Lead acid battery production technology

Mar 15, 2024 · Lead acid battery production technology1, lead-acid battery process overview Lead-acid battery is mainly composed of battery tank, battery cover, positive and negative

Bhutan Energy Storage Battery Ranking: Powering the

The Current Champions: Top Battery Technologies in Bhutan While Bhutan doesn''t manufacture batteries domestically (yet!), its strategic partnerships tell an interesting story. Here''s the podium:

Battery Racks and Cabinet – Andrea FZCO

Andrea is a specialist custom manufacturer of Cabinets & Racks to suit various needs small or large. This includes Network, Server, Industrial, Security applications, and more. With a large

VRLA battery cabinets

3 days ago · Function VRLA (Valve Regulated Lead Acid) batteries are lead batteries with a sealed safety valve container for releasing excess gas in the event of internal overpressure.

Best battery for solar energy Bhutan

s tailored to specific energy needs. Lead-Acid Batteries: These affordable, traditional batteries are suitable for small off-grid systems but have a shor in Gelephu Mindfulness City, Bhutan.

Energy Storage Lead-Acid Battery Manufacturers: The Power

Feb 9, 2025 · Why Lead-Acid Still Rules the Energy Storage Arena Think lead-acid batteries are yesterday''s news? Think again! These workhorses still power 60% of global energy storage

Lithium Ion Battery Storage Cabinet | Storage Cabinet Supplier

We are a supplier of high-quality Lithium Ion Battery Storage Cabinet, featuring a powder-coated steel chamber with self-closing, oil-damped doors for safe storage and controlled battery

Bhutan s Lead-acid Battery Production Ranking

Top Lead-acid Battery Manufacturers Suppliers in Bhutan The cost per kWh for lead-acid batteries remains the most economical for residential battery-based systems. In particular,

Top Lead-acid Battery Manufacturers Suppliers in Bhutan

Dec 4, 2024 · The cost per kWh for lead-acid batteries remains the most economical for residential battery-based systems. In particular, flooded lead-acid batteries offer the most

Bhutan Energy Storage Battery Ranking: Powering the

Nestled in the Himalayas, Bhutan might be better known for its Gross National Happiness Index than energy storage battery rankings. But here''s the kicker: this carbon-negative country is

Yuasa to showcase latest Lithium Energy Storage Cabinet technology

Yuasa, the world''s leading battery manufacturer, will showcase a state-of-the-art Lithium-ion (Li-ion) energy storage cabinet at this year''s Data Centre World. The system will sit alongside an

Bhutan liquid cooled energy storage battery manufacturer

Industry knowledge Foreign rooftop solar energy Unbranded lead-acid batteries What is a solar panel coil Advantages and disadvantages of dish solar power generation Solar panels short

Update Information

- Netherlands communication base station lead-acid battery cabinet manufacturer

- Gaborone communication base station lead-acid battery energy storage cabinet manufacturer

- Nominal voltage of lead-acid battery cabinet

- Battery cabinet aluminum row manufacturer

- Lead-acid battery cabinet to charge energy storage

- Battery cabinet manufacturer qualification query website

- Cairo energy storage lithium battery energy storage cabinet manufacturer

- Minsk DC screen battery cabinet manufacturer direct sales

- Swiss outdoor communication battery cabinet rack manufacturer

- Albanian energy storage lead-acid battery manufacturer

- Residents above the lead-acid battery energy storage cabinet of the communication base station

- Moroni energy storage cabinet battery manufacturer

- Lithium battery station cabinet manufacturer battery

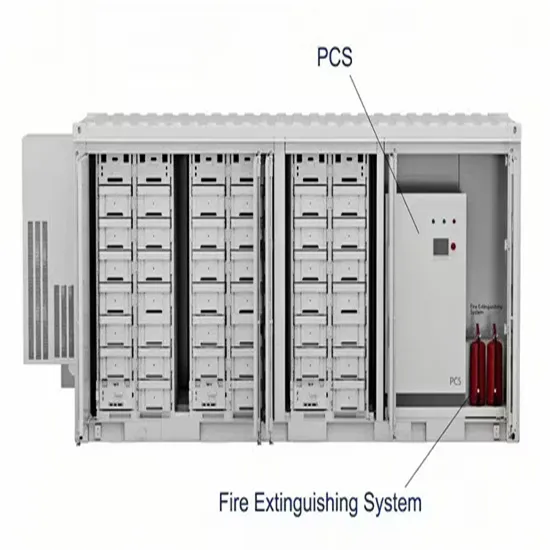

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.