What Are Bifacial Solar Panels? Benefits & How

Mar 28, 2025 · Bifacial solar panels are more durable and long-lasting due to their robust design and construction. How Do Bifacial Solar Panels Work? At the

AASMT_FAQ_7-17-25

Jul 17, 2025 · In 2019, an exemption from Section 201 tariffs on bifacial solar panels limited the effectiveness of that tariff: More than 90% of imported panels are now bifacial. The effective

Solar Industry & Chinese Tariff Update

May 28, 2024 · Threatened Tariffs on Bifacial Solar Panels: The President imposed tariff-rate quotas and duties under Section 203 of the Trade Act of 1974 up to 30% on all CSPV products

Bifacial Solar Panels: Everything You Need to Know

Discover the benefits of bifacial solar panels, the cutting-edge technology that captures sunlight from both sides to maximize energy efficiency and output. Learn how bifacial solar panels can

Section 201 – Imported Solar Cells and Modules

3 days ago · In his announcement, the President included an exemption for bifacial solar panels. This decision comes after the ITC recommended in November 2021 to extend the safeguard

President Biden raises quota on tariff-free solar

Aug 13, 2024 · The Biden Administration is not against imposing tariffs, though, especially on solar modules. Imported solar panels also fall under Section 201

What is a Bifacial Solar Panel? A Deep Dive into Double-Sided Solar

Jul 3, 2024 · Learn what is a bifacial solar panel, how it works, and whether it''s the right choice for your solar needs. Explore the pros, cons, and considerations for bifacial solar panel installations.

Solar Industry & Chinese Tariff Update

May 28, 2024 · In response to the April 2022 Auxin Solar investigation request, Commerce finalized anti-dumping/countervailing duties on crystalline silicon photovoltaic cells ("CSPV")

Solar panel import duties | Norton Rose Fulbright

Feb 28, 2022 · Jinko and Risen solar panels are subject to anti-dumping duties of 32.69% (although Jinko panels appear to be being blocked by US Customs due to forced labor

Bifacial Solar Panels Subject to Section 201 Duties

Jun 26, 2024 · With the exemption removed, bifacial solar cells/panels will now be subject to Section 201 duties. The affected solar cells and modules are classified under the following

Bifacial modules excluded from Section 201 tariffs, returns

Nov 19, 2021 · U.S. manufacturers purchase cells from Southeast Asia for local assembly. Ship modules from Southeast Asia to the U.S. Ship China-made modules to the U.S. With bifacial

As Biden Executive Order Ends, Duties Exceeding 200% to be

May 3, 2024 · The Biden administration is expected to end an exemption for bifacial solar panels, which are primarily produced in China, imposing another 14.25% tariff on those modules.

Bifacial Solar Panels Materials & Functionality

Feb 14, 2025 · Bifacial solar panels revolutionize energy capture by utilizing sunlight from both sides. With innovative materials like monocrystalline silicon

White House removes bifacial solar tariff exemption,

May 16, 2024 · Bifacial solar panels generally used in utility-scale solar projects are not currently subject to safeguard tariffs under Section 201 of the Trade Act of 1974. After the Trump

Bifacial solar panels lose tariff exemption after

May 16, 2024 · The Biden Administration today put imported bifacial solar panels back under Sec. 201 tariffs, after the specialty solar panels enjoyed a two-year

6 FAQs about [Are bifacial solar panels anti-dumping ]

Are bifacial solar panels subject to tariffs?

Bifacial solar panels generally used in utility-scale solar projects are not currently subject to safeguard tariffs under Section 201 of the Trade Act of 1974. After the Trump administration implemented an exclusion for bifacial modules, they now make up almost all U.S. solar panel imports, the White House said.

Will bifacial solar cells/panels be subject to Section 201 duties?

With the exemption removed, bifacial solar cells/panels will now be subject to Section 201 duties. The affected solar cells and modules are classified under the following Harmonized Tariff Schedule (HTS) codes:

Why did the president remove bifacial solar panels?

The Office of the President has turned its focus to solar panels, announcing the removal of the bifacial solar panel Section 301 tariff exclusion and addressing issues of stockpiling during trade cases, alongside promoting the nation’s manufacturing base. From pv magazine USA

Will bifacial solar panels lose exemption?

In addition to bifacial panels losing their exemption, the Biden Administration said it will raise the tariff-rate quota (TRQ) of silicon solar cells by 7.5 GW, if needed.

Will Biden extend bifacial solar panels?

On February 4, 2022, President Biden announced an extension and modification of the existing safeguard tariffs for an additional four years. In his announcement, the President included an exemption for bifacial solar panels. This decision comes after the ITC recommended in November 2021 to extend the safeguard tariffs for an additional four years.

When can I import bifacial solar panels?

The affected solar cells and modules are classified under the following Harmonized Tariff Schedule (HTS) codes: Importers who signed contracts by May 16, 2024, may import bifacial solar panels without Section 201 duties from June 26, 2024, to September 23, 2024, provided the contract terms have not changed.

Update Information

- Riyadh bifacial solar panels

- Guinea s bifacial solar panels

- Bifacial solar panels used in Mombasa Kenya

- Advantages and disadvantages of bifacial solar panels

- Use of bifacial solar panels in Northern Cyprus

- Do photovoltaic power generation require solar panels

- House roof solar photovoltaic panels

- Photovoltaic requires solar panels

- Solar photovoltaic polycrystalline panels

- Rooftop photovoltaic panels for solar power generation

- Photovoltaic solar panels generate electricity in winter

- Urgent sale of a batch of solar photovoltaic panels

- 18400W solar panels

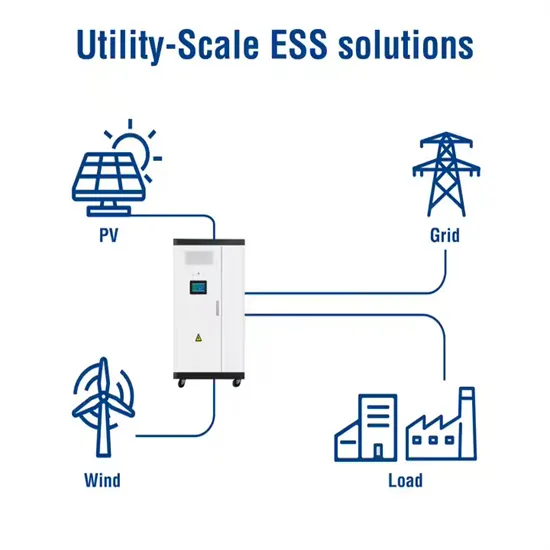

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.