Top Sodium-Ion Battery Manufacturers Powering 2025 Energy

Jul 16, 2025 · Discover top sodium-ion battery manufacturers of 2025 driving clean, affordable energy storage for EVs, grid systems, and industrial applications worldwide

Sodium Based Battery Manufacturers | ENSMAR

Dec 24, 2024 · We are a leading company in the development and production of sodium-based batteries, offering high-quality, long-lasting energy storage solutions for your needs, Our

CATL on sodium-ion, manufacturing and European market

May 14, 2025 · Three executives from the world''s largest battery company CATL gave a Q&A at ees Europe last week, with Energy-Storage.news in attendance.

Top 10 Sodium ion battery manufacturing China Products

China is a global leader in battery production, and sodium ion battery factories are crucial for diversifying energy storage solutions. They help reduce reliance on lithium, promote

List of Main Sodium ion Battery Manufacturers [2024]

In 2024, a new generation of battery manufacturers is emerging, each bringing their unique innovations to the forefront of energy storage technology. This comprehensive guide presents

About Us-Zhejiang NaTRIUM Energy Co., Ltd.

NaTRIUM Energy integrates research, development, production, and sales.Manufacture products such as layered oxide cathode materials, polyanion cathode materials, prussian blue cathode

What''s Currently Happening in Sodium-Ion Batteries? 2025

Apr 10, 2025 · As of 2025, sodium-ion batteries are well-positioned to achieve cost parity with lithium-iron-phosphate (LFP) batteries, a key milestone for market competitiveness. With

Sodium-ion: The Battery Built for Trade Resilience

Apr 29, 2025 · In a world where energy security increasingly intertwines with national security, the global battery supply chain has become a critical focal point of international tensions. As trade

6 FAQs about [Sodium energy storage battery manufacturers direct sales]

What is a sodium battery?

Sodium battery companies specialize in developing energy storage systems using sodium-ion technology as a cost-effective, sustainable alternative to lithium-ion batteries. Key players include Faradion (UK), Tiamat (France), HiNa Battery Technology (China), Natron Energy (US), and Altris AB (Sweden).

Who are the leading sodium-ion battery manufacturers?

As we conclude our exploration of the leading sodium-ion battery manufacturers, it’s clear that the future of energy storage is in capable hands. The companies listed here—CATL, HiNa Battery Technology, Natron Energy, Faradion, Tiamat Energy, Northvolt, ZOOLNASM, EVE, Lishen, and Great Power—represent the vanguard of a technological revolution.

Are sodium-ion batteries the future of energy storage?

With companies like NextThing Technologies, Faradion, AMTE Power, and Natron Energy leading advancements, sodium-ion technology is set to redefine energy storage. The industry is moving toward scalable, safe, and cost-efficient battery solutions, making sodium-ion batteries a cornerstone of future energy infrastructure.

What companies use sodium batteries?

Chinese telecom giants like China Tower use sodium batteries for 5G infrastructure backup, while European automakers test them for low-speed EVs. Grid operators value their fire resistance for large-scale installations near urban areas. How Are Startups Disrupting the Sodium Battery Market?

Are sodium ion batteries a viable alternative to lithium-ion?

With the global push for sustainable energy, sodium-ion batteries are emerging as a cost-effective, safe, and scalable alternative to lithium-ion technology. Leading battery manufacturers are developing next-generation sodium-ion solutions for applications ranging from home energy storage to grid-scale deployment.

What companies use sodium?

Key players include Faradion (UK), Tiamat (France), HiNa Battery Technology (China), Natron Energy (US), and Altris AB (Sweden). These firms focus on applications in electric vehicles, grid storage, and renewable energy integration, leveraging sodium’s abundance and safety advantages. Data Center ESS

Update Information

- Dili Energy Storage Lithium Battery Direct Sales

- Gaborone energy storage lead acid battery direct sales

- North Korea energy storage battery direct sales store

- Communication base station energy storage battery solar factory direct sales

- Monaco battery energy storage box direct sales company

- European energy storage lithium battery sales manufacturers

- Battery container energy storage manufacturers

- Ashgabat energy storage container factory direct sales

- South Tarawa Energy Storage Power Direct Sales Manufacturer

- Direct sales of energy storage batteries in South Korea

- Mauritius lithium energy storage power direct sales

- South Korean battery energy storage system manufacturers

- Avalu Portable Energy Storage Power Supply Direct Sales Store

Solar Storage Container Market Growth

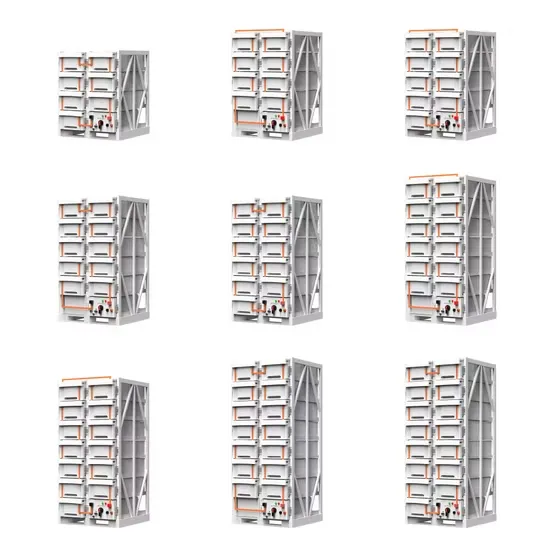

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.