Tesla Energy Software | Tesla Other Europe

Nov 11, 2023 · Tesla is the world''s only major vertically integrated energy storage provider. Unique seamless integration of hardware, firmware and software means industry-leading

An integrated solution of software and hardware for

Aug 1, 2022 · This article presents LimnoStation, a low-cost integrated hardware and software solution that employs IoT concepts with LoRaWan, whose main objective is to monitor

Energy Storage Software Market Growth 2025–2033

Jul 28, 2025 · Global Energy Storage Software Market size was USD 7010.26 Million in 2024 and is projected to touch USD 8981.54 Million in 2025, advancing further to reach USD 65205.81

Risen Energy Introduces Integrated Solar Storage Systems

Jun 19, 2025 · Risen Energy presents Full-Stack Renewable Solutions at SNEC 2025, offering solutions that include smart energy, storage, and solar power.

Combined hardware-software approach addresses growing

Feb 25, 2025 · AI plays a key role in improving battery performance, making the Eatron-Infineon technology a solution for applications including robotics, wearables, portable medical devices,

Application of energy storage in integrated energy systems

Aug 1, 2022 · The main techno-economic characteristics of the energy storage technologies, including: super-conducting magnetic energy storage, flywheel energy storage, redox flow

Battery Energy Storage Systems

Dec 1, 2023 · Battery Energy Storage System (BESS) is becoming a key technology to support the energy transition. Therefore, choosing the right System Integrator able to seamlessly

Grid energy storage adds flexibility and reliability to your

Fluence designs complete energy storage products with safety integrated into every layer of system controls and hardware. Designed to meet and exceed industry safety standards, such

Tigo Energy Initiates ''Made in the USA'' Manufacturing

1 day ago · Leveraging its vertically-integrated approach from mine to material manufacturing, Graphite One intends to produce high-grade anode material for the lithium-ion electric vehicle

Shanghai SineSunEnergy Co., Ltd. | 光伏零部件 | 中国大陆

Apr 7, 2023 · SineSunEnergy always pursues better quality and higher technology products, we can provide a full range of voltage levels from 5V to 1500V full-scenario energy storage

Future energy infrastructure, energy platform and energy storage

Dec 15, 2022 · The energy platform consists of the hardware and software to generate, store, control and transmit electricity/data, the digital platform to share and manage the

Qcells to acquire Geli, expanding its offerings in

Aug 6, 2020 · Leveraging Geli''s proprietary artificial intelligence technology for designing, automating, and managing energy storage systems, Qcells will be

6 FAQs about [Energy storage hardware and software integrated products]

What does a battery energy storage system integrator do?

Image: RWE. The battery energy storage system (BESS) industry is changing rapidly as the market grows. At the heart of what is becoming a crowded and competitive market is the role of the system integrator: putting together the components and technologies that bring BESS projects to life.

What is factory-built energy storage?

Factory-built energy storage supports the world’s leading power generators and utilities with grid-scale applications, industry-leading safety, and proven scalability. As the industry shifts from MW-sized projects to GW-scale portfolios, storage systems must meet new standards in delivery, performance, and safety.

Which battery integrators have a plug & play solution?

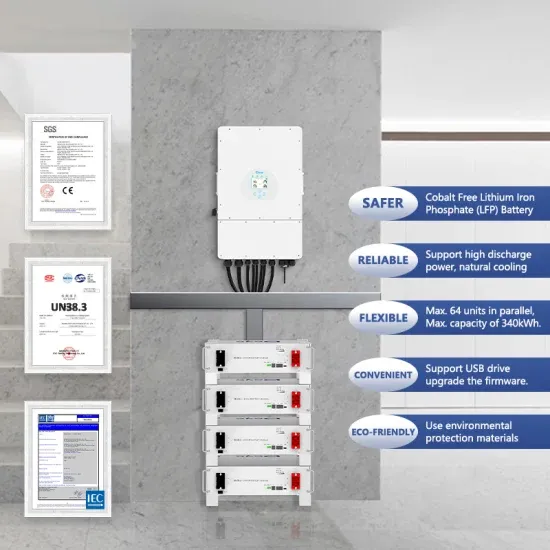

Other large international battery OEM players like LG Energy Solution, CATL and Samsung SDI have launched their own plug and play solutions which are fairly easy for EPCs or integrators to work with, again, eating into what might previously have been the preserve of the integrator alone.

