Mobile Communication Network Base Station Deployment

Apr 13, 2025 · This paper discusses the site optimization technology of mobile communication network, especially in the aspects of enhancing coverage and optimizing base station layout.

Cost of Living in Guatemala. Prices in Guatemala. Updated

Summary of cost of living in Guatemala: The estimated monthly costs for a family of four are 2,593.8$ (19,881.7Q), excluding rent. The estimated monthly costs for a single person are

Public Transportation in Guatemala City

Mastering the public transportation system in Guatemala City is a crucial aspect of adapting to life there. This article provides a detailed overview of the available local transit options.

Energy profile: Guatemala

Apr 27, 2022 · Guatemala is a country rich in natural resources, which translates into great opportunities for cleaner energy generation. The country currently produces 57% of its energy

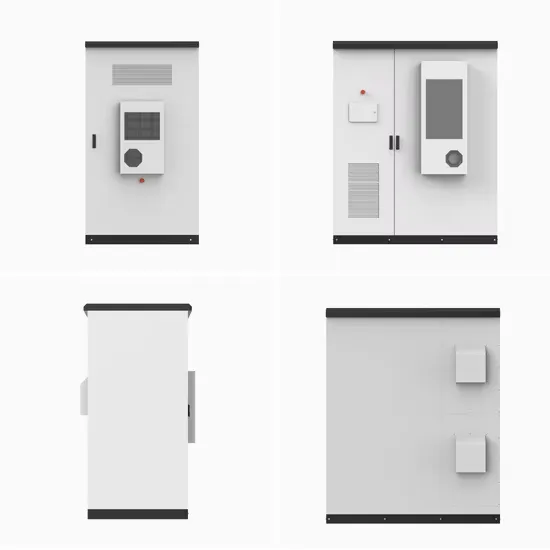

Guatemala Communications City Outdoor Power Supply

May 12, 2025 · Understanding the Needs of Guatemala''s Urban Communications Infrastructure Guatemala''s rapid urbanization and growing demand for reliable communication networks

Optimised configuration of multi-energy systems

Dec 30, 2024 · Additionally, exploring the integration of communication base stations into the system''s flexibility adjustment mechanisms during the configuration is important to address the

Guatemala LTE Base Station System Market (2025-2031)

Guatemala LTE Base Station System Industry Life Cycle Historical Data and Forecast of Guatemala LTE Base Station System Market Revenues & Volume By Type for the Period

Guatemala Communications City Outdoor Power Supply

May 12, 2025 · Guatemala''s rapid urbanization and growing demand for reliable communication networks require outdoor power supply systems that can withstand challenging environments.

Cost of Living in Guatemala City

Aug 6, 2025 · Guatemala City is 58.9% less expensive than New York (excluding rent, see our cost of living index). Rent in Guatemala City is, on average, 84.4% lower than in New York.

Guatemala Base Station Antenna Market (2024-2030) | Value,

How does 6W market outlook report help businesses in making decisions? 6W monitors the market across 60+ countries Globally, publishing an annual market outlook report that

6 FAQs about [Guatemala City communication base station wind power cost]

How much electricity does Guatemala have?

As of 2020, Guatemala had 4110 MW of installed electrical capacity, based primarily on hydro power (38.38%), fossil fuels (30.36%), and biomass (25.20%). Other renewable sources represented a much smaller percentage of capacity, including wind (2.61%), solar (2.25%) and geothermal energy (1.20%).

What is Guatemala's energy source?

This page is part of Global Energy Monitor 's Latin America Energy Portal. In 2018, Guatemala derived 57.43% of its total energy supply from biofuels and waste, followed by oil (29.54%), coal (7.68%), hydro (3.22%), and other renewables such as wind and solar (2.12%).

Why is Guatemala a good place to invest in energy?

Guatemala is a good place for energy investments because it offers opportunities for cleaner energy generation due to its rich natural resources. The country is also working on policies to promote efficient energy supply, allowing U.S. companies to provide technology and know-how.

How is electricity regulated in Guatemala?

Guatemala's electricity industry is regulated by the General Electricity Act (Ley General de Electricidad) and the CNEE (Comisión Nacional de Energía Eléctrica). The DGH (General Direction of Hydrocarbons) regulates the hydrocarbon sub-sector.

Is Guatemala's electricity market free?

Guatemala’s electricity market has been operating as a free market since 1996, when the activities of the electricity industry were separated, opening the generation and commercialization of energy to free competition.

What is the most important pipeline in Guatemala?

Guatemala's most important pipeline is the 474 km Hydrocarbons Stationary Transport System, which brings oil from the Campo Xan and Rubelsanto fields to the Puerto Santo Tomás de Castilla export terminal.

Update Information

- Is the cost of wind power for Manama communication base station high

- Nuku alofa communication base station wind power and photovoltaic power generation parameter query

- Kuwait City 5G communication base station wind and solar complementary construction project

- Sierra Leone Future Science and Technology City Communication Base Station Wind and Solar Complementarity

- 5g communication base station wind and solar hybrid power supply required

- Seychelles communication base station wind power line maintenance

- One communication base station is shared by several wind power operators

- Liberia-produced communication base station wind power products

- Small communication base station wind power photovoltaic

- Vaduz Communication Base Station Wind Power Maintenance Project

- Textbook Communication Base Station Wind Power Structure

- Communication base station wind power signal frequency

- There is a communication base station wind power in the residence

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.