Unity™ Outdoor Integrated Base Station 2W_Unity™ 5G Outdoor

May 9, 2025 · SageRAN Unity™ 5G Integrated Base Station leverages the NXP LX2160A platform, featuring low power consumption, easy customization, and high integration

Unity™ Outdoor Integrated Base Station 40W_Unity™ 5G Outdoor

Oct 22, 2024 · SageRAN Unity™ 5G Integrated Base Station is based on the advanced multi-core ARM and FPGA scheme, and adopts the integrated design method of 5G BBU and RRU.

Shanghai to build 8,000 5G base stations in 2021

Jan 25, 2021 · Shanghai will build 8,000 5G outdoor base stations in 2021 as part of efforts to accelerate the construction of new infrastructure in the digital era, local authorities said on Jan

Optimizing the ultra-dense 5G base stations in urban outdoor

Dec 1, 2020 · The objective of this study is to develop a location optimization model to support the planning of ultra-dense 5G BSs in urban outdoor areas and to help address the cost

Radio Frequency EMF Measurements and Exposure Assessment from 5G

Mar 31, 2023 · This paper presents preliminary results of radio-frequency electromagnetic field (RF-EMF) measurements in outdoor environments. The purpose is to measure and evaluate

Optimization of 5G base station deployment based on

In previous research on 5 G wireless networks, the optimization of base station deployment primarily relied on human expertise, simulation software, and algorithmic optimization. The

Ericsson, KDDI deploy underground 5G base stations in Japan

May 15, 2023 · Ericsson supports KDDI''s installation of Japan''s first sub-terrain 5G base stations, meaning they are below ground level and not visible Enables construction of various types of

5G Outdoor Coverage Solution_5G Outdoor Coverage

May 9, 2025 · Solution Description Based on the integrated base station developed by LX2160A, SageRAN adopts the integrated design method of 5G BBU and RRU. Based on the

Consumer Trends Driving 5G Outdoor Macro Base Station

Jul 26, 2025 · The global 5G Outdoor Macro Base Station market is experiencing robust growth, driven by the increasing demand for high-speed data and low-latency connectivity across

Unity™ 4+5G Outdoor Integrated Base Station

May 9, 2025 · SageRAN Unity™ 4+5G Outdoor Integrated Base Station is a highly efficient 4+5G base station designed for outdoor use. It features an integrated 4 and 5G BBU and RRU, and

Unity™ Outdoor Integrated Base Station 20W_Unity™ 5G Outdoor

May 9, 2025 · SageRAN Unity™ 5G Integrated Base Station is based on the advanced multi-core ARM and FPGA scheme, and adopts the integrated design method of 5G BBU and RRU.

Assisted Outdoor 5G Base Station Coverage Using Passive

May 19, 2024 · This paper proposes a solution to the problem of communication link interruption between 5G base stations and user devices in smart cities. The main benefit of this technology

More Than 25,000 5G Outdoor Base Stations and Over

It is expected that by the end of this year, more than 30,000 outdoor 5G base stations and over 50,000 indoor small stations will have been built. In key areas, 5G coverage in underground

6 FAQs about [5g outdoor base station]

What is a 5G small cell base station?

5G Small Cell indoor and outdoor 'all-in-one' radio access for private 5G wireless networks. 5G Small Cell Base Stations (Micro Cell, Femtocell) offer advanced features and “stand alone” capability for private networks.

What is a 4G & 5G LTE base station?

Covering all common 4G and 5G LTE bands, the base stations feature software-defined radio, allowing great flexibility of operation and future upgrade paths. The CableFree Advanced 4G and 5G LTE SDR (software-defined radio) Small Cell Base Station – Outdoor Version – is suitable for a wide variety of applications.

What is a 4G & 5G LTE SDR base station?

The CableFree Advanced 4G and 5G LTE SDR (software-defined radio) Small Cell Base Station – Outdoor Version – is suitable for a wide variety of applications. Covering all common 4G and 5G LTE bands, the base stations feature software-defined radio, allowing great flexibility of operation and future upgrade paths.

What is a x4000 5G base station?

"Stand Alone" operation is possible which enables the 5G Base station to connect remote terminals without need for external network elements. Custom designed for private 5G mobile networks using 5G FR1 radio spectrum. The X4000 5G 'All-in-One' includes Radio Unit (RU), Distributed Unit (DU) and Centralised Unit (CU).

Does CableFree offer a 5Ghz base station?

CableFree offers Band 46 5GHz LTE Base Station and Outdoor CPE devices for operation in Unlicensed 5GHz spectrum, enabling smaller operators and private customers to build LTE without requiring access to licensed spectrum. Band 46 covers 5150 – 5925MHz and uses TDD-LTE technology. Contact CableFree for details.

What is x4000 5G SDR small cell outdoor base station?

X4000 5G SDR Small Cell Outdoor base stations enjoy great flexibility, high performance as well as very low cost of operation and ownership. "Stand Alone" operation is possible which enables the 5G Base station to connect remote terminals without need for external network elements.

Update Information

- 5g outdoor service base station

- 5g outdoor base station

- What voltage does an outdoor 5G base station generally use

- 5g outdoor base station construction project

- Outdoor 5G base station power supply cost

- El Salvador 5G communication base station inverter grid connection bidding

- 5g base station power distribution cabinet work

- 5g base station communication high voltage distribution box energy mode

- 5g communication base station flywheel energy storage setting requirements

- Bandar Seri Begawan 5G communication base station inverter grid connection construction project

- Comoros Communication 5g base station signal is unstable

- 5g base station electromagnetic battery monitoring

- Estonia 5G communication green base station area

Solar Storage Container Market Growth

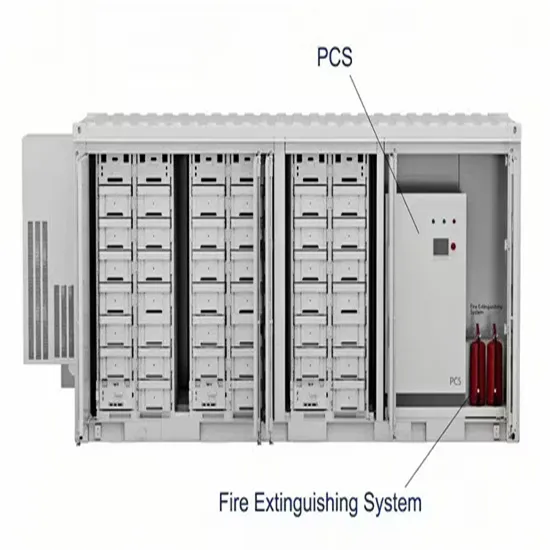

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

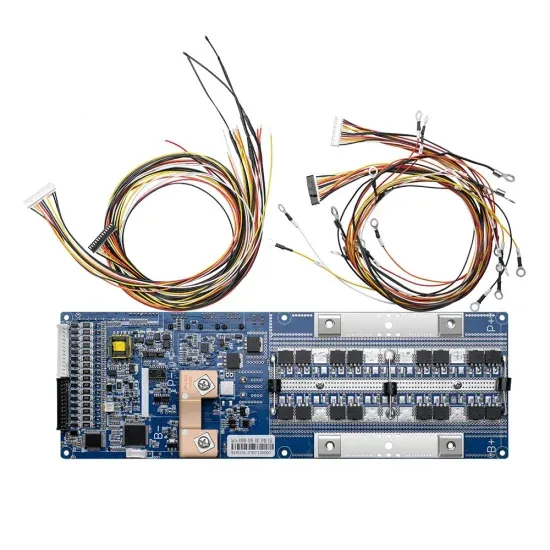

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.