How Do Energy Storage Power Stations Make Money? A

Mar 14, 2024 · Why Energy Storage Is the New Cash Cow of the Power Sector Let''s face it—energy storage power stations aren''t just giant batteries sitting around waiting for a

Optimal configuration of photovoltaic energy storage capacity for

Nov 1, 2021 · The configuration of user-side energy storage can effectively alleviate the timing mismatch between distributed photovoltaic output and load power demand, and use the

What kind of assets are energy storage power

May 5, 2024 · Energy storage power stations are regarded as critical assets due to several factors including 1. their role in grid stability, 2. the ability to optimize

Efficient operation of battery energy storage systems,

Nov 30, 2022 · The main objective of the work is to enhance the performance of the distribution systems when they are equipped with renewable energy sources (PV and wind power

Optimal Deployment of Energy Storage for Providing Peak Regulation

Aug 8, 2019 · On this basis, an optimal energy storage allocation model in a thermal power plant is proposed, which aims to maximize the total economic profits obtained from peak regulation

The economic use of centralized photovoltaic power

Jan 15, 2025 · Firstly, the costs of photovoltaic power generation, photovoltaic hydrogen production, and photovoltaic energy storage were calculated in more detail to obtain the total

Powering Ahead: 2024 Projections for Growth in the European Energy

Feb 20, 2024 · Europe''s utility-scale energy storage installations are primarily propelled by market dynamics, with power stations generating revenue mainly through auxiliary services and peak

What taxes do shared energy storage power stations pay?

Jan 23, 2024 · Bold Text: Understanding the tax landscape governing shared energy storage power stations is a multifaceted endeavor that requires careful consideration of various

Revenue Sources of Energy Storage Photovoltaic Power Stations

As solar energy adoption accelerates globally, energy storage photovoltaic (PV) power stations have emerged as game-changers in renewable energy economics. This article breaks down

Operation strategy and capacity configuration of digital

Aug 15, 2024 · The rapid development of renewable energy sources, represented by photovoltaic generation, provides a solution to environmental issues. However, the intermittency of

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Summary Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their

Evaluating the revenue potential of energy storage

Jul 20, 2025 · Owners of energy storage systems can tap into diversified power market products to capture revenues. So-called "revenue stacking" from diverse sources is critical for the

Analysis of energy storage power station investment and

Nov 9, 2020 · In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three

Unlocking Energy Storage: Revenue streams and

Apr 4, 2025 · shaving, load levelling, and seasonal energy management. Flywheel energy storage (FES) has a smaller power range but responds quickly, making it useful in improving grid

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their profitability

Unlocking Energy Storage: Revenue streams and

Apr 4, 2025 · Energy storage''s role in the clean energy transition ESS play a crucial role in the clean energy transition. They enable grid stability and reliability by mitigating fluctuations in

What are the revenues of energy storage power stations?

Mar 23, 2024 · 1. Energy storage power stations generate revenues through various streams, including operational efficiency, ancillary services, and market participation.2. The total income

Economical Optimal of Virtual Power Plant with Source,

Dec 1, 2021 · Xiaohui Chang, Wei Chen, and Chunquan Mi Abstract—As an emerging form of energy aggregation, virtual power plant (VPP) can reduce the impact of the uncertainty of the

Portable Power Station Market Size | Research Report [2032]

Jul 28, 2025 · With the rise in solar power energy in terms of panels, modules, and vessels, many portable power stations have led to its usage in the residential and commercial sectors. The

What are the sources of revenue for independent energy storage?

Aug 18, 2024 · In summation, independent energy storage systems represent a critical component of modern energy landscapes, with multiple avenues for revenue generation rooted in their

Peak shaving benefit assessment considering the joint operation

Jan 15, 2022 · The rapid development of battery energy storage technology provides a potential way to solve the grid stability problem caused by the large-scale construction of nuclear

How can energy storage projects improve their revenue

Oct 23, 2024 · Revenue Stacking and Diversification Multiple Revenue Streams: Energy storage projects can capture revenue from various sources, including wholesale energy markets, grid

How Energy Storage Power Stations Generate Operating

From California to Guangdong, operators are cracking the code on energy storage power station operating income using four primary models: capacity leasing, spot market arbitrage, grid

analysis of the revenue model of energy storage power stations

Here''s some videos on about analysis of the revenue model of energy storage power stations Partnership to generate revenue from battery storage and Flexible energy specialist

6 FAQs about [Source of revenue for energy storage power stations]

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

What is a power storage facility?

In the first three applications (i.e., provide frequency containment, short-/long-term frequency restoration, and voltage control), a storage facility would provide either power supply or power demand for certain periods of time to support the stable operation of the power grid.

Update Information

- What are the ultra-high cycle energy storage power stations

- What are the BESS services for energy storage power stations

- What are the small energy storage power stations in Auckland New Zealand

- Skopje has several energy storage power stations

- What are the energy storage power sources for power stations

- What are the mobile energy storage power stations in Nauru

- Invest in independent energy storage power stations

- The cost of purchasing energy storage for photovoltaic power stations

- Are there subsidies for Panama s energy storage power stations

- What are the lithium battery energy storage power stations in Sri Lanka

- What are the chemical energy storage power stations in Albania

- How many wind and solar energy storage power stations are there in Beirut

- What are the capacity electricity price energy storage power stations

Solar Storage Container Market Growth

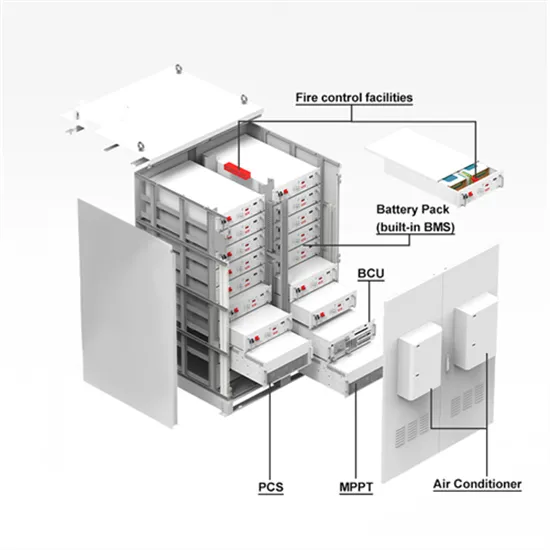

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.