has a large information update, according to the analysts. Sinovoltaics uses nameplate capacity figures and publicly available information. The analysts noted that Europe, Turkey, and Kazakhstan currently have 22 GW of module production capacity.

Where are solar PV modules manufactured?

Currently, at least 38 solar PV module production equipment manufacturers operate across nine European countries—Germany, France, Italy, the Netherlands, Switzerland, Spain, Hungary, Finland, and Norway. The majority, approximately 75%, specialize in manufacturing equipment for solar cells and modules.

What are sinovoltaics supply chain maps?

Sinovoltaics regularly publishes supply chain maps to inform developers and industry members about emerging PV suppliers and the latest developments in global solar manufacturing. The reports are free and published in the form of infographics and data tables.

How can Europe reindustrialize the solar industry?

He emphasized that production equipment is a vital part of Europe’s reindustrialization and that the solar sector can leverage its potential through initiatives such as the International Solar Manufacturing Initiative.

Update Information

- Solar cell site cabinet price

- Small solar independent power supply system

- Pumping water to supply water to solar energy

- Banjul Solar Power Supply System

- Malaysia Penang outdoor solar energy storage power supply

- Price of energy storage cabinet converted to solar power supply

- 6 kW solar emergency power supply

- Outdoor Solar Wireless Site Energy Recommendations

- China-Africa Solar Light Power Supply System

- Solar Base Station Power Supply

- Photovoltaic solar panel supply

- Photovoltaic solar power supply system

- Solar outdoor wireless no internet site energy price

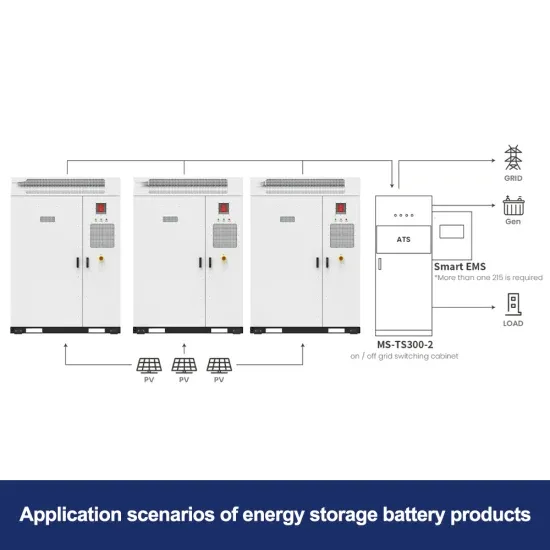

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.