Investor I4B, utility Luminus start building 600MWh Belgium BESS

Jun 17, 2025 · Belgium is one of Europe''s most developed markets for large-scale energy storage, with grid-scale lithium-ion BESS projects being deployed starting in 2020/21. 2025

Financial close for 600 MWh Belgian battery

Jun 18, 2025 · Belgian utility Luminus has closed financing for the 150 MW/600 MWh BESS it is installing in the Wallonian region of Navagne. Described as the largest BESS currently under

NHOA and ENGIE begin construction of Belgian 400MWh BESS

May 16, 2025 · The Kallo BESS project will play a pivotal role in the energy transition of the region. The project represents a strategic repurposing of the former Kallo power plant site,

BATTERY ENERGY STORAGE SYSTEMS (BESS)

Apr 28, 2025 · BESS are used for storing energy generated from a renewable energy source (e.g., solar or wind power) and non-renewable sources. BESS technical solutions are

Presentación de PowerPoint

Sep 30, 2021 · BESS Advantages Offering large number of application opportunies in addition to black start capabilities. Fast response (<1 sec) of power supply to the grid until the gas turbine

Investor I4B, utility Luminus start building 600MWh Belgium BESS

Jun 17, 2025 · Groundbreaking on the BESS project. Image: Luminus. Infrastructure investor I4B and utility Luminus have closed the financing and launched construction on a

Battery Energy Storage System

5 days ago · Battery Energy Storage System Diesel generators are commonly used for additional power supply at construction sites today. As a low carbon alternative, Battery Energy Storage

On BESS Capacity Optimization of Hybrid Coal-Fired Generator and BESS

Aug 16, 2025 · To obtain a cost-effective BESS investment, this paper develops a new sizing method, which optimizes the BESS capacity by simulating the operation of the hybrid coal

NHOA and ENGIE begin construction of Belgian 400MWh BESS

May 16, 2025 · Utility-scale energy storage systems provider NHOA Energy, together with ENGIE, has commenced construction on a 400 megawatt-hour (MWh) battery energy storage system

Stacking the Deck: Unlocking BESS Revenue Streams

Oct 24, 2024 · Battery Energy Storage Systems (BESS), unlike traditional energy generators, rely on multiple revenue streams like arbitrage, ancillary services, and capacity markets. This

ENGIE & NHOA Start 400 MWh Battery Project in Belgium

Aug 16, 2025 · With a storage capacity of 400 megawatt-hours (MWh), this project represents a cornerstone in Belgium''s transition to a more sustainable, decentralized, and renewable

On BESS Capacity Optimization of Hybrid Coal-Fired Generator and BESS

Apr 4, 2025 · To obtain a cost-effective BESS investment, this paper develops a new sizing method, which optimizes the BESS capacity by simulating the operation of the hybrid coal

IS BESS A VIABLE ALTERNATIVE TO DIESEL GENERATORS

Bess energy storage power station A battery energy storage system (BESS) is an electrochemical device that charges (or collects energy) from the grid or a power plant and then discharges

6 FAQs about [Belgian power station generator BESS]

Is ENGIE generating a Bess project in Belgium?

ENGIE is also generating two other BESS projects in Belgium which already have credentials in place, a 100-MW/400-MWh scheme in Kallo and an 80-MW/320-MWh battery in Drogenbos. The firm targets 10 GW of battery capability globally by 2030. At the end of 2023, it contained 1.3 GW of battery capacity in function and 3.6 GW secured under development.

What is ENGIE's Vilvoorde Bess project?

ENGIE has started building one of Europe’s largest Battery Energy Storage Systems (BESS) at its Vilvoorde place in Belgium. The project, authorised in July 2023 and selected for power remuneration in October 2023, has an inaugurated capacity of 200 MW on a 3.5-hectare site. What are the specifications of ENGIE’s Vilvoorde BESS project?

How much electricity does Bess Vilvoorde use?

