Top Air Conditioning Unit Manufacturers in Israel

Information about Air Conditioning Unit in Israel The air conditioning unit industry in Israel is influenced by several key considerations that potential investors or stakeholders should be

Top 26 HVAC System Manufacturers in Israel (2025) | ensun

Sol-In utilizes advanced sensor technology and AI to enhance indoor air quality, focusing on ventilation, air cleaning, and purification. Their data-driven insights help buildings comply with

Solar Air Conditioner Price: A Comprehensive Guide to Costs

May 21, 2025 · The growing demand for eco-friendly cooling solutions has made solar air conditioners an attractive option for many American households and businesses. Solar air

The Best Air Conditioning Units for 2024: What We

With the wide variety of air conditioning units available today, finding the perfect one for your needs can be a bit overwhelming, and as temperatures keep climbing, the need for a

Efficient Cooling with Advanced israel use solar air conditioner

Efficiently cool spaces while harnessing solar power with innovative israel use solar air conditioner. Experience cost savings, eco-friendly operation, and enhanced comfort for your

Solar A.C: What is Solar AC, How It Works, and Why Nexus Solar

Mar 16, 2025 · What is a Solar Air Conditioner? A Solar Air Conditioner is an innovative cooling system that operates using solar energy instead of traditional electricity. It harnesses the

4 FAQs about [Israel brand solar air conditioner]

Is solcold a Israeli startup?

In June 2016 SolCold received its first exposure when it was selected as one of six Israeli startups to participate in the Global Entrepreneurship Summit in California, organized by the US State Department and White House.

Does MTA sell chillers in Israel?

MTA is represented in Israel for about 30 years. MTA was founded in1982 in Northern Italy and currently employs over 400 individuals worldwide. They run three production plants with total 58,000 m2 production area. MTA markets chillers in 80 countries; chillers range 1.4-1,800 kw for commercial and industrial usage.

Who makes i-Sol heat pump?

i-Sol: A registered brand name produced by Gadir Systems. I-Sol is an energy efficient heat pump for high temperature, floor heating and for swimming pools, at country clubs, sport centers, hospitals, hotels, retirement homes, factories, public, private facilities and private houses.

What is a hybrid air-conditioning system?

A hybrid air-conditioning system is installed in the Porter School of Environmental Studies (PSES) Building. Powered primarily by solar energy and barely using grid electricity, the system integrates a variety of innovative environmental technologies.

Update Information

- Solar Air Conditioner Components and Cost

- Jerusalem 4 2m solar air conditioner

- How much electricity can a solar air conditioner generate

- Slovenia outdoor solar air conditioner port

- Niamey 48v solar air conditioner

- Polish solar air conditioner quality sample

- Large solar air conditioner in Pristina

- Can Palau s 48v solar air conditioner be used at night

- Xiaomi Solar Air Conditioner New Energy Air Conditioner

- Pakistan s own solar air conditioner

- Kabul EK Solar Air Conditioner

- Energy consumption of solar air conditioner

- Design of solar air conditioner in Finland

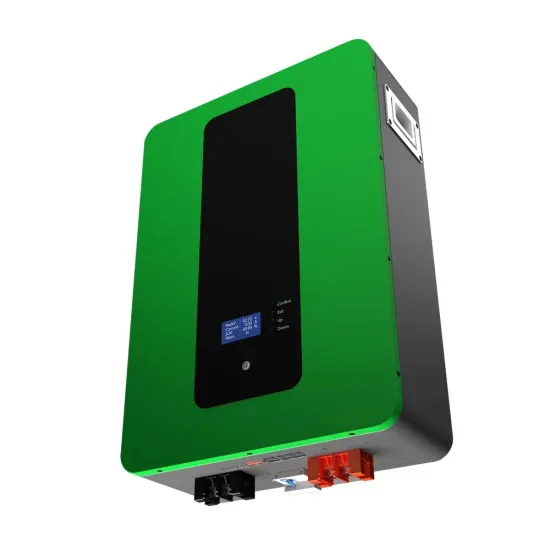

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.