A holistic assessment of the photovoltaic-energy storage

Nov 15, 2023 · The Photovoltaic-energy storage-integrated Charging Station (PV-ES-I CS) is a facility that integrates PV power generation, battery storage, and EV charging capabilities (as

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their profitability

Analysis of energy storage power station investment and

Nov 9, 2020 · In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three

New Energy Storage Business Models and Revenue Levels

Jun 15, 2024 · Method The paper studied the application scenarios of energy storage on the power generation side, grid side, and user side, analyzed the economic benefits and income

Typical Application Scenarios and Economic Benefit

May 18, 2022 · Energy storage system is an important means to improve the flexibility and safety of traditional power system, but it has the problem of high cost and unclear value recovery

Economic Analysis of Energy Storage Stations: Costs, Profits,

Jun 22, 2022 · Today''s stations are hustling with multiple income sources: The energy storage world is buzzing about sodium-ion batteries - think of them as lithium''s cheaper cousin. With

What are the photovoltaic energy storage power

Jun 28, 2024 · Photovoltaic energy storage power stations are innovative facilities that harness solar energy through photovoltaic (PV) systems, coupled with

The Economic Value of Independent Energy Storage

Aug 12, 2023 · This article establishes a full life cycle cost and benefit model for independent energy storage power stations based on relevant policies, current status of the power system,

China''s pressing issues as solar-plus-storage booms

Jul 20, 2023 · China''s urgent need of improving ESS utilization on the generation side On March 29, 2023, the National Platform for Safety Information Monitoring of Electrochemical Energy

China to Let Emerging Energy Firms Boost Income Through

Nov 29, 2022 · It means that those companies that provide the grids with stable or flexible power supply will benefit from a supplementary source of income. It is difficult for battery storage

energy storage power stations cannot generate income

Energy Storage Configuration for EV Fast Charging Station Considering Characteristics of Charging Load and Wind Power Fast charging stations play an essential role in the

Net income of energy storage with different rated power

Download scientific diagram | Net income of energy storage with different rated power ratios. from publication: An optimal energy storage system sizing determination for improving the utilization

Research on the operation strategy of energy storage power

Sep 25, 2023 · With the development of the new situation of traditional energy and environmental protection, the power system is undergoing an unprecedented transformation[1]. A large

Income sources of energy storage power stations

storage power station [41] in Qinghai Province. Among them, the income sources of Shandong independent energy storage power station are mainly the peak-valley ansmitting electricity to

Unlocking Profit Potential: 7 Revenue Streams for Modern Energy Storage

Why Energy Storage Projects Need Diverse Income Sources You know, the energy storage sector''s projected to hit $86 billion by 2030 according to the 2024 Global Market Insights

Economic Analysis of Energy Storage Stations: Costs, Profits,

Jun 22, 2022 · Why Energy Storage Stations Are Becoming the Grid''s New Rock Stars Imagine your smartphone battery deciding when to charge itself based on electricity prices - that''s

Flexible energy storage power station with dual functions of power

Nov 1, 2022 · The high proportion of renewable energy access and randomness of load side has resulted in several operational challenges for conventional power systems. Firstly, this paper

Pumped storage power stations in China: The past, the

May 1, 2017 · The pumped storage power station (PSPS) is a special power source that has flexible operation modes and multiple functions. With the rapid economic development in

Simulation and application analysis of a hybrid energy storage

Oct 1, 2024 · A simulation analysis was conducted to investigate their dynamic response characteristics. The advantages and disadvantages of two types of energy storage power

Share or not share, the analysis of energy storage interaction

May 1, 2023 · The result shows that, in renewable energy cluster the stations with intermittent output or with the higher prediction accuracy are more willing to participate in sharing. The

6 FAQs about [Income sources of energy storage power stations]

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Update Information

- What are the energy storage power sources for power stations

- Individuals can invest in energy storage power stations

- Investment situation of energy storage power stations

- What are the energy storage media in energy storage power stations

- Government supports the construction of energy storage power stations

- The cost of purchasing energy storage for photovoltaic power stations

- What are the ultra-high cycle energy storage power stations

- Application scenarios of vanadium battery energy storage power stations

- Skopje has several energy storage power stations

- Europe builds grid-side energy storage power stations

- What are the photovoltaic energy storage power stations in South Africa

- Are there energy storage power stations in Myanmar

- Which companies have energy storage power stations in Haiti

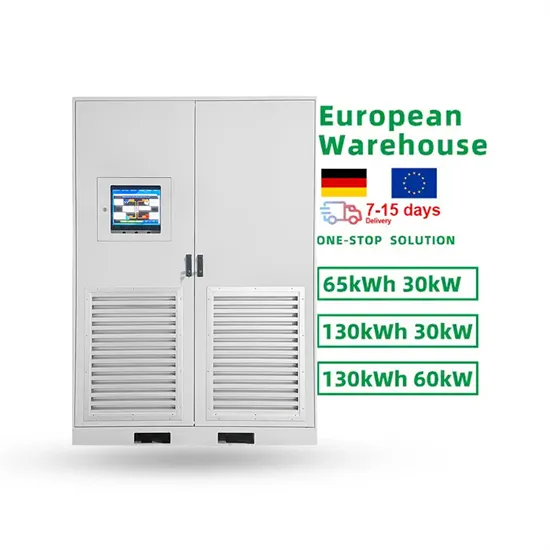

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.