Disassembly of Huawei s photovoltaic large inverter

Feb 13, 2022 · When Huawei first entered the inverter industry,it made both traditional central invertersand string inverters. Initially,the company made central inverters for utility-scale

Huawei''s 3000 Inverters Power the Successful Grid

The world''s largest open-air offshore photovoltaic project, the HG14 million kilowatt offshore photovoltaic project of Guohua Investment Shandong Branch of China Energy Group, has

Does Huawei export photovoltaic inverters

Apr 28, 2020 · Dive into the world of solar hybrid inverters: understand how they work, their features, benefits, and how they compare to normal inverters.,Huawei FusionSolar provides

Huawei''s 3000 Inverters Power the Successful Grid

Each power generation unit is equipped with dozens of 300KTL inverters, which can not only convert the direct current emitted by the photovoltaic modules into alternating current, but also

Technical Report Template

Oct 27, 2017 · Whilst inverters are typically expected to last for at least half the project lifetime of a PV plant (25 years), considering a bathtub failure rate and relatively low current failure rate for

Huawei leads global inverter market as shipments hit 589

Jul 11, 2025 · Chinese companies made up nine of the 10 largest global inverter suppliers in 2024, with total inverter shipments reaching 589 GW (AC), according to Wood Mackenzie. Chinese

Global PV inverter shipments rise 10% to 589 GWac in 2024,

Jul 11, 2025 · China alone received 330 GWac, marking a 14 per cent increase over 2023 and more than half of global demand. "Both vendors consolidated the market and achieved their

Huawei Photovoltaic Inverter Production Key Locations and

Huawei, a leader in smart energy solutions, operates multiple production bases for photovoltaic (PV) inverters worldwide. These facilities are strategically located to serve growing demand in

Huawei Photovoltaic Inverters in 2025: Leading the Global

Jan 31, 2025 · Huawei remains a top-tier producer of photovoltaic inverters, commanding 23% of global market share as of Q1 2025 according to Wood Mackenzie''s latest renewable energy

Huawei photovoltaic inverters exported to Vietnam

Export limiters limit the power generation from the Huawei PV inverter so that amount of power to be exported to the grid can be limited. ZED Advance can also work as an Huawei smart PV

Huawei Inverters | Photovoltaic

Huawei solar inverters have received positive reviews for their efficiency and reliability. They are widely used in residential, commercial and utility-scale solar installations globally. Huawei''s

PV Plants Connecting to Huawei Hosting Cloud Quick Guide (Inverters

Jul 18, 2025 · Inverters,SmartLogger3000PV Plants Connecting to Huawei Hosting Cloud Type Description Service Owner Quick Guide (Inverters + SmartLogger3000 + MBUS PV module

Huawei Ousted from SolarPower Europe Amid EU Investigation

May 14, 2025 · Chinese companies dominated the European PV market, supplying at least 95% of modules and 80% of inverters. By the end of 2023, Huawei and Sungrow alone had

Huawei Malaysia, Kvc Industrial Supplies and JJ

Feb 24, 2022 · Huawei, as the leader in the global smart PV market with its string inverters consistently ranked first in the world for the past six years, will

SolarPower Europe Revokes Huawei''s Membership Over EU

May 16, 2025 · Huawei, alongside Chinese firm Sungrow, supplies over 160 GW of PV inverters in Europe, with Huawei holding a 25–30% market share in residential inverters and 30% in large

6 FAQs about [Huawei exports photovoltaic inverters to Latvia]

How many GW of inverters will Huawei supply in 2021?

The 5GW of inverters the deal will see supplied over 2020 and 2021 add to the 1.6GWac of inverters wholesaler Wattkraft is said to have distributed last year. Ulf Hermenau, Huawei's DACH Channel Sales director, said the firm is looking forward to “further strengthening its partnerships” in the residential and C&I segments.

Can a smart PV management system run a 100MW PV plant?

The product can, Huawei claims, support a smart PV management functionality able to carry out full-load remote scans for a 100MW PV plant within 15 minutes. The 5GW of inverters the deal will see supplied over 2020 and 2021 add to the 1.6GWac of inverters wholesaler Wattkraft is said to have distributed last year.

What is Huawei fusionsolar 6.0 smart PV solution?

Launched at the All-Energy Australia show last October, the FusionSolar 6.0 Smart PV Solution integrates a 1500V inverter with a tracker system and various other functions. The product can, Huawei claims, support a smart PV management functionality able to carry out full-load remote scans for a 100MW PV plant within 15 minutes.

What is Huawei doing in Europe?

Ulf Hermenau, Huawei's DACH Channel Sales director, said the firm is looking forward to “further strengthening its partnerships” in the residential and C&I segments. Huawei’s renewed targeting of Europe comes five months after its inverters were the first to comply with new grid codes in Spain, currently the continent’s fastest-growing PV market.

Who makes fusion Solar Smart PV string inverters?

In a recent statement, the Chinese group said its Hannover-based wholesaler partner Wattkraft Solar will distribute Fusion Solar Smart PV string inverters, a product line it last updated around five months ago.

Which continent has the greatest business opportunity for inverter substitution?

The prospect of increased inverter inflows into Europe emerges as new data suggests the continent will hold the greatest business opportunity for inverter substitution.

Update Information

- Repairing photovoltaic inverters in Latvia

- What are the string photovoltaic inverters

- Huawei photovoltaic inverter maintenance

- Huawei Uzbekistan small photovoltaic panels

- Can wind power be generated by photovoltaic inverters

- Huawei Eastern Europe Solar Photovoltaic Panels

- A factory producing photovoltaic inverters in Karachi Pakistan

- Tax increase on photovoltaic inverters

- New Delhi subsidizes photovoltaic inverters

- Are photovoltaic micro inverters useful

- Huawei Tanzania Energy Storage Photovoltaic Products

- Vilnius makes photovoltaic inverters

- Huawei Uzbekistan Ecological Photovoltaic Panel

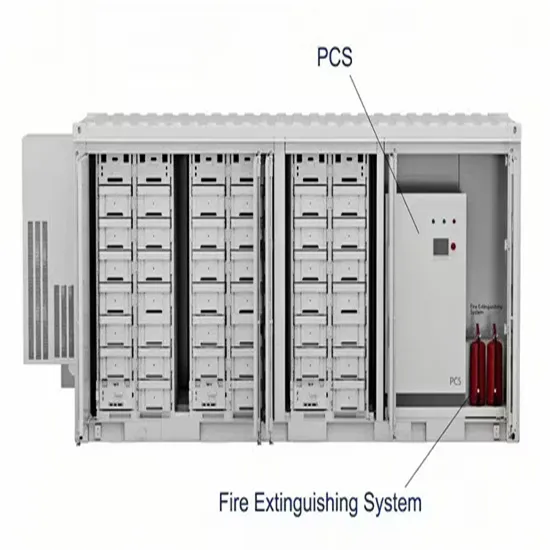

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.