Australia Energy Storage Systems Market Size & Forecast 2032

Aug 17, 2025 · The Australia Energy Storage Systems Market is projected increase from USD 7829.13 million in 2023 to an estimated USD 15562.2 million by 2032, representing a CAGR of

Australia Energy Storage Systems (ESS) Market Size, Demand

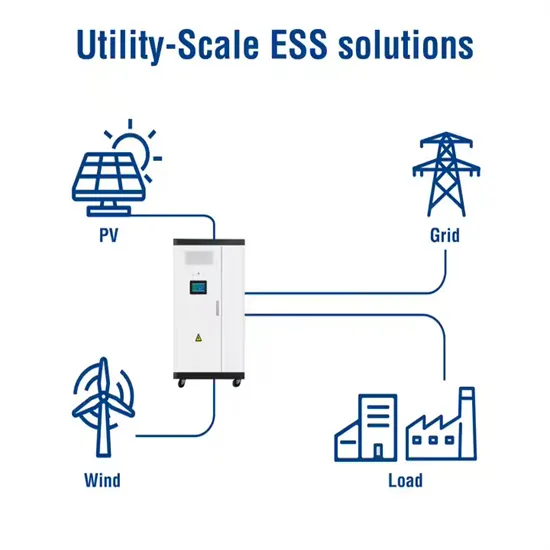

The Australian energy storage systems (ESS) market is fueled by the increasing demand for renewable energy resources like solar and wind, which require proper storage facilities to

Consultation Regulation Impact Statement

Dec 5, 2022 · Energy use from commercial refrigeration is growing in both Australia and New Zealand due to increased demand for ready-to-eat food, increased population growth and

Energy Storage Financeability in Australia

Mar 11, 2024 · Nexa Advisory, commissioned by the Clean Energy Investor Group (CEIG), has undertaken research to define the challenges and propose policy solutions that are practical

Australia Energy Storage Market Analysis: Profit Models,

Australia''s energy storage market began its journey in 2016, driven by key factors such as weak grid infrastructure, abundant renewable energy resources, and high electricity prices for

Global Energy Storage Cabinet Supply, Demand and Key

The global Energy Storage Cabinet market size is expected to reach $ 1780.9 million by 2030, rising at a market growth of 13.0% CAGR during the forecast period (2024-2030).

Energy Storage Cabinet Market Report | Global Forecast

Energy Storage Cabinet Market Outlook In 2023, the global energy storage cabinet market size is estimated to be valued at approximately USD 8.5 billion. According to market forecasts and

Energy Storage: Opportunities and Challenges of

Feb 3, 2025 · The report aims to identify the potential economic benefits and challenges together with additional employment opportunities for Australian research and industry in the global and

Australian energy storage market analysis

2 days ago · According to BNEF data, Australia will achieve 1.07GWh of energy storage installed capacity in 2022, with household storage accounting for nearly half, showing a development

Navigating Energy Storage Cabinet Market Trends: Competitor Analysis

Apr 1, 2025 · The energy storage cabinet market, currently valued at $820 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR)

Australia Energy Storage Market Size & Share Analysis

Apr 3, 2025 · The Australia energy storage market is driven by growing renewable energy adoption, grid stability needs, and government incentives. Increasing demand for battery

Australian Energy Storage Power: From Boom to Grid

Here''s the rub: While Australia deploys 3.2GW of new storage in 2024 [6], curtailment rates keep climbing like Bondi Beach temperatures. Spring 2024 saw 27% solar and 11% wind energy

Global Energy Storage Field Demand Analysis: Trends,

Apr 22, 2020 · Why Energy Storage Became the World''s Hottest Backstage Player Let''s start with a reality check: The global energy storage market is currently doing the financial equivalent of

Australia Energy Storage Market Size, Share Analysis | 2025-33

The Australia energy storage market share is expanding, driven by the rising integration of renewable energy sources such as solar and wind into the national grid, increasing

Australia Energy Storage Market Size, Share Analysis | 2025-33

Australia Energy Storage Market Size and Share: The Australia energy storage market size was valued at 4.0 GW in 2024. The market is projected to reach 17.8 GW by 2033, exhibiting a

The role of energy storage in Australia s future energy

Feb 3, 2025 · Energy storage enables time-flexible use of generated electricity by storing it to enable electricity on demand. Storing energy and outputting it at a moment''s notice when

Energy Storage Demand: Powering the Future with

Jun 17, 2022 · Why Energy Storage Demand Is Stealing the Spotlight Let''s face it: energy storage isn''t exactly sexy —until your phone dies mid-video call or your neighborhood goes dark

Australian Energy Storage Market Analysis Full Report V10

Apr 27, 2020 · Under a high growth scenario, around 450,000 energy storage systems could be installed by 2020. The combination of residential and commercial energy storage could deliver

Energy Storage Outlook

May 25, 2025 · Global installed energy storage is on a steep upward trajectory. From just under 0.5 terawatts (TW) in 2024, total capacity is expected to rise ninefold to over 4 TW by 2040,

6 FAQs about [Australian energy storage cabinet demand analysis]

What types of energy storage are available in Australia?

purchase in Australia. lithium-ion technologies. installed indoors. This report is a comprehensive analysis of the Australian energy storage market, covering residential, commercial, large-scale, on-grid, off-grid and micro-grid energy storage.

How many large-scale energy storage projects are there in Australia?

The report identifies 55 Australian large-scale energy storage projects which are either existing, planned or proposed. Excluding pumped hydro, these represent over 4 GWh of storage. 9 gigawatts (GW) of capacity have been completed, planned or are in the pipeline. Of those, 19 have been completed and another 36 have reached financial close.

Will solar batteries be the dominant form of battery storage in Australia?

Bloomberg New Energy Finance estimates that by 2020, solar batteries will be the dominant form of battery storage. Analysis by the Smart Energy Council from the survey and interviews with market participants for this report suggests battery manufacturing costs are likely to fall in Australia by around 15% each year to 2020.

How many Australians are working in energy storage?

Our survey found that today more than 2,000 Australians are directly employed in the energy storage sector. Under the high-growth scenario outlined in this report, more than 35,000 Australians could be working directly or indirectly in the energy storage industry in 2020.

How do I track distributed small-scale energy storage installations in Australia?

Tracking data on distributed small-scale energy storage installations in Australia is extremely difficult. There is no national, State or Territory record of installations and there is currently no requirement to register installations. The Council of Australian Governments is seeking to create a new register.

How many large-scale solar projects are there in Australia?

In addition to 55 Australian large-scale energy storage projects, the Smart Energy Council has identified more than 120 large-scale solar projects. These large-scale solar projects, totalling more than 9 GW, have been completed, commissioned or are in the pipeline. Many would be suitable for energy storage to be added.

Update Information

- Analysis of energy storage cabinet demand in Moldova

- Analysis of energy storage cabinet demand in Peru

- Energy storage cabinet space analysis base station

- Analysis of price trend of lithium battery for energy storage cabinet

- Yaounde Energy Storage Cabinet Demand

- Energy storage cabinet space analysis and design plan

- Poland large energy storage cabinet wholesaler

- Victoria Factory Energy Storage Cabinet

- Installation of energy storage cabinet for base station communication equipment

- Plug-in energy storage cabinet

- Energy Storage Cabinet IoT Battery Technology

- Ratio of production cost of energy storage cabinet

- Heavy industry energy storage cabinet manufacturer in the Democratic Republic of Congo

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.