Black Mountain Energy Storage | 领英

Black Mountain Energy Storage aims to develop utility scale energy storage solutions uniquely positioned to provide key grid reliability services required to support the integration of

''Will you leave?'': A rural Texas community pushes back

Jul 25, 2024 · Jackson Hughes, Black Mountain Energy Storage''s Manager of Development, responded that utility-scale batteries are typically used when demand and prices for energy

Oologah residents frustrated with proposed energy storage

Jan 16, 2025 · Dan Ditto is the Director of Land for Black Mountain Energy Storage. He says with the coal plant retiring in 2026, this will be a good thing for the town of Oologah.

Black Mountain Energy Storage: A Leader in the Field

Mar 31, 2025 · Black Mountain Energy employs a comprehensive array of energy storage technologies, including: Advanced Battery Energy Storage Systems: Optimize power output

GridStor acquires key battery energy storage projects in

Jan 27, 2025 · GridStor, a leading developer and operator of utility-scale battery energy storage systems (BESS), has announced the acquisition of two significant projects designed to

Black Mountain Energy Storage (Battery Storage Project in

A two hundred megawatt / four hundred megawatt-hour battery storage project located in Oklahoma. The project will increase the resilience of the electric grid, helping ensure a daily

GridStor Acquires Battery Storage Project in Oklahoma from

Jan 20, 2025 · GridStor announced that it has acquired a battery storage project in Oklahoma, totaling 200 MW / 800 MWh to be developed in two phases, from Black Mountain Energy

6 FAQs about [Black Mountain Energy Storage Power]

Who is Black Mountain Energy Storage?

Leveraging cumulative decades of electric market experience, Black Mountain Energy Storage develops powerful, flexible, and strategically placed battery energy storage projects to foster a resilient electric grid. BMES’ quickly expanding team of energy experts are fast actors in pipeline development of utility-scale energy storage solutions.

Will recurrent buy Black Mountain Energy Storage?

Today, Recurrent announced the acquisition of two standalone energy storage projects from Black Mountain Energy Storage. The projects, which are in the South Load Zone of the Texas ERCOT market, are each anticipated to store up to 200 MWh of energy.

Did UBS acquire Black Mountain Energy Storage?

UBS Asset Management today announced the acquisition of five standalone, development-stage energy storage projects in Texas from Black Mountain Energy Storage. Read more Cypress Creek Renewables has added 400MW/600MWh to its storage portfolio after acquiring four Texas standalone energy storage projects from Black Mountain Energy Storage.

What happened to Black Mountain Energy's Valhalla gas project?

Black Mountain Energy (BME) reportedly achieved several key milestones for its Valhalla gas project during the June quarter — its second quarter since listing on the ASX. The company was admitted to the official list of the ASX on December 23, 2021 after completed an IPO which raised $11 million.

Does Black Mountain Energy have a seismic project in the Canning Basin?

Black Mountain Energy completes seismic line clearing activities at its Valhalla project in the Canning Basin. The company will now look to begin seismic data acquisition work, with a planned Odin 2D seismic program to result in 130 kilometers of additional data.

Why did Black Mountain Energy IPO?

Black Mountain Energy successfully completed an A$11 million IPO via the issue of 55 million shares at A$0.20/share. Executive Chairman Rhett Bennett said, “We are excited to bring our expertise to Australia and champion the effort to deliver responsibly developed and environmentally conscious natural gas supply.”

Update Information

- Black Mountain Energy Storage Power Station Island

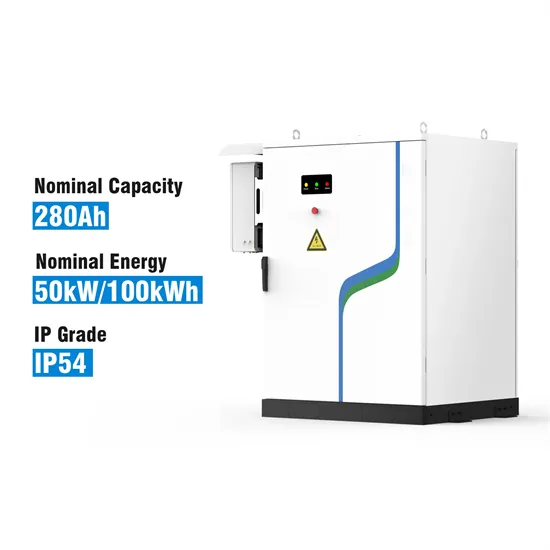

- Black Mountain Cabinet Energy Storage System

- Black Mountain Photovoltaic Energy Storage Battery

- Icelandic centralized energy storage power station

- Dubai Energy Storage Power Station

- North Cyprus power plant builds energy storage power station

- Peak shaving energy storage power station type

- Cost of energy storage power station

- Ukrainian wind energy storage power supply manufacturer

- Power station energy storage scale requirements

- Selection of operating units of energy storage power station

- Venezuela Compressed Air Energy Storage Power Station

- Energy Storage How many containers are needed for a power station

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.