UAE''s Industrial Strategy 2030: The Drive Behind Storage

May 2, 2025 · Key drivers include government initiatives to modernize storage facilities and significant projects like the Dubai Industrial Strategy 2030. Dubai and Abu Dhabi lead the

UAE Energy Storage System Market Size and Forecasts 2030

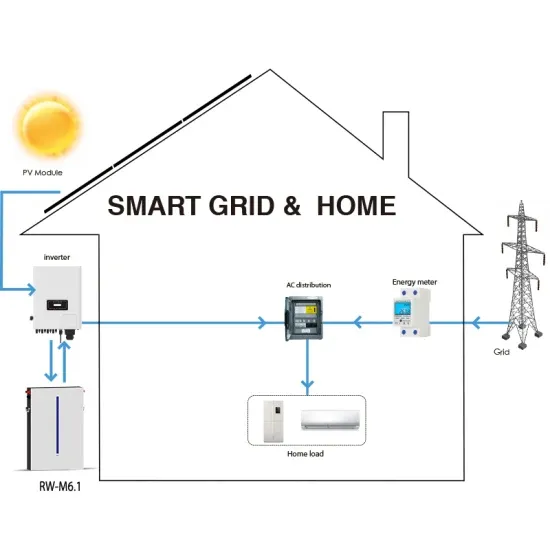

Apr 26, 2025 · The energy storage system market in UAE caters to diverse applications across residential, commercial, industrial, and utility sectors: Residential Storage: Small-scale

A complete list of commercial energy storage cabinet

on the energy storage-related data released by the CEC for 2022. Based on a brief analysis of the global and Chinese energy storage markets in terms of size and future development, the

Global Ranking of Large Energy Storage Fields: Top Players

Apr 28, 2022 · Why the Energy Storage Market Is Hotter Than a Tesla Battery in July If the energy storage industry were a Netflix show, 2025 would be its blockbuster season finale. With global

Top five energy storage projects in the UAE

Commercial and industrial solar power refers to any ground-mounted or rooftop distributed solar generation system or systems designed and installed for commercial or industrial applications,

Dubai Energy Storage Power: Where Innovation Meets the

Jul 26, 2021 · when most people think of Dubai, they imagine skyscrapers, luxury hotels, and endless sand dunes. But here''s a fun twist: this desert metropolis is quietly becoming a global

100 companies for Energy Storage in United Arab Emirates

Top Energy Storage Companies in United Arab Emirates The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and

Battery Racks and Cabinet – Andrea FZCO

Andrea is a specialist custom manufacturer of Cabinets & Racks to suit various needs small or large. This includes Network, Server, Industrial, Security applications, and more. With a large

Powering the Future: Energy Storage Solutions

Oct 14, 2023 · Leading Energy Storage Projects in the UAE. The UAE is not just setting targets; it''s achieving them. A prime example is the Themar Al Emarat

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Feb 4, 2022 · Meeting the national renewable energy targets requires scaling up and systematic integration of variable renewable energy (VRE) systems into the power grid, which in turn

Commercial and Industrial Energy Storage

Oct 31, 2024 · The market for "Commercial and Industrial Energy Storage Cabinet System Market" is examined in this report, along with the factors that are

Successful Sale of Outdoor Air-Cooled Air Conditioning for Industrial

Our outdoor air-cooled air conditioners are designed to provide reliable and efficient cooling for energy storage systems, even in challenging outdoor environments. These systems are ideal

United Arab Emirates Power Storage: Leading the Global Energy

Ranked 8th globally in energy storage project reserves [1] [2], the UAE''s 400 MW EWEC-backed storage project might seem modest compared to Saudi Arabia''s 2,200 MW NEOM gigaproject.

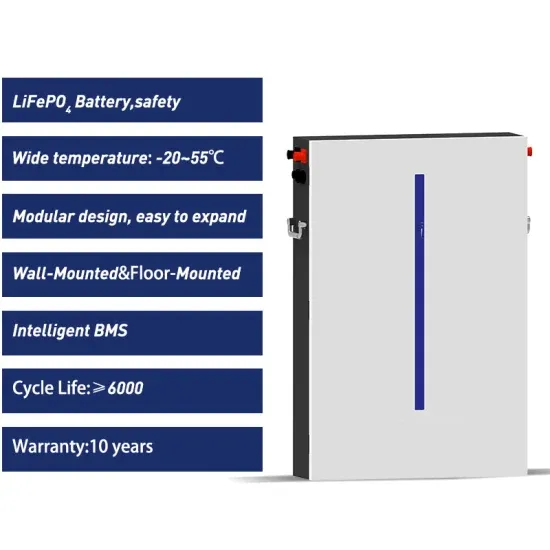

Battery Cabinet Supplier | Battery Supplier

Redox Energy UAE is a trusted Battery Cabinet Supplier in the UAE, offering high-quality enclosures designed for secure and efficient energy storage solutions. These cabinets provide

