Price per square meter of photovoltaic panels for foreign

What are solar panel import tariffs? Solar panel import tariffs are primarily intended to support the development of a new U.S.-based solar module manufacturing supply chain, which is

New US tariffs on solar imports threaten to phase out

Apr 22, 2025 · Solar photovoltaic (PV) module manufacturers in Malaysia owned by China-based players could face the risk of being phased out due to the latest US-imposed duties on solar

Impact of adjusted Section 301 tariffs on solar industry

Sep 17, 2024 · As a result, cell and module imports from China to the U.S. have significantly decreased in recent years. The new 301 tariff increases will have minimal impact on the PV

New US solar tariffs on Southeast Asia to raise

Dec 3, 2024 · A new round of U.S. solar panel import tariffs on Southeast Asian producers is expected to raise consumer prices and cut into producer profit

2024 Monthly Solar Photovoltaic Module Shipments

Dec 11, 2024 · Table 7. Photovoltaic module import shipments by country, 2024 Imports at the national level are published in Table 6. Country of origin is not published to protect individual

Photovoltaic Panel Import Tariffs: A 2025 Global Trade Analysis

Starting January 2025, Chinese-made solar wafers and polysilicon face a staggering 50% import tariff, building on September 2024''s 50% duty on Chinese solar cells and modules. But here''s

Turkey sets minimum price for solar cell imports

Feb 3, 2023 · Under the government''s new algorithm, the minimum price for imported solar cells will be $60/kg. Hakki Karacaoglan, chief executive of German consultancy KRC Energy, said

Europe hoarding €7bn worth of Chinese solar panels in

Jul 26, 2023 · Chinese-manufactured solar photovoltaic (PV) panels are piling up in European warehouses, with approximately 40 GW of capacity currently in storage – the same amount

Global solar module prices mixed on varying

Jan 17, 2025 · In a new weekly update for <b>pv magazine</b>, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global

Impact of adjusted Section 301 tariffs on solar industry

Sep 17, 2024 · Given the sharp reduction in imports of Chinese cells and modules, the recent adjustment of the Section 301 tariffs will have little short-term impact on the US PV industry.

Monthly Solar Photovoltaic Module Shipments Report

Overview Beginning in January 2017, we required some of the respondents for the annual survey Form EIA-63B, Photovoltaic Module Shipments Report, to report monthly data. The subset of

Global Solar Panel Import Data 2024-25: Top Solar Panel

Jul 2, 2025 · According to the global trade data and solar panel import data, the total value of solar panel imports reached $48 billion in 2024, a 13% increase from the previous year. The

Spring 2024 Solar Industry Update

Jun 14, 2024 · The median price for residential PV systems reported by EnergySage increased 6.3% y/y to $2.8/Wdc—in-line with mid-2020 price levels. Global polysilicon spot prices fell

Chinese Solar Giants Raise Panel Prices as Demand Picks Up

Feb 26, 2025 · Yicai contacted leading Chinese PV firms after recent online rumors had claimed module prices were raised by few Chinese cents per watt. Due to the electricity reform

Making solar a source of EU energy security

Aug 29, 2022 · Europe''s solar dependency on China By 2008, China emerged as the dominant producer of solar PV panels. By 2012, it accounted for 64 % of worldwide production and, as of

6 FAQs about [New photovoltaic panel import price]

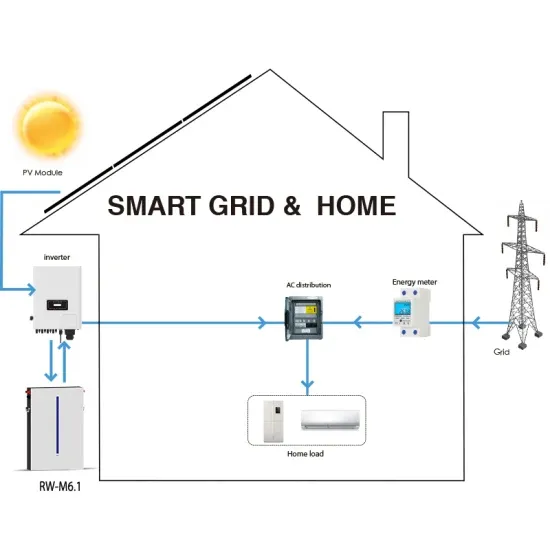

What are the components of a photovoltaic system?

Key components of photovoltaic systems include solar panel modules, energy storage batteries, wires, photovoltaic inverters, mounting brackets, etc. Specifically, the main materials for solar panels include solar panel chips, PVC materials, solder, tempered glass, and automatic assembly machines for solar modules.

Will US solar import tariffs hurt Southeast Asian producers?

BEIJING, Dec 2 (Reuters) - A new round of U.S. solar panel import tariffs on Southeast Asian producers is expected to raise consumer prices and cut into producer profit margins, but was largely anticipated by industry, analysts said.

How many solar panels are produced in China in 2022?

The graph showing the annual export value of Chinese solar panels in USD highlights that by 2022, China's solar panel production had reached 1.4 trillion RMB, accounting for over 80% of the world's solar product capacity.

Will US solar import tariffs affect producer profit margins?

Reporting by Colleen Howe; Editing by Clarence Fernandez Our Standards: The Thomson Reuters Trust Principles. A new round of U.S. solar panel import tariffs on Southeast Asian producers is expected to raise consumer prices and cut into producer profit margins, but was largely anticipated by industry, analysts said.

Who makes solar panels?

Suntech: Produces solar panels that combine innovation, quality, and service to deliver high performance. Sharp Energy: Known for its advanced solar PV (photovoltaic) technologies and solutions. It's important to note that these brands typically have strict distribution systems in place.

How much do solar panels cost in China?

For instance, as of December 2023, the cost of solar modules in China was $0.15 per watt, significantly lower than in India ($0.22 per watt), Europe ($0.30 per watt), and the USA ($0.40 per watt). This means that components made in China are 50% cheaper than those made in Europe and 62.5% cheaper than those made in the USA.

Update Information

- New brand photovoltaic panel price

- Kingston s new photovoltaic panel manufacturer

- Tonga new photovoltaic panels selling price

- Csi solar photovoltaic panel price

- Price of a photovoltaic solar panel

- 570w photovoltaic panel price

- Caracas photovoltaic panel new panel manufacturer

- 275 Photovoltaic panel price

- Niamey Industrial Photovoltaic Panel BESS Price

- N-type photovoltaic panel manufacturer price

- Photovoltaic panel full set detailed price

- New photovoltaic panel manufacturer

- Moscow 30 kW photovoltaic panel price

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.