Do battery OEMs need a system integration system?

For battery OEMs to take a significant share of the system integration market, they will need to develop their software, their O&M capabilities and ability to offer long-term whole system warranties, manage the asset and be able to integrate the PCS.

What's going on with a battery storage project in Germany?

The Germany-headquartered vertically integrated energy company is “very keen” on progressing its in-house capabilities in battery storage, with a number of projects in the works in the US and Europe, including two hybrid plants pairing run-of-river hydropower with 117MW of batteries in Germany.

What does a system integrator do?

System integrators are diving deeper into understanding what is required of them within warranties and what their customers — often project developers — are looking for. The market is better trying to understand the whole after sales service piece, from operations and maintenance (O&M), to warranties. This is still a very “tailored” offering.

Update Information

- Grenada Industrial and Commercial Energy Storage Products

- Jamaica solar energy storage products

- Libya exports energy storage products

- Liechtenstein wind solar and energy storage integrated project

- Energy storage power integrated chassis manufacturer

- Composition of integrated energy storage system

- Huawei Havana Energy Storage Products

- What are the products of mobile energy storage equipment

- Magadan photovoltaic energy storage integrated machine

- Advantages and disadvantages of energy storage products

- What types of energy storage products are there

- Belgian energy storage photovoltaic power generation products

- Off-grid energy storage power station seamlessly integrated with electricity

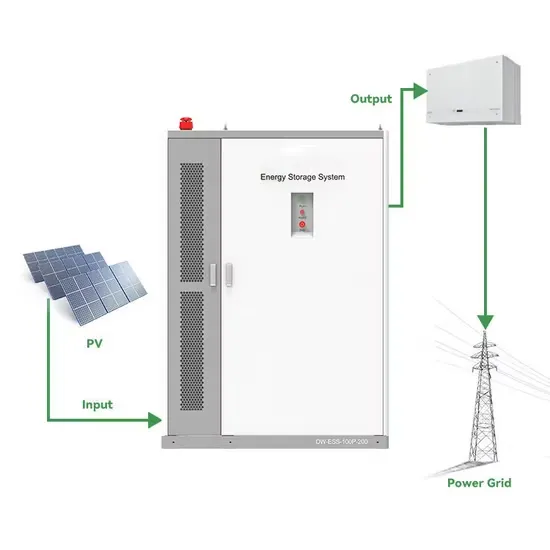

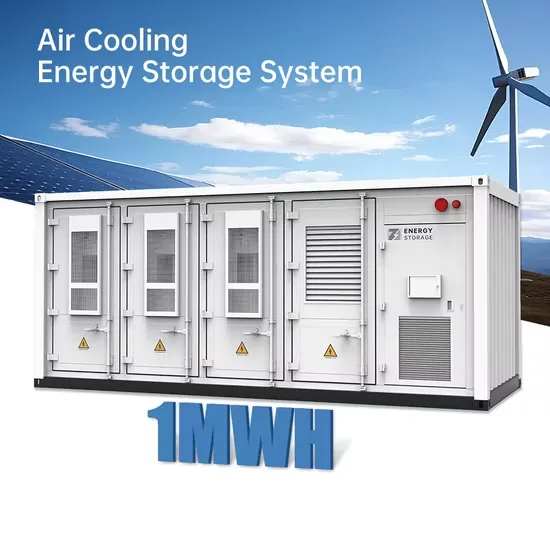

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

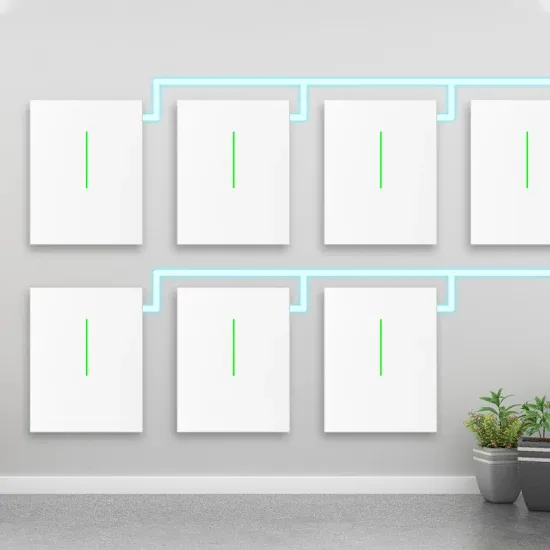

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.