Dubai Industrial Park Energy Storage Projects: Powering the

Jun 19, 2024 · Battery Energy Storage Systems (BESS) are the backbone of Dubai''s strategy. These aren''t your average AA batteries—think lithium-ion giants storing enough juice to power

5 FAQs about [Dubai Industrial Energy Storage Cabinet Field]

What is Mohammed bin Rashid Al Maktoum solar power plant – thermal energy storage system?

The Mohammed Bin Rashid Al Maktoum Solar Thermal Power Plant – Thermal Energy Storage System is a 100,000kW concrete thermal storage energy storage project located in Seih Al-Dahal, Dubai, the UAE. The thermal energy storage battery storage project uses concrete thermal storage storage technology.

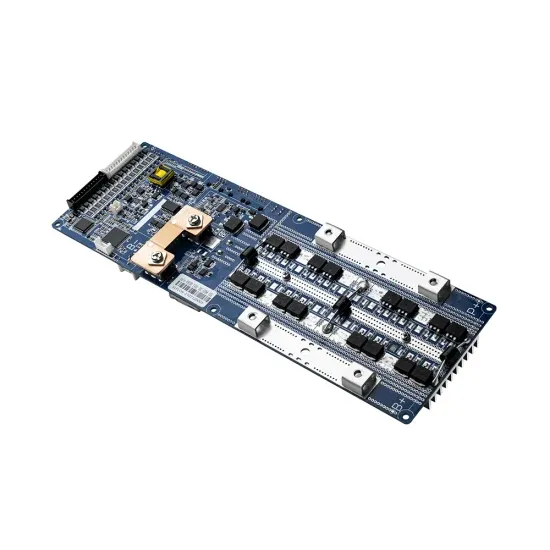

What are CATL battery-powered energy storage systems?

CATL battery-powered energy storage systems provide energy storage and flexibility in power generation. Instant utilization and energy output due to battery electrochemical technology and the technology of electricity production using gas-piston units can be combined into a single most efficient system.

What is thermal energy storage battery storage project?

The thermal energy storage battery storage project uses molten salt thermal storage storage technology. The project was announced in 2018 and will be commissioned in 2030. The project is owned by Shanghai Electric Group; Acwa Power and developed by Abengoa. 2. Mohammed Bin Rashid Al Maktoum Solar Thermal Power Plant – Thermal Energy Storage System

How does a CATL energy storage system work?

CATL energy storage systems provide smart load management when working in parallel with the network, instantly modulate the frequency and peaks depending on the load on the external network. In this case, the ESS performs the functions of increasing and expanding peak power, backup power functions and smoothing consumption peaks.

How many GWh will a storage system produce in 2022?

The successful global experience of implementing storage systems is about 0.5 GWh for 2020-2021 and will be increased to 1.5 GWh in 2022. A number of pilot projects for the introduction of storage devices in the United Arab Emirates is being jointly prepared.

Update Information

- Industrial energy storage cabinet source manufacturer in Dubai UAE

- European Industrial and Commercial Energy Storage Cabinet Brand

- Ulaanbaatar Industrial and Commercial Energy Storage Cabinet Model

- Nuku alofa Industrial and Commercial Energy Storage Cabinet

- Zambia Industrial Energy Storage Cabinet Brand

- United Arab Emirates Industrial Energy Storage Cabinet Solutions

- Equatorial Guinea Industrial Energy Storage Battery Cabinet Photovoltaic

- Banjul Industrial and Commercial Energy Storage Cabinet

- Gabon Industrial Energy Storage Cabinet Cooperation Model

- San Salvador Industrial Energy Storage Cabinet Manufacturer

- Prague Industrial and Commercial Energy Storage Cabinet Manufacturer

- South American Industrial and Commercial Energy Storage Cabinet Prices

- Dakar Industrial Energy Storage Cabinet Manufacturer

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.