Equivalent to 160,000 5 kWh domestic batteries, it will cover the electricity consumption of 96,000 households. The battery park has a 15-year contract with Elia, the national grid operator. BESS Vilvoorde will be launched in two phases, with the commissioning of 100 MW of batteries in September 2025, and a further 100 MW in January 2026.

Which ENGIE projects are advancing in Belgium?

ENGIE is also advancing two other BESS projects in Belgium, located in Kallo (100 MW / 400 MWh) and Drogenbos (80 MW / 320 MWh), for which permits have already been obtained. BESS Vilvoorde is a testament to ENGIE's commitment to developing large-scale flexibility solutions, crucial for the integration of renewable energy.

What's going on with the Bess project in Belgium?

Groundbreaking on the BESS project. Image: Luminus. Infrastructure investor I4B and utility Luminus have closed the financing and launched construction on a 150MW/600MWh BESS project in Belgium.

What is the Bess Vilvoorde project?

The BESS Vilvoorde project aligns with ENGIE’s commitment to developing large-scale flexibility solutions, crucial for integrating renewable energy production. This project will contribute to ENGIE’s target of reaching 10 GW of installed battery capacity globally by 2030.

Update Information

- Singapore Rainproof Power Station Generator BESS

- BESS photovoltaic power station generator in Bosnia and Herzegovina

- Tirana Power Station Generator BESS

- Berlin Rainproof Power Station Generator BESS

- Romania Long EK photovoltaic power station generator

- Photovoltaic power station generator efficiency

- BESS price drops after energy storage power station

- Swiss mobile power station generator prices

- Kampala mobile power station generator set

- Power Station Generator Layer

- Does Hungary have BESS outdoor base station power supply

- Mobile generator for power station

- How to charge for Monrovia Telecom BESS power station

Solar Storage Container Market Growth

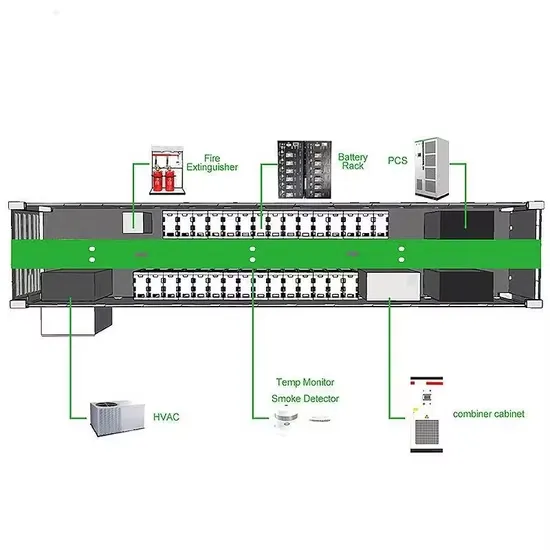

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

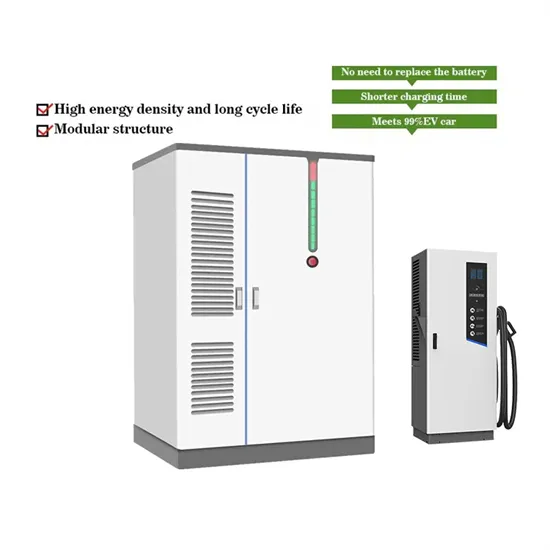

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.