Iberia: Why are there no batteries in Spain?

Spain''s battery energy storage market is at a critical point. Despite being a leader in renewable energy deployment in Europe, the country has only 18 MW of standalone batteries installed,

Introduction to Battery Energy Storage Markets: Spain and

Jan 9, 2025 · This blog post forms part of our new series, "Introduction to BESS (Battery Energy Storage Systems) Markets", which will cover the drivers and revenue streams of different EU

Spain targets 20GW of energy storage by 2030 as part of

Feb 12, 2021 · A Spanish hybrid plant from Acciona that features battery storage paired with a wind farm. Image: Acciona. Update 19 February 2021: Yann Dumont, president of the Spanish

Unstoppable Power: Top 10 Spanish Energy-Storage Battery

6 days ago · Spain''s energy-storage battery landscape is rich and varied: Basquevolt pushes solid-state R&D, Zeleros/Battera builds modular system design, Grenergy scales utility-grade

Spain and Germany, joint leaders in energy storage in Europe

Apr 12, 2023 · Spain, with 20,074 megawatts, and Germany (16,431 megawatts), account for most of the energy storage systems in Europe measured by capacity. Both countries are also

Spain sets new 2030 energy storage target of 22.5 GW

Sep 27, 2024 · The draft went through public consultation in mid-2023. A key focus of the PNIEC 2023 is promoting renewables, storage, and demand management to enhance their

Backup power for Europe

Apr 25, 2025 · In this report, we delve into the developments in the regulatory framework of the Spanish electricity system and explore the potential of Spain''s battery energy storage systems

Zelestra and EDP Sign Landmark Solar Plus Storage PPA in Spain

Jul 29, 2025 · Zelestra, a global, multi-technology, customer-focused, renewable energy company, and EDP, a global energy company leader in the renewable energy sector, have

How to qualify for energy storage grants in Spain

Jun 10, 2025 · Jon Ander López Ibarra, product manager for battery energy storage systems (BESS) at Spanish power conversion system company Jema Energy, says Spain needs to

Spain & Italy | BESS Premium Opportunities in Renewables

May 26, 2025 · Spain and Italy present a €45 million opportunity for BESS insurance premiums. Discover how NARDAC supports renewable energy projects in these regions.

Spain reached 100 pct renewables a week before

Apr 29, 2025 · The exact causes of the dramatic blackout in Spain and Portugal are not yet known. But the lack of battery storage left its high renewables grid

Battery storage in Spain: Opportunities and challenges for

2 days ago · The first solution is battery storage systems that enable peak shift, i.e. feeding electricity into the grid at times when the wholesale price is higher, usually before and after

What Spain''s capacity market means for storage

Aug 20, 2024 · The Spanish government is also looking to create an energy storage value chain within a €1 billion investment program. A Strategic Project for the Economic Recovery and

Iberdrola to deploy 300MWh of battery storage projects in Spain

Jan 25, 2024 · Iberdrola will deploy battery storage (BESS) projects in Spain adding up to 150MW/300MWh, to be co-located with existing PV plants.

6 FAQs about [Battery Energy Storage in Spain]

Why do we need battery energy storage systems in Spain?

Due to the large capacity of installed hydroelectric and thermal storage systems and the resilience of the Spanish power grid, the need for Battery Energy Storage Systems (BESS) in Spain has been relatively low. The lack of a clear regulatory framework for BESS has also hindered its development in Spain so far.

What is Spain's battery storage market?

Spain’s battery storage market is dominated by customer-sited systems. Utility-scale storage remains nascent. Currently, Spain’s storage market is mainly composed of small-scale batteries co-located with solar PV. Spain’s household electricity prices now stand at over EUR 0.30/kWh on average.

Can battery storage systems be retrofitted in Spain?

The first solution is battery storage systems that enable peak shift, i.e. feeding electricity into the grid at times when the wholesale price is higher, usually before and after sunset. Fortunately, the retrofitting of battery storage systems in Spain is unproblematic from a regulatory perspective.

What is the future of energy storage in Spain?

In conclusion, the legislative landscape for BESS in Spain is evolving to support the country’s ambitious renewable energy targets. While challenges remain, the combination of supportive policies, financial incentives, and technological innovation bodes well for the future of energy storage in Spain.

Which wind farm has the first battery storage system in Spain?

The Elgea-Urkilla wind farm, located in Araba (Basque Country), has the first battery storage system in a wind farm in Spain. This type of storage system collects the energy produced by the wind and has an installed power of 5MW and 5 MWh of storage capacity. It is the first green hydrogen plant in Europe.

How much energy storage capacity does Spain have?

When it comes to installed energy storage capacity in general, Spain is one of the leading countries within Europe (see figure 2). Currently, Spain has 6.3GW of hydroelectric and 1GW of thermal storage capacity installed. In fact, the non-BESS storage capacity in Spain is higher than in any other European country.

Update Information

- Battery Energy Storage in Spain

- Spain Barcelona outdoor energy storage battery company

- Xiaomi energy storage cabinet battery quality

- Honiara communication energy storage battery manufacturer

- How much does it cost to upgrade the battery of the energy storage cabinet

- 12v400ah energy storage battery price

- China aids in building battery energy storage system for communication base stations

- Cameroon Douala Photovoltaic Energy Storage Battery

- How much does Kosovo energy storage battery cost

- Is the battery in the energy storage cabinet very powerful

- Energy Storage Battery Cabinet Standard

- Energy storage battery container design solution

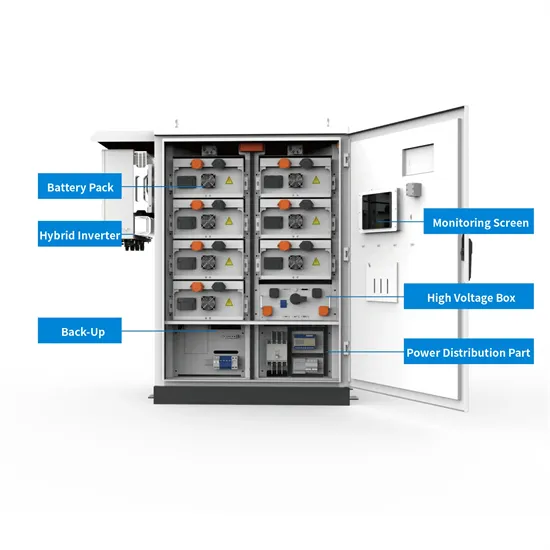

- Introduction to equipment in the battery energy storage system of communication base stations

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.