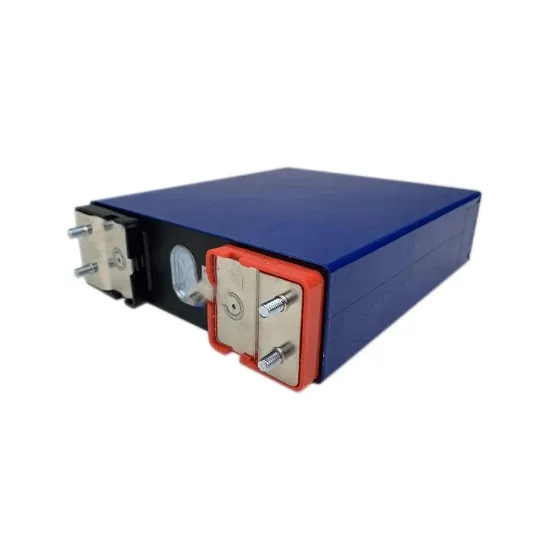

Oslo energy storage power supply customization

BW Solar agrees to sell 1.3-gigawatt portfolio of solar and energy storage development sites to Capital Power. December 3, 2021. BW Solar Holding Inc., a subsidiary of BW Solar Inc., and

oslo energy storage box customization

Energy systems for the future: Norway''''s largest battery energy The team focuses on energy storage systems based on hydrogen technology and batteries. Our activities include synthesis,

Portable Energy Storage Battery Customization in Bergen

May 12, 2025 · Bergen''s unique geography—nestled between fjords and mountains—creates distinct energy challenges. Off-grid operations, maritime activities, and renewable energy

CALB''s "Ultimate Range" Marine Battery Shines at Norway

Jun 10, 2025 · CALB''s marine battery energy storage system, anchored by its self-developed "Ultimate Range" battery, overcomes three critical industry challenges with industry-leading

Norway''s battery strategy

Sep 7, 2022 · In "Norway''s Battery Strategy", we discuss the battery value chain in more detail and present ten actions for sustainable industrialisation, which in aggregate should be

Oslo Grid Energy Storage Project: Powering Norway''s Green

At its core, the Oslo Grid Energy Storage Project uses a BESS (Battery Energy Storage System) that could power 40,000 homes for 4 hours. But here''s the kicker – it''s not just about storage

Europe''s Battery Storage Market: Opportunities and

Nov 9, 2024 · As Europe''s battery energy storage system (BESS) market rapidly expands, battery capacity has now surpassed 20 GW. While Norway once set ambitious goals to become the

Oslo lianxin energy storage intelligent equipment

After setting impressive EV battery records, Norway has turned its focus to an even larger market: batteries for stationary energy storage - a market expected to reach EUR 57 billion by 2030.

7 Top Energy Storage Companies in Norway · August 2025

Aug 1, 2025 · Detailed info and reviews on 7 top Energy Storage companies and startups in Norway in 2025. Get the latest updates on their products, jobs, funding, investors, founders

Ranking of Norwegian Power Storage Companies: Who''s

Aug 17, 2022 · Ever wondered how a country famous for fjords and northern lights became Europe''s green energy lab? Norway''s power storage companies are quietly rewriting the rules

Norway energy storage container customization

Today Norway has not one, but two huge battery markets. "There are two market drivers for batteries: EVs and stationary energy storage. Energy storage is coming on strong now. It''''s the

Norway''s maturing battery industry embraces green energy storage

May 8, 2023 · Whether for EVs or energy storage, Norway has always had ideal conditions for battery growth: renewable energy in the form of hydropower, strong government financial

Ottawa energy storage lithium battery customization

The application of energy storage lithium battery packs in household energy storage and commercial energy storage. There are more and more applications of lithium battery packs in

6 FAQs about [Norway intelligent energy storage battery customization]

Does Norway have a battery market?

Today Norway has not one, but two huge battery markets. “There are two market drivers for batteries: EVs and stationary energy storage. Energy storage is coming on strong now. It’s the key to turning intermittent wind and solar into a stable energy source,” explains Pål Runde, Head of Battery Norway.

How big is Norway's battery market?

batteries for stationary energy storage - a market expected to reach EUR 57 billion by 2030. Now, a more mature Norwegian battery industry has greater potential to accelerate the renewable energy transition in Europe. Today Norway has not one, but two huge battery markets.

What does battery Norway do?

Battery Norway will contribute to the: • Development of a national Norwegian battery strategy that facilitates sustainable growth. • expansion of the Norwegian battery supply chain and ecosystem. • building of relevant industrial competence and infrastructure. • explore synergies within the Norwegian and Nordic battery ecosystems.

Is Norway a battery region?

As a battery region, the Nordics have become a notable actor in the broader European battery market. They have also joined forces on global projects, such as the export of energy storage systems to Egypt and Lebanon. “The rest of the world understands that Norway is an important player in all things battery.

Is Norway a good place to buy EV batteries?

An early adopter of electric transport, Norway continues to capture EV battery headlines. Electric cars now account for 79 per cent of new cars sold in Norway, and the MS Medstraum was recently launched as the world’s first electric fast ferry. In a global report on lithium-ion batteries, Norway ranked first in sustainability.

Are EV batteries the future of energy storage?

“There are two market drivers for batteries: EVs and stationary energy storage. Energy storage is coming on strong now. It’s the key to turning intermittent wind and solar into a stable energy source,” explains Pål Runde, Head of Battery Norway. An early adopter of electric transport, Norway continues to capture EV battery headlines.

Update Information

- Norway intelligent energy storage battery customization

- Cameroon large capacity energy storage battery customization

- Singapore large capacity energy storage battery customization

- Sao Tome Energy Storage Battery Intelligent Manufacturing

- Huawei Intelligent Energy Storage Battery

- Energy storage lithium-ion battery intelligent sensor

- Caracas Energy Storage Battery Intelligent Manufacturing Company

- Estonian energy storage battery customization company

- Dodoma Intelligent Energy Storage Battery

- Malta battery energy storage box customization factory

- Australia Portable Energy Storage Battery Customization

- Huawei Angola energy storage battery customization

- West Africa Performance Energy Storage Battery Customization

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.