Battery Energy Storage Systems Report

Jan 18, 2025 · This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Which energy storage battery is cost-effective?

Mar 31, 2024 · 1. The most cost-effective energy storage battery is currently the lithium-ion battery, due to its balance of performance, longevity, and price. 2.

BESS Costs Analysis: Understanding the True Costs of Battery Energy

Aug 29, 2024 · As of recent data, the average cost of a BESS is approximately $400-$600 per kWh. Here''s a simple breakdown: This estimation shows that while the battery itself is a

The future cost of electrical energy storage based on

Jul 10, 2017 · Electrical energy storage could play a pivotal role in future low-carbon electricity systems, balancing inflexible or intermittent supply with demand. Cost projections are

What is the appropriate price for lithium energy storage power supply

Jun 19, 2024 · The appropriate price for lithium energy storage power supply is influenced by several key factors, namely 1. market dynamics, 2. technological advancements, 3. economic

Cost and Performance of Grid Scale Energy Storage

Jul 6, 2023 · The future power plants are expected to have large proportions of intermittent energy sources like. wind, solar or tidal energy that require scale-up of energy storage to match the

Cost Projections for Utility-Scale Battery Storage: 2023

Jul 25, 2023 · Executive Summary In this work we describe the development of cost and performance projections for utility-scale lithium-ion battery systems, with a focus on 4-hour

How much is lithium energy storage power supply | NenPower

Jan 13, 2024 · 1. The current market price for lithium energy storage power supplies ranges from $200 to $700 per kilowatt-hour (kWh), depending on the specific characteristics of the

2020 Grid Energy Storage Technology Cost and

Dec 11, 2020 · This report represents a first attempt at pursuing that objective by developing a systematic method of categorizing energy storage costs, engaging industry to identify theses

Where Does China Rank in Energy Storage Costs? A 2025

Aug 10, 2020 · Let''s cut to the chase: China currently leads the global race in energy storage cost reduction, with 2024 figures showing lithium iron phosphate (LFP) battery systems hitting a

Energy Storage Technology and Cost Characterization

Jul 25, 2019 · This report defines and evaluates cost and performance parameters of six battery energy storage technologies (BESS) (lithium-ion batteries, lead-acid batteries, redox flow

How much does lithium battery energy storage cost per watt?

Jul 7, 2024 · The cost of lithium battery energy storage can vary significantly based on several factors, including 1. the type of battery technology utilized, 2. manufacturing scale and

6 FAQs about [Which lithium energy storage power supply has the best cost performance]

Are lithium-ion batteries more expensive than solid-state batteries?

As mentioned, lithium-ion batteries are popular but more expensive. Newer technologies like solid-state batteries promise higher performance at potentially lower costs in the future, but they are still in the developmental stage. Government incentives, rebates, and tax credits can significantly reduce BESS costs.

Which battery energy storage technology has the lowest annualized value?

• On an annualized basis, Li-ion has the lowest total annualized $/kWh value of any of the battery energy storage technologies at $74/kWh, and ultracapacitors offer the lowest annualized $/kW value of the technologies included. An attempt was made to determine the cost breakdown among the various categories for PSH and CAES.

Are lithium ion batteries expensive?

Lithium-ion batteries are the most popular due to their high energy density, efficiency, and long life cycle. However, they are also more expensive than other types. Prices have been falling, with lithium-ion costs dropping by about 85% in the last decade, but they still represent the largest single expense in a BESS.

What are the most cost-effective energy storage technologies?

Overall, on a $/kWh basis, PSH and CAES are the most cost-effective energy storage technologies evaluated within this report. Energy storage technologies serve a useful purpose by offering flexibility in terms of targeted deployment across the distribution system. Pathways to lower the $/kWh of the battery technologies have been defined.

Are battery energy storage systems worth the cost?

Battery Energy Storage Systems (BESS) are becoming essential in the shift towards renewable energy, providing solutions for grid stability, energy management, and power quality. However, understanding the costs associated with BESS is critical for anyone considering this technology, whether for a home, business, or utility scale.

Are O&M costs lower for lithium-ion systems?

O&M costs are typically lower for lithium-ion systems due to fewer moving parts, but they should still be factored into your long-term budget. Modern BESS solutions often include sophisticated software that helps manage energy storage, optimize usage, and extend battery life.

Update Information

- Which lithium energy storage power supply is best in Niger

- How much does lithium energy storage power supply cost in Milan Italy

- Which energy storage power station is the best

- ApiA lithium energy storage power supply price

- Which energy storage power supply should I choose in Rabat

- Tanzania lithium energy storage power supply procurement

- How much does lithium energy storage power cost in Bosnia and Herzegovina

- How much does Ecuador s solar energy storage power supply cost

- Afghanistan lithium energy storage power supply

- Lilongwe lithium energy storage power supply manufacturer supply

- Sukhumi lithium energy storage power supply factory direct supply

- Which company is good at energy storage power supply

- How much does the energy storage power supply in Alexandria Egypt cost

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

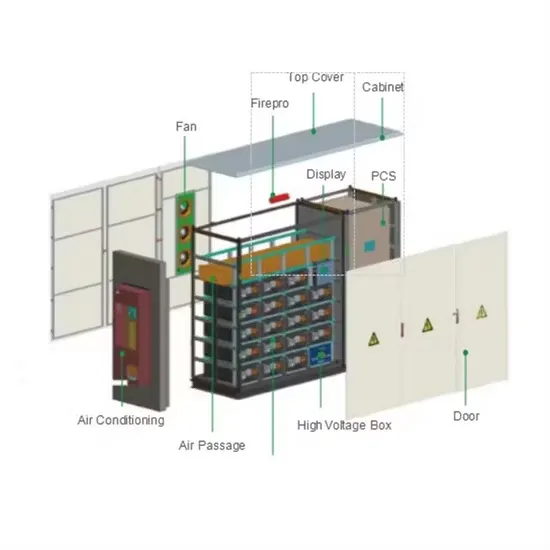

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.